Welcome to the world of Boca Raton foreclosures. It's a corner of the real estate market where sharp buyers can find incredible entry points into one of South Florida's most sought-after communities. These properties aren't your typical listings; they represent a strategic chance to acquire valuable real estate, but only if you know how to navigate the specialized process. Getting it right takes knowledge, a bit of patience, and a clear game plan.

What Exactly Is a Foreclosure in Boca Raton?

At its core, a foreclosure is simply the legal process a lender uses to get its money back when a borrower stops paying the mortgage. Think of it like a bank repossessing a luxury car—same idea, but with a house. The lender takes back ownership and then usually sells the property to cover the outstanding loan.

You might think foreclosures are rare in an affluent city like Boca Raton, but they happen more often than people realize. Financial hardship can hit anyone, regardless of their home's price tag. When it does, it creates an opening for buyers to purchase properties that might otherwise be out of reach.

Why Do These Opportunities Even Exist?

Even in prestigious neighborhoods, life happens. Economic downturns, job loss, or other personal circumstances can cause homeowners to default on their mortgages. This isn't a sign of a market collapse; it's just a niche segment that savvy buyers can tap into. We even saw this with the recent situation at the 101 Via Mizner apartment building, a luxury high-rise, proving no property is completely immune to financial pressures.

The trick is to see these events not as simple "distressed sales" but as strategic openings. For someone with the right know-how, a foreclosure can be the key to unlocking the coveted Boca Raton lifestyle.

A Unique Slice of the Market

The Boca Raton foreclosures market offers a fascinating contrast to the city's high-end reputation. The inventory isn't just one type of property; you can find everything from sprawling single-family homes to ocean-view condos in high-rises, often listed below their typical market value.

These potential discounts are a powerful entry point for both investors and regular homebuyers who want to get into a luxury market at a more manageable price point. You can discover more insights about foreclosure auctions in Boca Raton to really grasp the potential here.

A foreclosure isn’t just a transaction; it's a chance to acquire significant value in a high-demand area. Understanding the process is the first step toward turning a complex situation into a successful investment.

This guide will walk you through everything you need to know, from finding the right properties to navigating the auction and finally closing the deal.

Getting a Handle on Today's Foreclosure Trends

To really get the lay of the land in the Boca Raton foreclosures market, you have to look past individual listings and dig into the hard numbers. The data tells the real story—how fast the market is moving, how much competition you’re up against, and where the real opportunities are hiding. Think of it like checking the weather before a long road trip; it prepares you for what's coming.

The number of foreclosure auctions is one of the best indicators we have for market health. When auction activity picks up, it's a clear sign that more distressed properties are coming down the pipeline. That can mean more choices for buyers, but it almost always brings more competition to the table, so staying on top of the trends is non-negotiable.

Looking at recent stats for Palm Beach County, where Boca Raton is located, you can see just how much things are shifting. We’ve seen some pretty significant year-over-year jumps in auction numbers, which tells us the foreclosure environment is anything but static.

What the Recent Auction Numbers Are Telling Us

The data shows a clear upward trend in foreclosure auctions at several points this year. Back in January, for example, there were 243 foreclosure auctions, which was a 7.52% bump from the year before. That was just the start.

February saw a 32% increase, and things really heated up over the summer. June and July saw massive spikes of 63.57% and 76.64%, respectively. If you want to see the numbers for yourself, you can review the full Palm Beach County foreclosure statistics and see the pattern.

This steady climb points to a changing economic tide, where more homeowners are unfortunately falling into financial distress. For a buyer, this information is pure gold. It confirms that the supply of foreclosed homes isn't a fixed number but a moving target you need to watch closely.

Watching foreclosure auction volume is a lot like tracking stock market tickers. Those spikes and trends can signal big opportunities for anyone who's paying attention and ready to move.

Understanding these numbers helps you figure out how aggressive you need to be with your bidding. A market with a rising number of foreclosures might let you get away with more conservative bids. But if you see that inventory start to dip, you can bet the competition is about to get fierce.

Using the Data to Build Your Strategy

It's not just about the raw number of auctions. The real actionable intelligence comes from looking at what kinds of properties are being foreclosed on and what they're actually selling for compared to their market value.

Here are the key things I always tell my clients to watch:

- Auction Volume: Are the numbers going up or down each month? A steady rise usually means more inventory is on its way.

- Average Sale Discount: How much of a bargain are people really getting? Knowing the typical discount below market value helps you set realistic expectations.

- Property Types: Are you seeing more condos, single-family homes, or luxury estates hitting the auction block? This helps you tailor your search to what’s actually available.

This change in the market is especially visible when you look at how certain segments, like luxury condos, have evolved. The dynamics have shifted quite a bit in recent years.

Boca Raton Luxury Condo Market Snapshot

The table below gives you a quick look at how the luxury condo market has changed, providing context for the current foreclosure environment. A lot has happened between 2017 and today.

| Metric | Q2 2017 | Q2 2025 (Projected) | Percentage Change |

|---|---|---|---|

| Average Sale Price | $1.2 million | $1.8 million | +50% |

| Days on Market | 120 days | 45 days | -62.5% |

| Inventory Levels | 8-month supply | 3-month supply | -62.5% |

| Price per Sq. Foot | $650 | $950 | +46% |

As you can see, the luxury market has gotten hotter, faster, and more expensive. With less inventory and properties selling quicker, any foreclosures that do appear in this segment are likely to attract intense competition.

By tracking these data points, you stop being a casual browser and become a strategic buyer. You can start to anticipate market shifts, spot the best targets before everyone else does, and make offers based on solid evidence, not just a hunch. In the competitive world of Boca Raton foreclosures, that's how you win.

Your Step-By-Step Guide to Buying a Foreclosure

Jumping into the market for Boca Raton foreclosures can feel like a lot to take on, but once you break it down into manageable steps, the whole process becomes much clearer. Buying a foreclosure isn't just one single action; it's a journey with a few distinct phases.

Whether you’re trying to snag a property before it ever goes to auction or you're ready to place a bid at the courthouse, having a solid plan is your best bet for success. It all starts with finding the right properties and, hopefully, ends with you holding the keys.

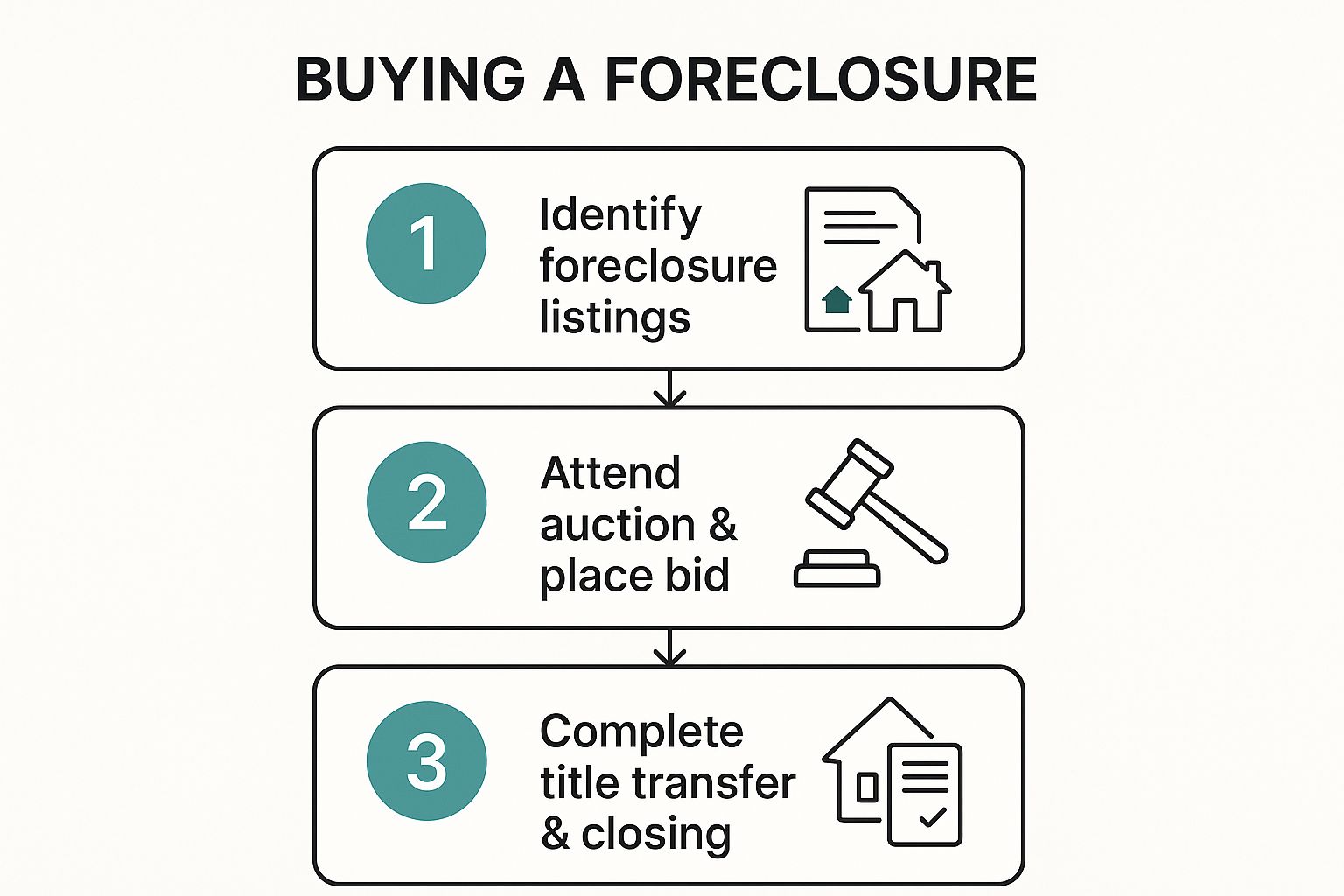

This chart lays out the typical stages you'll go through when buying a foreclosed home at auction.

Think of this as your roadmap from discovery to ownership. Knowing what to expect at each turn helps you line up your finances and get your legal ducks in a row ahead of time.

The Three Paths to a Foreclosure Purchase

There are really three main ways to buy a foreclosed property, and each comes with its own unique set of rules and risks. The best strategy for you will boil down to your comfort level with risk, how you plan to pay for it, and just how hands-on you're willing to get.

-

Pre-Foreclosure (Short Sales): This is your opportunity to buy the home straight from the owner before the bank officially takes it back. In this scenario, the owner is trying to sell for less than what they owe on the mortgage, which means the bank has to sign off on the deal. These sales can drag on, but they often give you more wiggle room for negotiation and, crucially, a chance to get a proper home inspection.

-

Courthouse Auction: This is what most people picture when they think of foreclosures. Homes that don't get sold during the pre-foreclosure stage are put up for public auction, which for Palm Beach County is typically held online. It’s a fast-paced, high-stakes game where the property goes to the highest bidder. The biggest challenge here? You usually have to pay the full amount almost immediately with certified funds and buy the property completely "as-is"—often without ever stepping inside.

-

Bank-Owned (REO) Properties: If no one buys the property at auction, ownership reverts back to the bank. At that point, it becomes a Real Estate Owned (REO) property. Buying an REO is a lot more like a standard home purchase. You can usually get a mortgage, schedule inspections, and negotiate with the bank through a real estate agent.

Navigating the Auction Environment

The courthouse auction is where you can find some of the best deals, but it's not for the faint of heart. It demands serious prep work. Before you even consider placing a bid, you have to do your homework, and that starts with a thorough title search. You need to uncover any hidden liens or claims against the property because once you buy it, those debts can become your responsibility.

Remember, at a foreclosure auction, you are buying the property and potentially all its financial baggage. A clean title search is non-negotiable to avoid inheriting someone else's debts.

Winning at an auction comes down to one simple rule: set a maximum bid and stick to it, no matter what. It’s incredibly easy to get swept up in the heat of the moment and overpay, which can completely erase your potential savings.

While the process can seem intimidating, it’s also one of the most direct ways to buy Boca Raton foreclosures for well below market value. If that level of risk isn't for you, there's nothing wrong with exploring other options. For instance, finding an apartment complex in Boca Raton can be a great way to secure stable housing while you get more familiar with the local market.

Weighing The Pros And Cons Of Foreclosure Investing

Jumping into the Boca Raton foreclosures market can be an absolute rollercoaster. It's a specialized game with the potential for huge wins, but you have to go in with your eyes wide open. Let's have a frank discussion about what you're really getting into before you even think about placing a bid.

The upsides can be incredibly tempting, and it all starts with the price. That's the main attraction, isn't it?

The Allure Of A Great Deal

Foreclosed properties almost always sell for a steep discount compared to their market value. This can mean walking into instant equity the day you get the keys, giving you a foothold in an otherwise pricey market like Boca Raton.

For investors, a lower buy-in price translates to bigger profit margins down the road or better cash flow on a rental. For a family, it could mean snagging a larger home or getting into a dream neighborhood that seemed out of reach. It’s this financial advantage that pulls people into the often-tricky world of foreclosures.

The magic of buying a foreclosure is simple: you’re getting an asset for less than what it's truly worth. That immediate value is the engine that drives this entire market.

And it's not just about the money. The process can sometimes be faster. Auction sales, for example, move quickly—once the gavel falls and the payment clears, the property is yours.

The Hidden Risks And Realities

But let's be real—the downsides are just as significant and can be financially crippling if you're not prepared. The biggest wild card is the property's condition. Foreclosures are sold “as-is,” no exceptions. That means you inherit every single problem, from a leaky roof to a cracked foundation. You're often buying the home sight unseen, which turns every purchase into a high-stakes gamble.

These homes might have sat empty for months or even years, suffering from serious neglect. A property that looks like a steal on paper can quickly become a money pit once you start uncovering the real cost of repairs.

Another major headache is the property's title. A foreclosure can be tangled in a messy web of unpaid property taxes, liens from contractors, or other legal claims. If you don't do your homework with a thorough title search, those debts can suddenly become your problem, adding thousands to your costs out of nowhere. When you're running the numbers, understanding the crucial tax deductions for real estate investors is also key, as it can help you offset some of these unexpected expenses and maximize your return.

Weighing Your Options: The Risks And Rewards

To make a smart decision, you have to see both sides of the coin clearly. Here’s a straightforward breakdown to help you compare the potential highs and lows.

| Potential Advantages | Potential Disadvantages |

|---|---|

| Significant Price Discount: Buy below market value for instant equity. | "As-Is" Condition: You inherit all existing and hidden problems. |

| Higher Profit Potential: Lower cost basis means better ROI for investors. | Hidden Costs: Major repairs can quickly erase any initial savings. |

| Less Competition (Sometimes): The complex process scares off many buyers. | Title Issues: Risk of inheriting liens, back taxes, or other claims. |

| Faster Purchase Process: Auctions can be much quicker than traditional sales. | No Inspections or Contingencies: You often have to buy sight unseen. |

Ultimately, buying a foreclosure is a calculated risk. The potential to secure a fantastic deal in a prime location like Boca Raton is very real, but it requires a ton of due diligence, a solid financial cushion for surprises, and a strong stomach for risk.

How To Finance Your Foreclosure Purchase

Trying to get a loan for a foreclosure in Boca Raton isn't quite like getting a standard mortgage for a new build. The money side of these deals plays by a different set of rules. Traditional lenders can get pretty nervous about financing properties that need a lot of work or come with the risks of a public auction.

Most foreclosures are sold "as-is." That’s a polite way of saying the home might have anything from leaky pipes to serious structural damage. To a conventional mortgage lender, that’s a huge red flag. They might flat-out deny your loan, leaving you in a tough spot after you've already committed to the purchase.

Specialized Loans For Distressed Properties

Since a typical home loan often won't cut it, buyers looking at Boca Raton foreclosures need to explore more creative financing options. These loans are specifically designed for properties that don’t tick all the boxes for a standard lender.

Here are a couple of solid alternatives:

- Renovation Loans (FHA 203(k)): This is a popular government-backed loan that’s a real game-changer. It rolls the home’s purchase price and the estimated repair costs into one single mortgage. It’s a perfect fit if you plan to live in the home and need the cash to bring it back to life.

- Hard Money Loans: Think of these as short-term loans from private investors, not big banks. The approval is based more on the property's potential value than your personal credit score. This makes them a great tool for real estate investors who need to close a deal fast, renovate, and flip the property.

Given how unique the Florida market can be, it's smart to see what a local lender can do for you. In fact, working with a mortgage lender with no overlays in FL can be a major advantage. They often have more flexible guidelines, which is exactly what you need when you're dealing with a non-standard property like a foreclosure.

Getting pre-approved for one of these specialized loans isn't just a good idea—it's absolutely essential. It shows sellers you're serious and have the financial muscle to see the deal through to the end.

The Critical Role Of Cash

No matter what kind of loan you're thinking about, you need to remember one thing: cash is king in the world of foreclosures. If you’re heading to a courthouse auction, you’ll need a hefty cash deposit just to get a bidding paddle.

And if you place the winning bid? You'll likely be required to pay the full amount within an incredibly tight window, often just 24 to 48 hours. In that scenario, cash isn't just an option; it's a requirement.

Even when buying a bank-owned (REO) property, having a good amount of cash on hand proves you’re a serious contender. It also gives you a much-needed financial cushion for all the surprise repairs that are bound to come up.

While foreclosure hunting can lead to a fantastic investment, it’s definitely not for everyone. If you’re looking for stability without all the financial risk, exploring https://cynthiagardens.com/the-case-for-affordable-apartments-balancing-budget-and-lifestyle-in-boca-raton/ can be a much smoother path.

How the Broader Boca Raton Housing Market Affects Foreclosures

It's easy to think of a foreclosure as a standalone event, but that's rarely the case. The number of Boca Raton foreclosures available is directly tied to the health of the city's wider real estate market.

Picture it like a coastal ecosystem. A slight change in the ocean's temperature can have a ripple effect on everything from tiny plankton to massive whales. In the same way, when the general housing market cools down, it creates the perfect conditions for foreclosure opportunities to bubble up.

When homes sit on the market longer, sellers who are already stretched thin can find themselves in a tight spot. This is where you, as an informed buyer, can step in. By keeping an eye on these high-level trends, you can start to predict where foreclosure inventory might pop up before it ever goes to auction. It's about more than just skimming headlines; it’s about using market data to give yourself a real advantage.

Reading the Tea Leaves of Market Data

Learning to read the signals in the market is key. When you see things like average home prices dipping or the number of available homes (inventory) starting to climb, it's often a sign that more homeowners are feeling the financial squeeze. These are the early warnings that more distressed properties could be on the horizon.

Take Boca Raton's luxury condo market, for example. We saw the average sold price for these high-end units drop from around $1,206,667 in Q2 2017 all the way down to $879,500 by Q2 2025. That's a 27.11% decrease, a clear signal that the market was cooling off significantly. You can dig into the specifics of these Boca Raton market trends to get a fuller picture.

The slowdown wasn't just in the price—it was also in how long it took to sell.

The average time a luxury condo spent on the market jumped from a brisk 90 days to a sluggish 328 days. When a pricey property sits unsold for almost a year, the financial pressure on the owner can become immense, often leading to foreclosure.

When you connect these dots, you stop being a passive buyer and become a proactive investor. You can see the bigger picture, pinpointing which parts of the market are under the most stress and, as a result, are most likely to yield the kind of foreclosure deals you're searching for.

Common Questions About Boca Raton Foreclosures

Diving into the market for Boca Raton foreclosures can feel like learning a new language. It’s totally normal to have a ton of questions, so let’s clear up a few of the most common ones that come up.

Are You on the Hook for Old Liens?

This is a big one. Let's say you win a property at a foreclosure auction. Are you suddenly responsible for all the debts tied to it, like unpaid property taxes or contractor liens? In many cases, the answer is a resounding yes.

That’s why a professional title search isn't just a good idea; it's absolutely essential. Before you even think about bidding, you need to know exactly what financial baggage the property is carrying. Otherwise, that "great deal" can quickly turn into a financial nightmare.

Can You Get a Regular Mortgage for a Foreclosure?

This is another critical point where foreclosures differ from standard home sales. If you're buying at a courthouse auction, you'll almost certainly need cash, and you'll need it fast. Traditional mortgages just don't work with that kind of timeline.

For bank-owned (REO) properties, you can sometimes get a traditional mortgage. The catch is the property's condition. Many lenders will refuse to finance a home that needs major work. This is where options like renovation loans come into play, specifically designed for fixer-uppers.

Remember, the financing path for a foreclosure is very different from a standard home purchase. Being prepared with the right type of loan or sufficient cash is non-negotiable.

What if You're the One Facing Foreclosure?

On the other side of the coin, homeowners facing foreclosure often wonder what they can do to save their homes. It's worth taking the time to understand what a foreclosure bailout loan entails, as it can sometimes provide a lifeline.

If the risks and repairs of the foreclosure market feel like too much to take on, don't forget that buying isn't your only choice. Renting is a fantastic way to enjoy the Boca Raton lifestyle without the high stakes. You can get a feel for the area first, and our guide to affordable apartments in Boca Raton is a great place to start looking.

If you're seeking a stable and serene living situation without the complexities of the foreclosure market, consider Cynthia Gardens. Find your ideal Boca Raton apartment with us today at https://cynthiagardens.com.