Navigating the world of student loans can feel overwhelming, but you are not alone. With rising education costs, millions of graduates are seeking effective student loan repayment strategies to manage their debt without sacrificing their financial future. The key is not just making payments; it is about choosing the right approach for your unique situation, income, and goals. This guide moves beyond generic advice to provide a clear roadmap with actionable steps and real-world examples.

We will break down eight proven methods, from aggressive payoff plans like the Debt Avalanche to federal programs such as Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR). Each strategy is detailed with the specific information you need to make an informed decision. Whether you are a recent FAU graduate living in Boca Raton or a young professional mapping out your financial future in South Florida, this comprehensive list will equip you with the knowledge to conquer your student loans. You will learn how to potentially lower your monthly payments, pay off your debt faster, or even qualify for forgiveness, setting you on a direct path toward financial freedom.

1. Debt Snowball Method

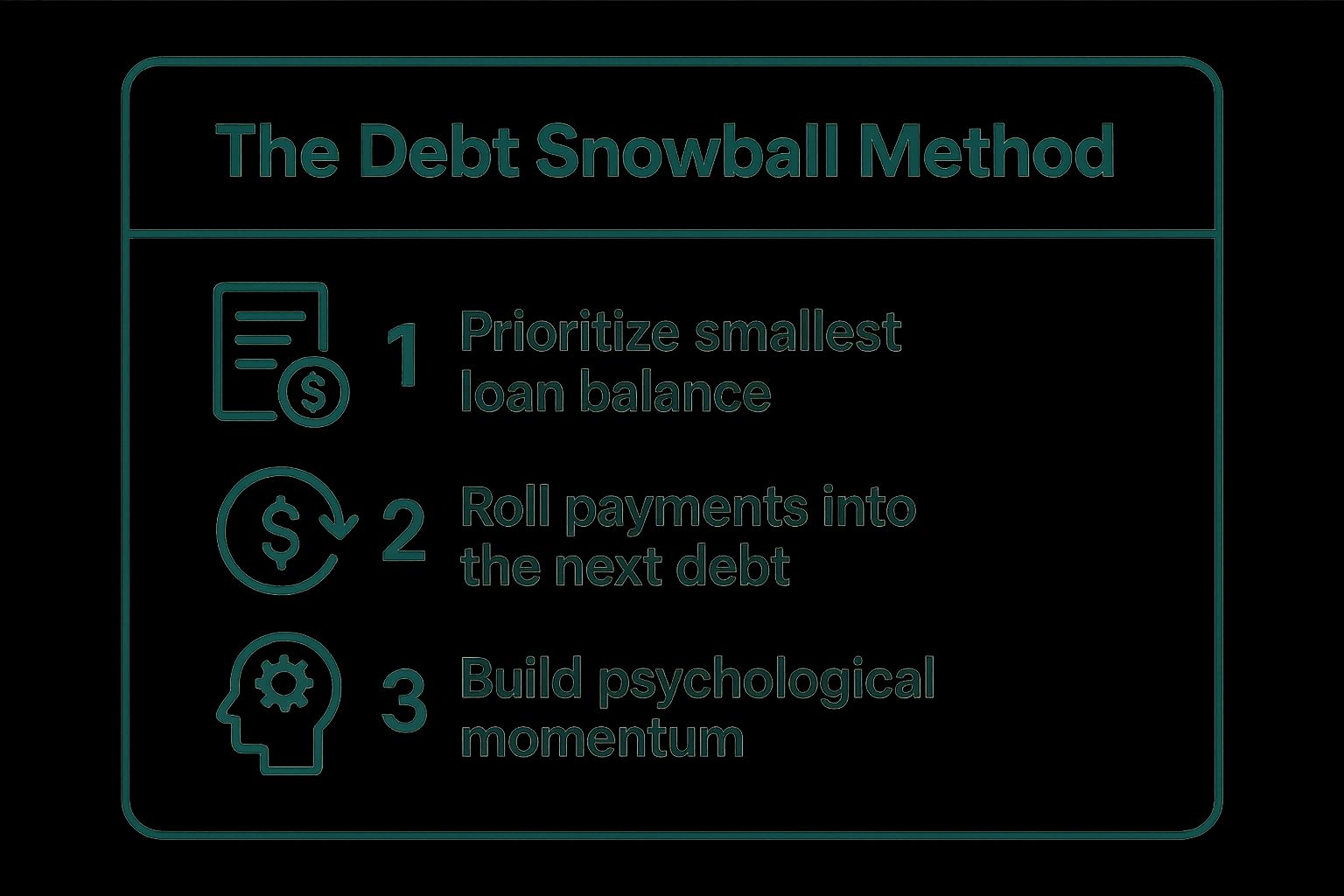

The Debt Snowball Method is a popular student loan repayment strategy that prioritizes paying off your smallest loan balances first, regardless of their interest rates. The core idea is to build momentum through quick, psychological wins. By eliminating smaller debts quickly, you gain motivation to tackle larger ones, creating a "snowball" effect as you roll each paid-off loan's payment amount into the next.

This approach, popularized by personal finance expert Dave Ramsey, appeals to those who feel overwhelmed by the sheer number of their loans. It provides a clear, actionable path forward that can transform a daunting task into a series of manageable achievements.

How It Works in Practice

Imagine you have three student loans:

- Loan A: $2,500 at 4.5% interest

- Loan B: $8,000 at 6.8% interest

- Loan C: $15,000 at 5.2% interest

Using the Debt Snowball Method, you would focus all your extra repayment efforts on Loan A first because it has the smallest balance. You would continue making only the minimum payments on Loans B and C. Once Loan A is paid off, you "roll" its monthly payment (plus any extra you were paying) into the payment for Loan B. After Loan B is eliminated, you combine both previous payments and attack Loan C.

Actionable Steps for Implementation

To start, list all your student loans from the smallest balance to the largest. Automate minimum payments for all but the top one on your list. Direct every extra dollar you can find in your budget toward that smallest loan until it's gone.

Key Insight: The power of the Debt Snowball Method isn't mathematical efficiency; it's behavioral science. The frequent victories keep you engaged and committed to your debt-free journey.

To help you visualize this strategy, the infographic below summarizes its core principles.

As the summary shows, this method simplifies your focus to conquering one debt at a time, using the momentum from each victory to power you through the next. Celebrating each paid-off loan is a crucial step to reinforce your progress and maintain motivation throughout the process.

2. Debt Avalanche Method

The Debt Avalanche Method is a student loan repayment strategy that prioritizes paying off your loans with the highest interest rates first. Unlike the Debt Snowball Method, this approach is purely mathematical, designed to save you the most money on interest over the life of your loans, making it the most cost-efficient strategy available.

This approach, often championed by financial analysts and advisors like Suze Orman, appeals to borrowers who are motivated by logic and long-term savings. By targeting high-interest debt, you systematically eliminate the loans that are costing you the most, accelerating your path to becoming debt-free in the most financially optimal way.

How It Works in Practice

Imagine you have three different student loans:

- Loan A: $15,000 at 5.2% interest

- Loan B: $2,500 at 4.5% interest

- Loan C: $8,000 at 6.8% interest

Using the Debt Avalanche Method, you would direct all your extra payments toward Loan C first because it has the highest interest rate (6.8%). You would make only the minimum required payments on Loans A and B. Once Loan C is paid off, you would take its entire payment amount and add it to your payments for Loan A, which is the next-highest interest rate loan.

Actionable Steps for Implementation

To begin, list all your student loans from the highest interest rate to the lowest. Ensure you are making the minimum payment on every single loan to avoid default. Then, commit any extra money in your budget toward the principal of the loan at the top of your list. Loan calculators can be a powerful tool to visualize the total interest saved with this method.

Key Insight: The Debt Avalanche Method requires discipline, as you may not get the quick satisfaction of paying off a loan quickly. Its power lies in its mathematical efficiency, which saves you the maximum amount of money in the long run.

This strategy is one of the most effective student loan repayment strategies for those who can stay motivated without the psychological boosts of small wins. By focusing on the numbers, you ensure every extra dollar you pay has the greatest possible impact on reducing your overall debt burden.

3. Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans are federal student loan repayment strategies that adjust your monthly payment based on your income and family size. Instead of a fixed amount determined by your loan balance, your payment is set to a more manageable percentage of your discretionary income. This approach makes payments more affordable for borrowers with lower or fluctuating earnings.

These plans, offered by the U.S. Department of Education, include options like Pay As You Earn (PAYE), Saving on a Valuable Education (SAVE, formerly REPAYE), and Income-Based Repayment (IBR). A key benefit is that any remaining loan balance may be forgiven after 20-25 years of qualifying payments, providing a long-term solution for those facing financial hardship.

How It Works in Practice

Imagine you are a recent graduate or a young professional in South Florida with federal student loans totaling $50,000 at 6% interest.

- Standard 10-Year Plan Payment: Approximately $555 per month.

- IDR Plan Payment: If your annual income is $40,000, your monthly payment under a plan like SAVE could be closer to $80 per month.

This significant reduction frees up cash flow, making it easier to cover living expenses in areas like Boca Raton while you build your career. The lower payment helps prevent default and keeps your loans in good standing, making it one of the most essential student loan repayment strategies for those with high debt-to-income ratios.

Actionable Steps for Implementation

To enroll, apply directly through the Federal Student Aid website or contact your loan servicer. You must recertify your income and family size annually to remain on the plan. Be mindful that while the monthly payments are lower, interest may still accrue, potentially increasing your total loan balance over time.

Key Insight: IDR plans are a financial safety net. They ensure your student loan payments never consume an unmanageable portion of your income, providing stability during early career stages or periods of reduced earnings.

As the summary shows, this method prioritizes affordability and long-term manageability. Keeping detailed records of your payments and annual recertification deadlines is crucial for successfully navigating these plans and staying on track for potential loan forgiveness.

4. Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program is a federal student loan repayment strategy designed to forgive the remaining balance on Direct Loans for borrowers committed to public service careers. The core concept is to reward individuals working full-time for qualifying employers, such as government agencies or non-profit organizations, by canceling their federal student debt after a decade of service and payments.

This program, established by the U.S. Department of Education in 2007, offers a powerful financial incentive for graduates entering lower-paying but socially vital fields. It aligns career goals with debt management, making it one of the most impactful student loan repayment strategies for those on a public service path.

How It Works in Practice

To qualify for PSLF, you must make 120 qualifying monthly payments while working full-time for a qualifying employer. These payments must be made under an income-driven repayment (IDR) plan. After reaching the 120-payment milestone, the remaining balance on your Direct Loans is forgiven, tax-free.

Consider a social worker with $80,000 in Direct Loans working for a 501(c)(3) nonprofit. They enroll in an IDR plan, which calculates their monthly payment based on their income. After making 120 on-time payments over 10 years of continuous, full-time employment, they can apply to have their remaining loan balance completely forgiven.

Actionable Steps for Implementation

First, use the Federal Student Aid's PSLF Help Tool to verify your employer's eligibility and submit an annual Employment Certification Form (ECF). This confirms your employment and tracks your qualifying payments, preventing surprises later. Ensure your loans are Federal Direct Loans; if you have other federal loan types like FFEL or Perkins, you may need to consolidate them into a Direct Consolidation Loan. Finally, enroll in a qualifying IDR plan and keep meticulous records of your payments and employment.

Key Insight: PSLF is not about paying off your loan faster; it's about minimizing your total out-of-pocket cost by paying as little as possible under an IDR plan until you reach the 120-payment mark for forgiveness.

This strategy requires long-term commitment and careful documentation. By annually certifying your employment and staying on an eligible repayment plan, you can confidently work toward a debt-free future while pursuing a meaningful career in public service.

5. Student Loan Refinancing

Student loan refinancing is a popular repayment strategy that involves taking out a new private loan to pay off your existing student loans. The goal is to secure a new loan with more favorable terms, such as a lower interest rate or a different monthly payment, which can save you a significant amount of money over the life of your loan. This approach is best suited for borrowers with a stable income and a strong credit score.

This strategy, advanced by fintech lenders like SoFi and Earnest, has become a mainstream option for managing high-interest debt. By consolidating multiple loans into a single private loan, borrowers can simplify their finances and potentially accelerate their payoff timeline. However, it's crucial to understand that refinancing federal loans with a private lender means permanently giving up access to federal protections, like income-driven repayment plans and loan forgiveness programs.

How It Works in Practice

Imagine you are an engineer with excellent credit and a stable job. You have several student loans totaling $60,000 with an average interest rate of 6.5%. Your monthly payment is high, and a large portion goes toward interest.

By shopping around with private lenders, you qualify for a new loan at a 4.25% interest rate. You use this new loan to pay off your old ones. This single action lowers your interest rate, which could reduce your monthly payment, allow you to pay off your debt faster with the same payment, or both. This is one of the most direct student loan repayment strategies for those with strong financial standing.

Actionable Steps for Implementation

First, check your credit score and gather your loan statements. Next, get rate quotes from multiple private lenders without impacting your credit score, as most offer a pre-qualification process. Carefully compare interest rates (both fixed and variable), loan terms, and any fees. If you decide to proceed, complete the application, and the new lender will pay off your old loans directly.

Key Insight: Refinancing is a powerful tool for borrowers with good credit to lower their interest costs, but it's an irreversible decision. You must weigh the savings against the loss of federal benefits like forbearance, deferment, and potential forgiveness.

To begin this process, list your current loans, noting their balances and interest rates. This will give you a clear baseline to compare against any refinancing offers you receive. Making an informed choice is essential to ensure this strategy aligns with your long-term financial goals and risk tolerance.

6. Employer Student Loan Assistance Programs

One of the most powerful student loan repayment strategies involves leveraging your job. Employer Student Loan Assistance Programs are an increasingly popular workplace benefit where companies contribute directly to their employees' student loan payments. This assistance can come in various forms, such as monthly contributions, annual lump-sum payments, or even facilitating better refinancing options.

These programs represent a major shift in employee benefits, as companies recognize the significant financial burden student debt places on their workforce. By offering this perk, employers can attract and retain top talent, making it a valuable asset for employees seeking to accelerate their debt repayment journey without sacrificing their own income.

How It Works in Practice

The implementation of these programs varies by company. Typically, an eligible employee enrolls in the benefit program, and the employer makes payments directly to the student loan servicer. This contribution is applied on top of the employee's regular minimum payment, directly reducing the principal balance and interest accrual.

Consider these real-world examples:

- PwC: The consulting giant offers associates and senior associates $1,200 per year for up to six years.

- Aetna: This healthcare company provides up to $2,000 annually, with a lifetime maximum of $10,000.

- Google: Many tech leaders offer significant annual contributions, often between $1,000 and $5,000, to stay competitive.

Actionable Steps for Implementation

First, check your current company's benefits portal or speak with HR to see if a student loan assistance program is offered. If you're job searching, make this a key factor in your decision. Always review the program's eligibility and vesting requirements carefully, as some may require a certain length of employment. Don't be afraid to negotiate for this benefit during salary discussions if it is not a standard offering.

Key Insight: Employer contributions are essentially "free money" applied directly to your loan principal. This strategy allows you to pay down your debt significantly faster without impacting your personal budget.

7. Strategic Extra Payment Application

Strategic Extra Payment Application is a powerful student loan repayment strategy focused on making payments beyond your required minimum. This method accelerates your payoff timeline and significantly reduces the total interest you pay by ensuring any extra money goes directly toward your loan's principal balance.

The key to this approach is being intentional. Instead of just sending more money, you must direct your loan servicer on how to apply it. This prevents the servicer from simply "prepaying" your next month's bill, which does little to reduce your long-term interest costs. It's a proactive method for those who want to maximize the impact of every extra dollar.

How It Works in Practice

Imagine your monthly student loan payment is $300, and this month you can afford to pay $400. Without specific instructions, the servicer might apply the extra $100 to your next month's payment. However, by strategically applying it, you instruct them to put that $100 directly onto the principal of your highest-interest loan. This immediately reduces the balance that accrues interest, saving you money from that point forward.

Applying a tax refund or a work bonus works the same way. A one-time $2,000 extra payment applied to the principal of a high-interest loan can shave months, or even years, off your repayment term and save you hundreds in interest.

Actionable Steps for Implementation

First, check your loan servicer’s website or call them to understand their process for applying extra payments to the principal. Many have a specific checkbox or field in their online payment portal. Always target your highest-interest rate loan first for maximum savings. Consider setting up bi-weekly payments; by making 26 half-payments a year, you effectively make one full extra monthly payment annually.

Key Insight: The effectiveness of this strategy lies in your communication with the loan servicer. Always verify that extra payments are applied directly to the principal of your chosen loan to ensure you’re reducing interest, not just paying ahead.

Regularly check your loan statements after making an extra payment to confirm it was applied correctly. Diligence here is crucial for making this one of the most effective student loan repayment strategies available.

8. Loan Consolidation Strategy

The Loan Consolidation Strategy involves combining multiple federal student loans into a single Direct Consolidation Loan. This process creates one new loan with a fixed interest rate that is the weighted average of the original loans' rates, rounded up to the nearest one-eighth of a percent. The primary goal is to simplify repayment and, in some cases, to unlock eligibility for certain federal repayment plans or forgiveness programs.

This strategy is particularly useful for borrowers with older loan types, such as Federal Family Education Loan (FFEL) Program loans, or those juggling multiple loan servicers. It streamlines your financial obligations into a single monthly payment, making your student loan repayment strategies easier to manage.

How It Works in Practice

Imagine a borrower has the following federal loans:

- Loan A: $10,000 FFEL loan at 6.0% interest

- Loan B: $15,000 Direct Subsidized Loan at 4.5% interest

- Loan C: $5,000 Direct Unsubsidized Loan at 4.5% interest

To qualify for Public Service Loan Forgiveness (PSLF), the borrower must consolidate the FFEL loan into the Direct Loan Program. By applying for a Direct Consolidation Loan through the official Federal Student Aid website, all three loans are combined. The new single loan of $30,000 would have a new weighted average interest rate and become fully eligible for PSLF, provided the borrower meets employment requirements. This also combines three separate payments into one manageable bill.

Actionable Steps for Implementation

To start, log in to your account on StudentAid.gov to view all your federal loans and access the free Direct Consolidation Loan application. Carefully review which loans are eligible and decide if consolidation aligns with your goals. For instance, consolidating Parent PLUS loans can make them eligible for the Income-Contingent Repayment (ICR) plan, which is a crucial step for some borrowers seeking forgiveness.

Key Insight: Consolidation isn't just for convenience; it's a strategic tool. Its primary power lies in making ineligible loans eligible for powerful federal programs like PSLF or specific income-driven repayment plans.

Before proceeding, always weigh the benefits against potential drawbacks, such as resetting your payment count for forgiveness (though temporary waivers can alter this) or losing specific benefits tied to your original loans. Consulting the official Federal Student Aid website is essential for making an informed decision.

Student Loan Repayment Strategies Comparison

| Method / Program | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Debt Snowball Method | Low – Simple to implement, easy to track | Low – Minimal tools needed | Moderate – Psychological momentum, faster payoff of small debts | Borrowers seeking motivation and quick wins | Builds confidence and motivation early |

| Debt Avalanche Method | Moderate – Requires discipline and tracking | Low to Moderate – Need interest rate info | High – Minimizes total interest paid | Borrowers prioritizing cost savings and efficiency | Most cost-effective, mathematically optimal |

| Income-Driven Repayment (IDR) | Moderate – Requires annual income recertification | Moderate – Documentation and paperwork | Moderate – Lower monthly payments, potential forgiveness | Low-income borrowers needing affordable payments | Payment adjusts to income, possible loan forgiveness |

| Public Service Loan Forgiveness (PSLF) | High – Strict eligibility, complex process | High – Employment verification & paperwork | High – Complete forgiveness after 10 years | Public service employees with eligible loans | Forgiveness amount is tax-free |

| Student Loan Refinancing | Moderate – Needs credit evaluation and application | Moderate to High – Good credit required | Variable – Potentially lower interest and monthly payments | Borrowers with good credit seeking better terms | Simplifies payments, may lower interest rates |

| Employer Student Loan Assistance Programs | Low – Dependent on employer offerings | Low – Employer contributions | Moderate – Speeds up payoff with extra funds | Employees at companies offering loan benefits | Free money, potential tax advantages |

| Strategic Extra Payment Application | Moderate – Requires educating servicers | Moderate – Extra disposable income needed | High – Saves interest, shortens loan term | Borrowers able to make extra payments strategically | Reduces interest, flexible payment amounts |

| Loan Consolidation Strategy | Moderate – Application and timing important | Low – Mostly paperwork | Moderate – Simplifies repayment, resets forgiveness clock | Federal borrowers managing multiple loans | Consolidates payments, enables forgiveness eligibility |

Take Control: Crafting Your Personalized Repayment Plan

Navigating the landscape of student loan repayment can feel overwhelming, but as this guide has demonstrated, you are far from powerless. The journey from debt to financial freedom is not about finding a single magic bullet. Instead, it’s about strategically assembling a personalized toolkit of effective student loan repayment strategies tailored to your unique financial DNA.

We've explored a powerful array of options, from the psychologically motivating Debt Snowball method to the mathematically efficient Debt Avalanche method. We’ve detailed how federal programs like Income-Driven Repayment (IDR) plans and Public Service Loan Forgiveness (PSLF) can provide critical relief and a structured path to debt cancellation for eligible borrowers. For those with strong credit and high-interest private loans, refinancing can unlock significant long-term savings.

Your Blueprint for Action

The most crucial takeaway is the power of a hybrid approach. A recent graduate working for a nonprofit in Boca Raton might enroll in an IDR plan to keep monthly payments manageable while simultaneously working toward PSLF. A young professional in South Florida’s booming tech scene might refinance their private loans and apply the Debt Avalanche method to aggressively pay down the highest-interest debt first, while also maxing out their employer's student loan assistance program.

Your next steps are clear and actionable:

- Inventory Your Loans: Create a master spreadsheet with every loan, including the servicer, balance, interest rate, and type (federal or private).

- Define Your Goals: Are you aiming to pay off debt as fast as possible, lower your monthly payment, or qualify for forgiveness? Your primary goal will dictate your strategy.

- Run the Numbers: Use online calculators to compare refinancing offers or simulate your payments under different IDR plans. Don't just guess; see the real-world impact of each choice.

- Automate and Optimize: Set up automatic payments to avoid missing one. When you can, use strategic extra payments, ensuring you instruct your servicer to apply the funds directly to the principal of your highest-interest loan.

By moving from passive acceptance to active, informed decision-making, you transform your student loans from a source of stress into a finite, manageable financial project. This proactive stance is the cornerstone of building long-term wealth and achieving the future you envision. Taking control of your student debt is one of the most empowering steps you can take toward financial independence, freeing up your resources to invest, save, and build the life you deserve.

A key component of managing your student loans is controlling your largest monthly expense: housing. Living affordably without sacrificing quality of life allows you to allocate more money toward your debt repayment goals. Discover how the thoughtfully designed and budget-conscious apartments at Cynthia Gardens can be the perfect foundation for your financial strategy in Boca Raton by visiting Cynthia Gardens today.