Before you even scroll through a single apartment listing, you have a chance to make the biggest impact on your rent bill. It’s a simple truth most renters overlook: your location is the single most powerful factor determining what you’ll pay each month. Making a smart choice here from the get-go is the foundation for some serious long-term savings.

Start With Smarter Location Choices

Believe it or not, your zip code often matters more than square footage or fancy amenities when it comes to your monthly rent. Choosing a neighborhood, city, or even a different state with a better handle on housing affordability can slash your expenses without you having to sacrifice your quality of life. The trick is to start thinking like a strategic renter right from the beginning.

Instead of getting tunnel vision on the trendiest, most in-demand neighborhoods, it's time to broaden your horizons. Look at the communities right next door or those that are just starting to pop up on people's radar. You'd be surprised how often moving just a few miles away can shave hundreds of dollars off your rent every single month. It takes a little extra homework, but the payoff is huge.

Understand Housing Affordability Metrics

A great way to find real value is to focus your search on genuinely affordable markets, because costs can swing wildly from one region to another. The Demographia International Housing Affordability report is a fantastic resource for this. It uses a "median multiple" to compare median home prices to median household income.

Here's the breakdown: a market with a multiple of 3.0 or under is considered affordable. Once it hits 9.0 or more, it’s labeled 'impossibly unaffordable.'

By prioritizing location affordability, you're not just finding a cheaper apartment; you're fundamentally changing your financial outlook. This single decision can free up hundreds, if not thousands, of dollars annually for other goals like saving, investing, or paying down debt.

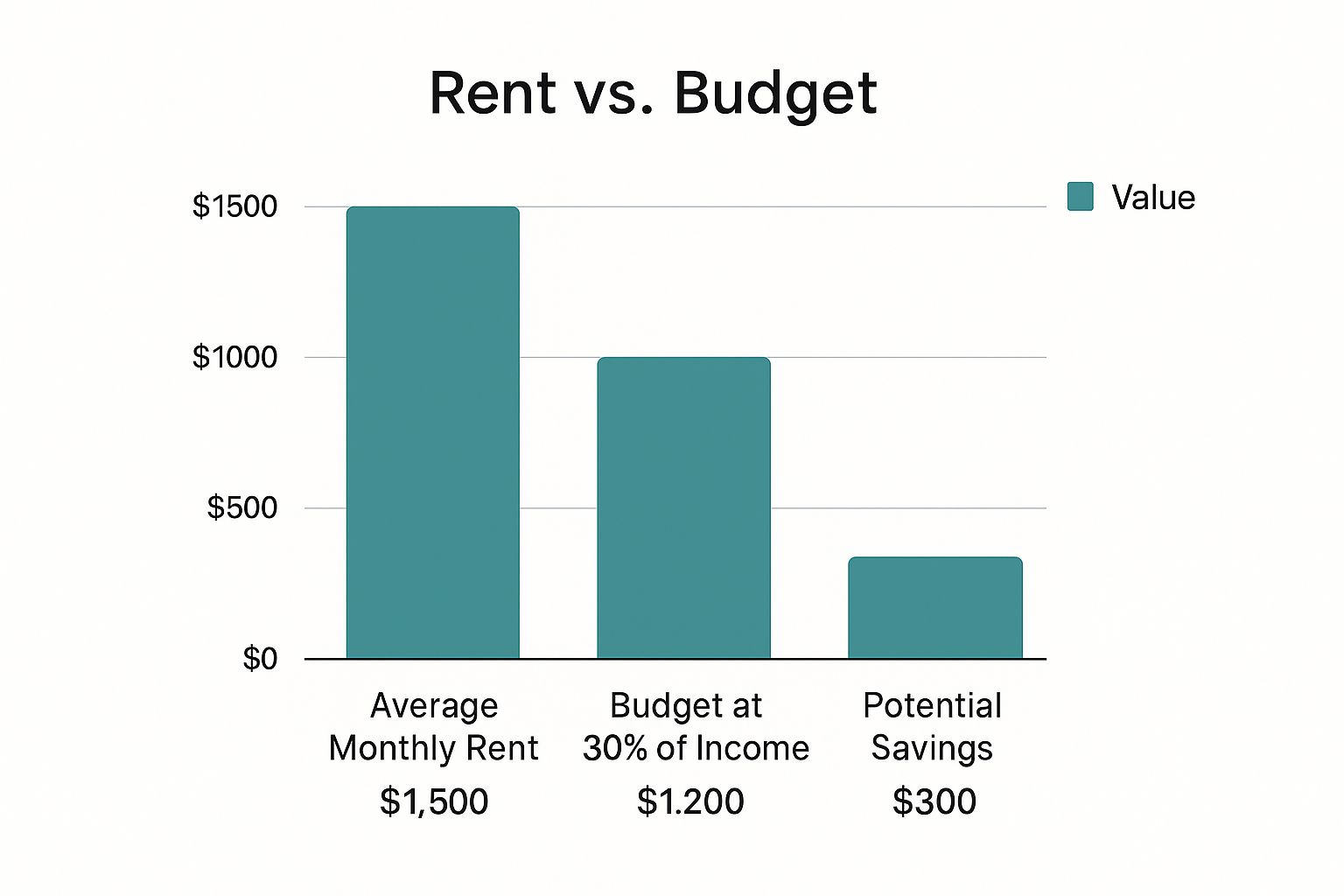

Visualizing Your Potential Savings

Seeing the gap between what you can afford and what the average rent is in a certain area can be a real eye-opener. It shows you exactly where your best opportunities are hiding.

As you can see, the most direct path to saving big every month is to make sure your location search lines up with your budget from the very start.

Comparing Different Location Strategies

Not every location-based strategy works for every renter. Your personal situation—like how flexible you are with commuting, whether you work remotely, and your lifestyle—will really shape what makes the most sense.

To help you decide, here’s a look at a few common approaches people take to find a more affordable place to live.

| Strategy | Potential Savings | Considerations |

|---|---|---|

| Move to an Adjacent Neighborhood | Moderate | Easiest move to make. Commute might get a bit longer, but the rent savings often outweigh the extra travel time. |

| Explore a Neighboring City | Substantial | A bigger lifestyle shift is needed. Perfect for remote workers or those who don't mind a longer commute for a major price drop. |

| Relocate to a Lower Cost-of-Living State | Highest | A significant life decision. Requires maximum flexibility but offers the biggest financial reward and can totally reshape your budget. |

Ultimately, the best choice depends on what you're willing to trade for those savings. For many, a slightly longer drive is a small price to pay for having an extra few hundred dollars in their pocket each month.

Find Affordable Apartments in Any Market

Alright, you've picked your ideal neighborhood. Now for the fun part: the actual hunt. If you want to find a great deal, you need to think beyond simply plugging filters into a search site. The smartest renters I know have a knack for reading the market and spotting opportunities others overlook.

It helps to have a feel for the current trends. While average rents are still on the rise, the good news is that the pace has slowed considerably from the frenzy of the last few years. Budgets are tighter all around, and that can create some wiggle room for you.

Look Beyond the Obvious Listings

The best deals are rarely in the brand-new, amenity-packed luxury buildings. You have to dig a little deeper. By broadening your search just a bit, you can uncover some real hidden gems that offer fantastic value.

I always tell people to check out these less-obvious options:

- Older Buildings: Sure, a property from a few decades ago might not have a yoga studio, but what it often does have are bigger floor plans and lower rent. I'll take space over a fancy gym I'll never use any day.

- Private Landlords: You can often find listings from individual owners on sites like Facebook Marketplace or Zillow. These landlords tend to be more flexible on pricing and lease terms than big, corporate management companies with strict rules.

- "For Rent" Signs: This is old-school, but it works. Take a drive or a walk through the neighborhoods you love. You’d be surprised how many great spots are advertised with a simple sign in the yard, meaning you'll face way less competition.

Taking these extra steps can make a huge difference. If you're looking in a specific spot, like near the university, checking local community boards or dedicated housing pages is a pro move for finding great https://cynthiagardens.com/apartments-in-boca-raton-near-fau/ without breaking the bank.

The real secret is to focus on your needs versus your wants. A well-built older apartment with a smart layout is a much better financial move than a tiny new unit with luxury perks you'll barely touch.

Master Your Search Timing

This is a big one. Timing your apartment search can give you a massive advantage. Just like with anything else, the rental market has its high and low seasons. Hunting during the "off-season" is your ticket to saving money.

Think about it: everyone wants to move in the spring and summer. That’s when demand is highest. But come winter, things cool down—a lot. The rental market is typically slowest between November and March.

During these colder months, you're not fighting a crowd of other renters. Landlords are more anxious to fill empty units, which puts you in a much stronger position.

This can lead to some serious perks:

- Lower advertised rents to attract tenants.

- More room to negotiate the monthly price.

- A better chance of getting concessions, like a free month or a waived security deposit.

By searching when everyone else is staying put, you become a top-tier applicant in a less crowded market. And once you land that affordable place, especially if it’s on the cozier side, learning the principles of space planning will help you make every single square foot count. It’s all part of the strategy to live well without overpaying.

Master the Art of Rent Negotiation

Here’s a secret many renters don't realize: the advertised price on an apartment isn't always the final price. You can often negotiate your rent, but most people never even try. With a little preparation and the right approach, you can turn a standard lease signing into a real opportunity to save money.

Successful rent negotiation isn't about being pushy. It’s a professional conversation where you present a compelling, mutually beneficial case. Property managers want reliable, long-term tenants who pay on time and take care of the place. You just need to show them you’re that person.

Come Prepared with Market Data

Walking into a negotiation without any research is like flying blind. Before you ever talk to the property manager, you need to do your homework. This is what shifts the conversation from what you want to pay to what’s actually a fair price based on the current Boca Raton market.

Start by digging into comparable apartment listings right in the neighborhood. Look for units with similar square footage, the same number of bedrooms, and comparable amenities. If you find several similar apartments renting for 5-10% less, you’ve just found your opening.

Don’t just compare prices—look for the story behind them. Is the building you’re interested in in a better location? Or does your potential unit have a drawback, like being next to a noisy elevator or having a less-than-ideal view? These are perfectly valid reasons to ask for a slight discount.

Armed with this data, you can approach the conversation confidently. Frame your request around the market facts you've gathered. This shows you're a serious, informed applicant, not just someone trying to get a deal.

Show Them You're the Perfect Tenant

At the end of the day, landlords and property managers want one thing above all: a low-risk, hassle-free tenant. Your personal qualifications are your most powerful negotiating chips. If you can make a property manager feel confident about you, they'll be far more willing to work with you on the price.

Be ready to highlight your strengths:

- A strong credit score is an instant sign of financial responsibility.

- Proof of stable income shows you can easily cover the rent.

- Glowing references from previous landlords prove you're a trustworthy resident.

- A desire to stay long-term. Offer to sign a longer lease, like 18 or 24 months, in exchange for a lower, locked-in rate. This is a huge win for them, as it saves them the cost and headache of finding a new tenant.

When you position yourself as the ideal candidate, you lower the landlord's perceived risk. That gives them a powerful reason to meet you in the middle.

Look Beyond the Monthly Rent Check

What if the landlord just won't budge on the monthly rent? It happens, especially in a tight market. If you hit a wall, it’s time to get creative. Saving money isn't just about the base rent—it's about your total living expenses.

Think about other costs associated with the apartment. Could you ask for a dedicated parking spot to be included at no charge? Maybe request an upgrade to a newer appliance or ask if they'll waive the pet fees.

Even small wins can add up to hundreds of dollars in savings over the life of your lease. Knowing which affordable apartments in Boca Raton offer the best overall value is a huge part of this strategy.

Explore Creative Living Arrangements

Sometimes, the most effective way to slash your housing budget is to think outside the box. A solo apartment might feel like the ultimate goal, but exploring different living situations can free up a surprising amount of cash each month for your other financial priorities.

Let's be real—renting is tough right now. According to the Harvard Joint Center for Housing Studies, millions of renters are "cost-burdened," which means they spend over 30% of their income just on a roof over their heads. With home prices climbing, it’s no wonder people are getting creative. Smart strategies like finding a roommate or opting for a smaller place aren't just workarounds; they're essential for anyone serious about saving money.

The Financial Power of Roommates

Getting a roommate is hands-down the quickest way to cut your rent in half, or even more. Think about it: a two-bedroom apartment in Boca Raton almost always costs less per person than renting two separate one-bedroom units. That one decision immediately lowers your biggest monthly bill and lets you split the costs of utilities and internet.

Of course, the key is finding the right person. You'll want to find someone with a compatible lifestyle and good communication habits.

- Establish Financial Ground Rules: Before anyone moves a single box, get a simple written agreement in place. It should cover how bills are split, when they’re due, and how you'll handle shared expenses like cleaning supplies or groceries.

- Discuss Living Habits: Have an honest chat about cleanliness, having guests over, and noise levels. A little transparency upfront can prevent some major headaches down the road.

A great roommate doesn't just cut your bills; they can become a great friend and support system. The financial benefits are just the start of a positive shared living experience.

Consider Co-Living and Other Alternatives

Beyond the classic roommate setup, other arrangements are popping up that can simplify your budget and your life.

Co-living spaces are a fantastic modern option. These communities offer a private bedroom while you share common areas like a high-end kitchen, lounge, and sometimes even a gym. The best part? The monthly fee often bundles rent, utilities, Wi-Fi, and even cleaning services into one predictable payment. It takes a lot of the guesswork out of budgeting.

If you’re a bit more adventurous, you could even try these less conventional paths:

- House-sitting: Look for opportunities to watch someone's home and pets while they travel. This can mean free or deeply discounted lodging for weeks or even months at a time.

- Downsizing: Moving into a smaller, more efficient apartment can dramatically reduce your rent and utility bills. To make a smaller space work without feeling cramped, understanding the benefits of self-storage can be a game-changer for keeping your belongings organized and out of the way.

By staying flexible and open-minded about how you live, you can turn your housing situation from a financial drain into a strategic advantage. The savings you unlock can help you build an emergency fund, pay off debt, or get you that much closer to a down payment on a place of your own.

Lower Your Housing Bill Beyond Rent

You’ve landed a great deal on your lease—that’s a huge win. But don’t stop there. The real cost of your apartment isn't just the number on your rent check. It’s the full picture: utilities, repairs, insurance, and even the cost of moving in. These expenses can creep up on you, quietly eating away at your budget if you aren't watching them closely.

Thinking about the total cost of living is the key to making an affordable apartment truly affordable. By getting smart about these other expenses, you can find extra savings that really add up over time.

Cut Down Your Monthly Utility Bills

Electricity, water, internet—these are the recurring bills you have a surprising amount of control over. A few small tweaks to your daily habits can lead to some serious savings over the course of a year.

It all starts with simple, energy-conscious habits:

- Unplug electronics when you're not using them. Many gadgets sip "phantom power" even when they’re off.

- Switch to LED light bulbs. They're a game-changer, using up to 80% less energy than old-school incandescent bulbs.

- Nudge your thermostat. Just a couple of degrees makes a difference. A smart thermostat can even do the work for you, learning your routine and optimizing temperatures automatically.

Especially here in sunny Florida, keeping your apartment cool is a big part of your energy bill. Simple solutions like DIY window insulation can make a huge impact by keeping the heat out and the cool air in.

Protect Yourself with Smart Renter’s Insurance

I see it all the time: renters skipping insurance to save a few bucks a month. Honestly, it's a massive gamble. One small kitchen fire or a burst pipe could leave you on the hook for thousands of dollars to replace everything you own. Renter’s insurance is your financial safety net, and it’s way more affordable than most people think.

The average cost of renter's insurance is only about $15 to $30 per month. That’s a tiny price to pay for the peace of mind that comes with protecting all your stuff. It usually covers personal property and liability, in case someone gets hurt in your home.

Don't just go with the first quote you find. Shop around and compare prices from a few different insurance companies. You can often score a discount by bundling it with your car insurance. This small monthly payment is a non-negotiable part of any smart rental strategy. For more on this, check out our guide on balancing budget and lifestyle in Boca Raton.

Handle Minor Fixes and Moving Costs

Ever had to pay for a simple service call for a clogged drain? Sometimes, small maintenance tasks fall on the tenant, and those little fees can be frustrating. Learning a few basic DIY skills—like fixing a loose cabinet handle or clearing a slow drain—can save you from those unexpected charges.

And let's not forget the cost of the move itself. Professional movers can cost a small fortune, especially for a local move. You can save hundreds by planning ahead. Start collecting free boxes from local grocery or liquor stores, and see if you can rally a few friends to help with the heavy lifting in exchange for pizza and gratitude. It makes a huge difference.

Burning Questions Renters Have About Saving Money

You've got the big-picture strategies down, from finding the right neighborhood to polishing your application. But when it comes to the nitty-gritty of saving on rent, a few common questions always seem to pop up. Let's tackle them head-on.

Getting answers to these specific scenarios can be the difference between a good deal and a great one.

Is It Better to Sign a Longer Lease to Get a Lower Rent?

More often than not, yes. Landlords and property managers absolutely love the stability of a long-term tenant. Every time an apartment turns over, it costs them money—think cleaning fees, fresh paint, marketing expenses, and lost income from the vacancy.

An 18-month or even a 24-month lease is a huge win for them. To lock in a reliable resident, they're frequently willing to knock a bit off the monthly rent. The catch? You have to be 100% sure you're staying put. Breaking a long-term lease can come with some seriously steep penalties that will wipe out any savings you pocketed, and then some.

Before you commit, do an honest gut check. How stable is your job? Your personal life? If there's even a slight chance you might need to move, the flexibility of a standard 12-month lease is the smarter, safer play.

How Much Can I Realistically Negotiate Off the Advertised Rent?

Ah, the million-dollar question. Unfortunately, there's no magic number. Your negotiating power is completely tied to the current market, how many empty units the building has, and even the season you're apartment hunting.

Think of it in terms of supply and demand:

- Renter's Market: When you see "For Rent" signs everywhere, you're in the driver's seat. Negotiating 5-10% off the asking price is a totally reasonable goal.

- Landlord's Market: If apartments are getting snapped up in a day, your wiggle room on price is probably zero.

But don't give up if the landlord won't budge on the monthly rent. Pivot your approach. Ask for other valuable concessions that still save you money. Could they throw in a free month? Waive the pet fee? Maybe include that premium parking spot at no cost? Your best leverage is always being a top-tier applicant who knows what comparable apartments in the area are actually renting for.

Can I Offer to Pay Several Months of Rent Upfront for a Discount?

This can be a very compelling move, particularly if you’re dealing with a private landlord or if your credit isn't perfect. Putting two or three months of rent on the table upfront is a massive signal of your financial health. It instantly calms a landlord's biggest fear: non-payment.

In exchange for that peace of mind, many will consider a small discount on your monthly rate. It shows you’re serious, responsible, and low-risk.

One crucial piece of advice: get any agreement like this in writing and make sure it's part of the official, legally binding lease. And never, ever hand over a large sum of cash before that lease is signed, sealed, and delivered by everyone involved.

Ready to find an affordable and beautiful apartment in a prime Boca Raton location? The team at Cynthia Gardens is here to help you find your perfect home without breaking the bank. Explore our available one-bedroom apartments today!