Trying to find an apartment without a credit check can feel like a huge hurdle, but it's far from impossible, especially in a place like Boca Raton. Many landlords use credit scores as a quick way to vet applicants, but plenty of others are willing to look at the whole picture. If you come prepared, you can easily prove you're a reliable tenant and land a fantastic new home.

Why Landlords Use Credit Checks and How to Bypass Them

It's definitely intimidating to fill out a rental application when you know your credit isn't perfect—or even non-existent. But you're not the only one in this boat. In fact, about 28% of Americans have credit scores that fall into the 'Fair' or 'Poor' categories, which can make a traditional apartment search tough.

So, why the big focus on credit? For landlords, it’s a shortcut. A high score suggests you’ve paid bills on time in the past, making you seem like a safe bet. A low score, on the other hand, can raise red flags, even if the number doesn't tell your full story.

Shifting Focus From Score to Stability

The good news is that a growing number of property managers and private landlords get that a three-digit number isn't the only way to measure a good tenant. They're more interested in what proves you can and will pay your rent every month. This is where you can shine.

Instead of getting hung up on a number from your past, these landlords are looking for real-time proof of your stability.

- Consistent Income: A steady job with enough income to comfortably cover rent is often the most important factor.

- Good Rental History: A glowing recommendation from a previous landlord can speak volumes, often more than a credit score.

- Financial Readiness: Showing you have the security deposit and first month's rent ready to go proves you're financially responsible.

Even if you're looking for a place that doesn't run credit, it’s a smart move to know what’s on your report. It helps you get ahead of any questions a landlord might have. You can obtain all three of your credit reports for free to see exactly what they would see.

By focusing on these strengths, you can build a strong application that makes you a standout candidate, regardless of your credit history.

Making Your Rental Application Stand Out

When you're applying for an apartment without a credit check, your application packet is everything. Think of it as your opportunity to paint a clear picture of your reliability—something a simple credit score can't do. You're not just filling out forms; you're building a case for why you're a great tenant.

The landlord's biggest question is always, "Can I count on this person to pay rent and respect the property?" A well-prepared set of documents can answer that question with a confident "yes" before they even have to ask.

Building Your "Tenant Reliability" Portfolio

Since you're not leaning on a credit report, you'll need to present a different kind of portfolio—one that showcases your financial stability and responsible character. It’s about showing the landlord you're a safe bet, not just telling them.

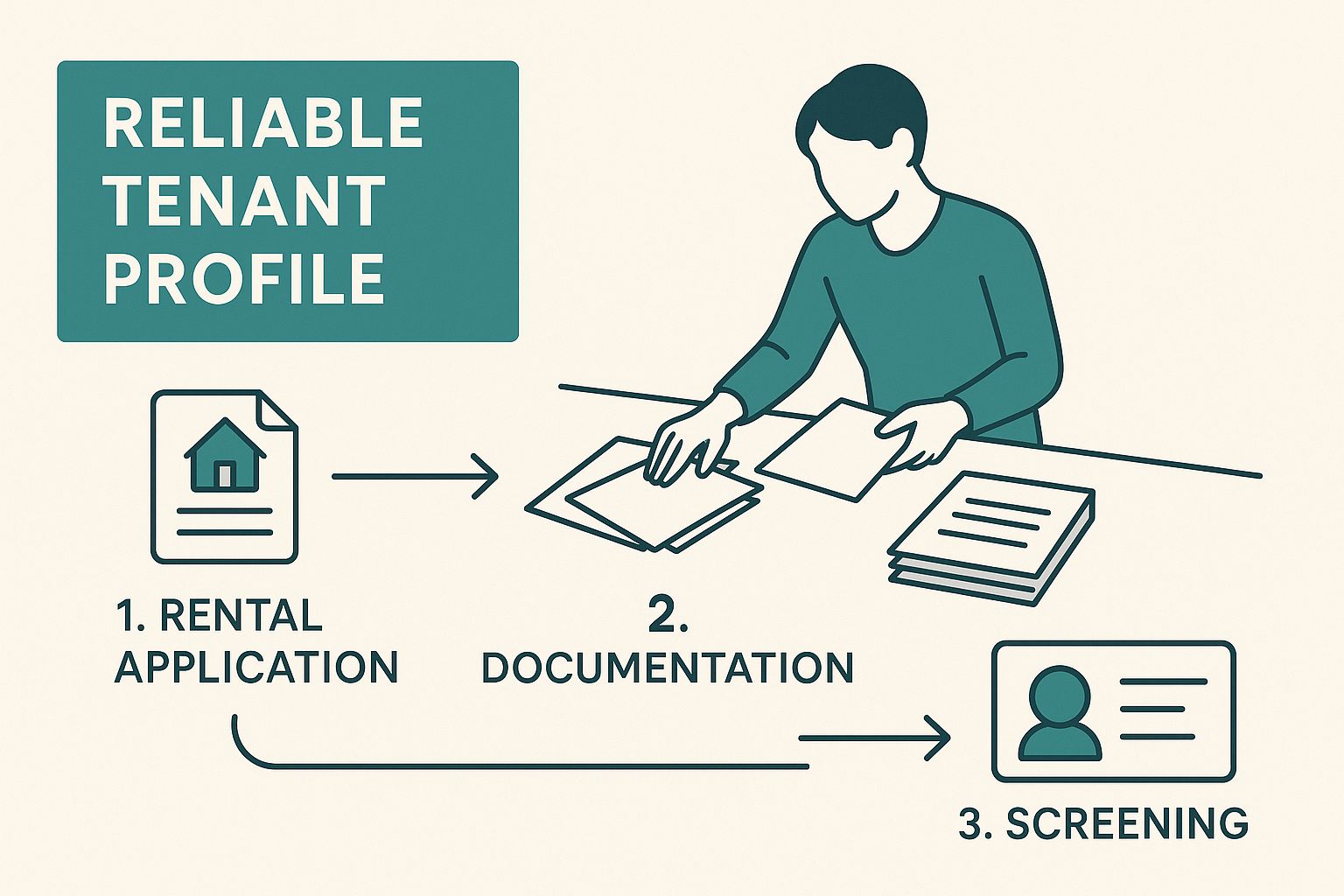

This infographic breaks down how each document works together to create a convincing profile for a landlord.

Your goal is to make the landlord's decision as easy as possible. Handing them a complete, organized packet upfront leaves no room for doubt and shows you’re a serious, prepared applicant.

Here’s exactly what you should have ready to go:

- Proof of Income: Have at least two recent pay stubs on hand. If you're self-employed, your last two months of bank statements or a recent tax return work perfectly to show a steady income.

- Employment Verification Letter: This is a game-changer. A simple letter from your employer on company letterhead that confirms your job title, salary, and how long you've been there provides powerful, third-party proof of your financial stability.

- References from Past Landlords: Good references are pure gold. They offer firsthand accounts of your history as a tenant who pays on time and takes care of the property.

- Personal and Professional References: Think about including people who can vouch for your character—a manager, a long-time colleague, or another respected person who knows you well.

Pro Tip: Create a one-page "Renter's Resume." It's a professional touch that really sets you apart. Briefly summarize your rental history, employment, and references, and include a short statement about why you’d be an excellent tenant.

What if you're a student or don't have a traditional job? You can still build a strong application. Proving your financial stability just requires a slightly different set of documents. We cover these unique situations in our guide on how to get an apartment if you're not working but have money.

No matter your situation, a clear, professional, and thorough application always makes a fantastic first impression.

How to Find Landlords Open to No Credit Check Renters

Alright, you've got your application package ready to go. Now, the real work begins: finding the right person to show it to. Looking for an apartment for rent without a credit check is all about a targeted search. Simply scrolling through the big rental websites will burn you out. You need a smarter strategy.

The truth is, large corporate apartment complexes are usually a dead end. They often use automated systems with strict credit score cutoffs, typically somewhere between 620 and 700. There's just no wiggle room. But don't get discouraged—landlords who skip the credit check are out there, and they're a crucial part of the rental market for anyone still building their credit. You can find more data on these national rent trends over at Apartments.com.

Focusing Your Search on Private Landlords

Your best shot will almost always be with smaller, privately-owned properties. Individual landlords are more likely to look at the whole picture—your solid income, glowing references, and stable job history—instead of just a three-digit number. They have the power to make a judgment call.

Here’s how you can find these landlords and get your application seen:

-

Get creative with online searches. Don't just tick the boxes in the filters. Type phrases like "private owner," "flexible terms," or even "no credit check" directly into the search bar. This can uncover listings where landlords mention these details in the description.

-

Go old-school and explore neighborhoods. Seriously, get in your car or take a walk through the areas you want to live in. Keep an eye out for those classic "For Rent By Owner" signs. Calling that number connects you directly to the person in charge, cutting out the middleman.

-

Check local community groups. Search on social media for Boca Raton community forums or neighborhood groups. People in these groups often share leads on available rentals or give shout-outs to landlords they know are fair and understanding.

A place like Cynthia Gardens in Boca Raton is a great example of the middle ground. It's a professionally managed community, but it operates with the kind of flexibility you’d expect from a private owner. They look at your overall qualifications, not just a credit report. It’s proof that you can find well-maintained communities that offer these kinds of flexible terms.

How to Strengthen Your Offer and Seal the Deal

Even when you've got all your paperwork lined up perfectly, a landlord might still pause. This is where you can get ahead of their concerns and really show you’re the right choice. Instead of waiting for them to find a reason to say no, you present them with more reasons to say yes.

Think of it as tipping the scales in your favor. You want to reduce any risk they might feel. The two best ways I’ve seen this done are by bringing in a qualified co-signer or by making a more attractive financial offer. Both signal that you're a serious, reliable applicant.

Find a Great Co-Signer

A co-signer is a financial backstop for the landlord. It’s usually a family member or trusted friend with a solid credit history who legally agrees to cover the rent if you ever fall behind. For a property owner, this is a massive vote of confidence.

Don't just mention you can get a co-signer; have them ready to go. They'll need to submit their own set of documents, so it’s best to have everything collected in advance.

- Proof of income (recent pay stubs are best)

- Authorization for their own credit and background check

- A copy of their government-issued ID

Walking in with your co-signer’s complete application package alongside your own shows incredible foresight and proves you respect the landlord’s need for security.

Make a Stronger Financial Commitment

Another powerful move is to sweeten the deal financially. This isn't a sign of weakness; it's a strategic business move that paints you as a low-risk, responsible tenant. When you handle it with confidence, it can instantly put your application at the top of the pile.

The goal here is to frame your offer as a sign of financial stability. You could offer to pay a larger security deposit—say, two months' rent instead of one. Or, you could propose paying the first two or three months of rent upfront.

This kind of gesture gives the landlord a significant financial cushion and proves you have the cash on hand to be a dependable resident. It shows you’re not just scraping by, but that you're invested in building a positive, long-term tenancy.

If you're thinking about how to manage these larger upfront costs, our guide on affordable financial services in Boca Raton has some great, practical advice. Taking these extra steps can often be the one thing that convinces a landlord to hand you the keys.

Navigating Your Search and Avoiding Rental Scams

When you're looking for an apartment without a credit check, you'll meet plenty of fantastic landlords. But let's be honest—it's also a hunting ground for scammers looking to exploit renters in a tough spot. Your best defense? Knowing the red flags so you can spot them a mile away.

This specific corner of the rental market has, unfortunately, become a magnet for scams. One of the biggest warning signs is a "landlord" pushing for a deposit or rent before you've even met them or seen a lease. You can get more background on this and how to stay safe from resources like Zillow's rental guide.

Common Scammer Tactics and Red Flags

Stay sharp and walk away if a potential landlord pulls any of these moves. A real property owner is just as invested in making sure you're a good fit for their property as you are in finding a great home.

Keep an eye out for these tell-tale signs:

- The High-Pressure Rush: Scammers create a false sense of urgency. They'll tell you other applicants are lined up and you have to send money right now to secure the place.

- The Phantom Apartment: They have a million excuses for why you can't see the unit in person. You'll be offered pictures or maybe a "virtual tour," but never a real walkthrough.

- Insisting on Untraceable Payments: They'll demand payment via wire transfer, Zelle, or other cash apps. Why? Because once that money is gone, it's nearly impossible to get back.

Here’s the number one rule I tell everyone: Never pay a deposit or first month's rent for a property you haven't visited in person. A legitimate landlord will always arrange a viewing and have a formal, written lease ready for you to sign before asking for a cent.

At the end of the day, trust your gut. If a deal looks too good to be true—like an apartment with rent way below the going rate for Boca Raton—it probably is.

Protecting yourself is part of the process. Our guide on how to dodge fraudsters when you're in financial distress dives even deeper into these strategies. A safe search is a smart search.

Common Questions About Renting With No Credit Check

As you get closer to finding the right place, you'll probably have a few lingering questions. It's totally normal. Getting these sorted out will help you sign that lease with total confidence.

Should I Bring Up My Low Credit Score?

You're never required to give a landlord your entire financial life story. That said, being proactive with a short, professional explanation can actually work in your favor. It builds a little trust right from the start.

For instance, you could explain that you’re a recent grad just getting on your feet, new to the U.S. and building credit from the ground up, or that an unexpected medical bill dinged your score a while back. The trick is to keep it brief and immediately shift the focus to your strengths: your reliable income, great references from past landlords, and how you manage your money now.

Are Apartments Without Credit Checks Pricier?

Not usually, no. The monthly rent for an apartment for rent without a credit check is driven by the same things as any other rental property—location, square footage, and what kind of amenities are included.

The main difference you might see is in the upfront move-in costs. A landlord might ask for a larger security deposit (maybe equal to two months' rent) or want the first and last month's rent when you sign the lease. It's their way of balancing the risk. Just make sure you're comparing the total move-in cost, not just the monthly rent, to get a true picture of what you'll need.

Even when they skip a formal credit pull, landlords are still doing their homework. You can absolutely expect them to run a background check for things like past evictions or a criminal record. They'll also be very diligent about calling your employer to verify your job and income.

This is why having all your paperwork—pay stubs, bank statements, reference letters—neatly organized and ready to hand over makes a huge difference. It keeps their screening process moving along quickly and gets you that much closer to getting the keys.

Ready to find a great home in Boca Raton without the credit check headache? Cynthia Gardens has beautiful one-bedroom apartments and flexible leasing that might be the perfect fit. Learn more and apply today!