When you sign a lease for a new apartment, you'll almost always be asked for a security deposit. It’s a standard part of renting, but what is it, really?

A security deposit is a specific amount of money you give your landlord before you get the keys. Think of it as a financial good-faith gesture—a promise that you’ll treat the property with care and stick to your lease agreement. It’s crucial to remember that this is not just an extra rent payment; it’s your money being held in trust by the landlord.

The Core Purpose of a Security Deposit

Imagine you're lending a friend your expensive camera. You trust them, but you might ask for a small deposit just in case something happens. A security deposit operates on the same basic principle, giving landlords a financial safety net to protect their investment.

This payment serves two main goals:

- For the Landlord: It provides funds to cover repairs for any damages beyond normal wear and tear. It can also cover unpaid rent if a tenant leaves unexpectedly.

- For the Tenant: It gives you a strong incentive to keep the apartment in good shape, knowing you’ll get that money back when you move out.

Security Deposits Around the Country

So, how much should you expect to pay? The most common amount is one month's rent, which has become the unofficial standard across many rental markets. Of course, this can shift depending on state and city laws.

Looking at data from 2025, the state-level averages reflect this trend. For example, Florida's average is around $1,444, while California is higher at $1,856, and New York lands at $1,507. It's always a good idea to review more details about security deposit trends to see how your local area compares.

How Is a Security Deposit Different from Rent?

If you're a first-time renter, it's easy to get confused by all the initial payments. You're often asked for the security deposit, first month's rent, and sometimes even the last month's rent all at once. Though they're paid together, they have completely different jobs. Getting this right is key to managing your finances.

A security deposit is your money, held by the landlord for the duration of your lease. Unlike rent, which is a payment for living in the space, the deposit is a refundable guarantee meant to be returned to you.

Let's break down how these payments work.

Security Deposit vs Rent Payments Explained

This table helps spell out the key differences between the major payments you'll make when you start a new lease.

| Payment Type | Purpose | When It's Paid | Is It Refundable? |

|---|---|---|---|

| Security Deposit | Covers potential damages or unpaid rent | Before move-in, with the first month's rent | Yes, if lease terms are met |

| First Month's Rent | Pays for your initial month of occupancy | Before move-in | No, it is a payment for service |

| Last Month's Rent | Pre-pays for your final month of occupancy | Before move-in | No, it is applied to your final rent bill |

Understanding these distinctions from the get-go helps you know exactly where your money is going and what you can expect to get back at the end of your lease.

Florida Security Deposit Laws: What Every Renter Needs to Know

When you hand over a security deposit, you're not just giving your landlord cash—you're trusting them with your money. Fortunately, Florida law isn't vague about this. It lays out a clear set of rules for how your landlord must handle, hold, and eventually return that deposit.

Once you’ve paid up, the ball is in your landlord’s court. They have exactly 30 days to give you written notice telling you where your money is. This notice has to include the name and address of the bank or institution holding the funds. It’s not just good practice; it’s the law.

Where Your Money Goes

Florida landlords don't just get to pocket your deposit. They have three specific, legally-approved options for holding onto it until you move out.

-

A Separate, Non-Interest Account: The most common method. Your money goes into a standard bank account in Florida, kept completely separate from the landlord's personal or business funds.

-

An Interest-Earning Account: They can also put your deposit in an account that accrues interest. If they do, they owe you a cut: either 75% of the interest earned annually or a flat 5% simple interest per year—their choice.

-

Posting a Surety Bond: A less common option is for the landlord to post a surety bond with the county. They're still on the hook for paying you 5% simple interest each year.

These rules are a fundamental part of your tenancy. Getting familiar with them is just as important as reading your lease. For more on that, take a look at these smart tips for navigating apartment lease agreements.

The Countdown to Getting Your Deposit Back

This is the part every renter cares about most: when do you get your money back? Florida has very strict deadlines for landlords once you've moved out.

The moment you hand back the keys, a timer starts. Your landlord has a specific window of time to either return your money or explain why they're keeping some of it.

If you’re getting the full amount back, your landlord has 15 days to return it. No ifs, ands, or buts.

If they plan to make a claim for damages or unpaid rent, the timeline extends to 30 days. Within that month, they must send you an itemized list of deductions via certified mail. Knowing these deadlines is your best defense—it gives you the power to hold your landlord accountable and protect your money.

The Landlord's Perspective on Security Deposits

As a renter, it’s easy to see the security deposit as just another big check you have to write before moving in. But to understand the whole picture, it helps to step into the landlord's shoes. For them, a security deposit isn't extra income; it's a crucial financial safety net.

Think of it as their insurance policy against the unpredictable nature of renting out a property. They're handing over a valuable asset, and the deposit is their primary buffer against potential problems that could pop up during your tenancy.

Mitigating Common Rental Risks

So, what exactly are landlords protecting themselves from? The deposit acts as a fund to cover several common issues that go far beyond the expected scuffs and minor nail holes of everyday living. Without it, these costs would come directly out of their pocket.

Here are the main financial risks a security deposit helps offset:

- Property Damage: We're talking about damage caused by neglect or misuse, like deep scratches in hardwood floors, broken countertops, or a pet-stained carpet that has to be completely replaced.

- Unpaid Rent: If a tenant suddenly leaves without settling their final month's rent, the landlord can use the deposit to cover that lost income.

- Early Lease Termination: A broken lease means the property sits empty, generating no income while the owner scrambles to find a new tenant. The deposit helps cushion that financial blow.

- Major Cleaning Bills: When a tenant moves out and leaves the place a mess, the deposit can pay for the kind of professional, top-to-bottom cleaning needed to make it rentable again.

From the property owner's viewpoint, the security deposit is all about risk management. It functions much like a financial institution holds capital in reserve—it’s a fund set aside to absorb unexpected losses and ensure the investment remains stable.

For landlords, keeping track of these deposits, the rules, and the paperwork is a huge responsibility. That's why many now rely on software to stay organized, and you can explore some of the best property management apps to see how the pros handle it.

What Can Landlords Actually Deduct From Your Deposit?

When your lease is up, your landlord can’t just keep your security deposit on a whim. Florida law is crystal clear about what they can and can't charge you for, and it all boils down to one simple idea: tenant-caused damage vs. normal wear and tear.

Think about it like this: if you rent a car for a week, the rental company expects it to come back with a little more dust on the floor mats. That's normal use. But if it comes back with a huge dent in the door, that’s on you. Your apartment is no different.

The landlord is on the hook for the costs of a property aging naturally. You, on the other hand, are responsible for damage you cause through accidents, neglect, or deliberate actions. Getting this distinction right is the key to getting your full deposit back.

Faded paint on the walls from sunlight or minor scuffs from moving furniture around are just part of a home being lived in. The same goes for carpeting that’s a bit worn in high-traffic areas. Your landlord can't charge you for that stuff. But a giant hole in the wall from a frustrated fist-pump or a broken window? That’s definitely damage, and you can bet the repair costs will come out of your deposit.

Normal Wear and Tear vs Tenant Damage

To make this even clearer, let's look at some real-world examples. It can be a gray area sometimes, but this table breaks down the most common issues you'll encounter.

| Issue | Normal Wear and Tear (Not Deductible) | Tenant-Caused Damage (Deductible) |

|---|---|---|

| Walls | Faded paint, minor scuffs, small nail holes | Large holes, unapproved paint colors, crayon marks |

| Flooring | Worn carpet from walking, minor scratches on wood | Deep scratches, pet stains, burns, chipped tiles |

| Fixtures | Loose faucet handle, faded light fixtures | Broken toilet seat, cracked mirror, missing light cover |

| Cleanliness | Dust, minor grime in hard-to-reach spots | Filthy oven, moldy fridge, trash left behind |

| Doors/Windows | Worn-out door seals, sticking window tracks | Broken panes, holes in doors, broken locks |

Remember, the goal is to leave the apartment in the same condition you found it, minus the inevitable signs of everyday living.

Common Reasons for Deductions

Beyond physical damage, landlords can legally dip into your deposit for a few other specific reasons directly tied to your tenancy. Knowing what they are ahead of time can save you from any nasty surprises after you've moved out.

Here are the most common things landlords can legally make a claim for:

- Unpaid Rent: This one is pretty straightforward. If you leave owing a month's rent, your landlord has every right to use the deposit to cover that debt.

- Major Cleaning Bills: You're expected to leave the place reasonably clean—what's often called "broom-swept" condition. If you leave it a disaster zone, the landlord can deduct the cost of hiring professional cleaners.

- Breaking Your Lease: If you move out early without following the proper steps outlined in your lease, your deposit can be used to cover the landlord's costs while they search for a new tenant.

- Unpaid Utility Bills: Did your lease put you in charge of the water or electric bill? If you move out and leave an unpaid balance, your landlord can use the deposit to settle up with the utility company.

Your Guide to Getting Your Full Security Deposit Back

Getting your security deposit back in full isn't a matter of luck. It's about being smart and proactive from the very beginning. Think of it as a simple three-part playbook: move-in, tenancy, and move-out. If you follow the steps, you can safeguard your money and sidestep any potential disputes. Your most powerful tool in this entire process? Clear, thorough documentation.

This approach turns a potentially frustrating experience into a manageable checklist, keeping you in the driver's seat.

Your Move-In Inspection Is Crucial

Your first, and arguably most important, task starts the moment you get the keys. Before a single box comes through the door, you need to conduct a detailed move-in inspection. This is your baseline, your official record of the apartment's condition before you ever lived there.

Grab your phone and take plenty of photos and videos of every room. Zoom in on any pre-existing damage, no matter how small it might seem at the time.

- Document everything: We're talking scuffs on the walls, scratches on the floorboards, carpet stains, or any appliance that’s not in perfect working order.

- Be specific: Don't just write "kitchen floor scratched." Instead, note "two 3-inch scratches on laminate flooring next to the refrigerator." Details matter.

- Notify your landlord: Send a dated, written copy of your inspection report, complete with all your photos, to your landlord or property manager. An email is perfect because it creates a time-stamped paper trail.

Best Practices During Your Tenancy

How you treat the apartment during your lease is just as important. If you notice any maintenance issues—a dripping faucet, a toilet that won't stop running—report them immediately. This not only gets the problem fixed but also demonstrates that you're a responsible tenant. Plus, it prevents a tiny issue from ballooning into a major repair that could come out of your deposit.

Understanding common rental mistakes can also keep your money in your pocket. To learn more, check out our guide on the 5 mistakes to avoid when renting an apartment in Boca Raton.

A Smooth and Successful Move-Out

When it's time to move, your objective is to return the apartment to the state you found it in, allowing for normal wear and tear. A deep clean is absolutely essential. For a complete rundown on how to leave your rental sparkling, this end-of-lease cleaning guide is an excellent resource.

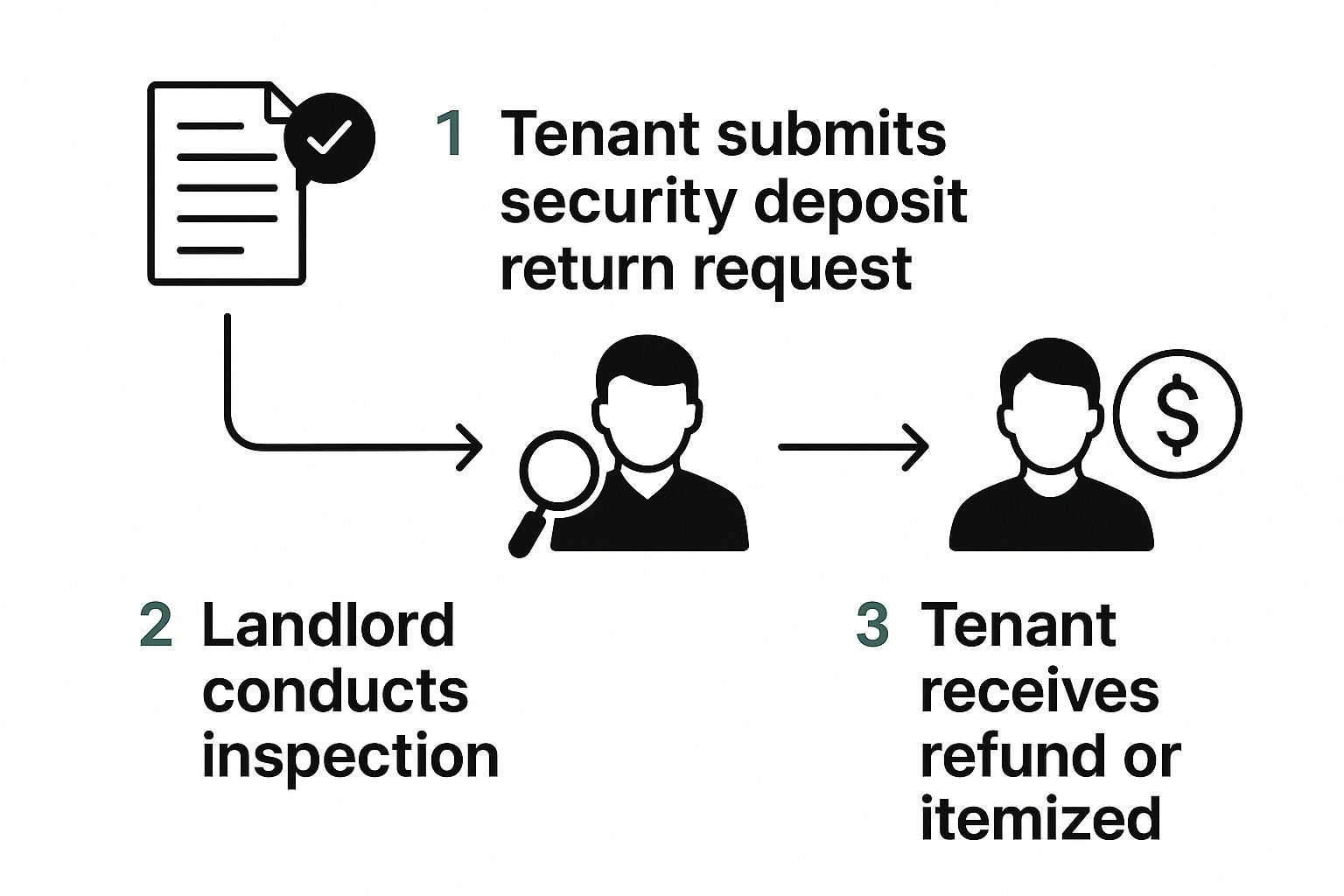

The infographic below breaks down the typical steps a landlord takes after you've moved out and are waiting for your deposit.

As you can see, the landlord's inspection is a key part of the process, which brings us to your final, crucial step.

Always request a final walkthrough with your landlord or property manager. Doing this together allows you to discuss any potential issues on the spot, giving you a chance to fix them and get immediate feedback. This one action drastically reduces the odds of any surprise deductions from your deposit.

Got More Questions? Here Are Some Common Ones

Even with the rules laid out, a few specific questions about security deposits pop up all the time. Let's tackle some of the most common head-scratchers so you can navigate your rental with confidence.

Can My Landlord Just Use My Deposit for Last Month’s Rent?

This is a big one, and the short answer is almost always no. In Florida, your security deposit is legally earmarked for covering damages or unpaid bills after you move out—it’s not a pre-payment for your final month.

Think of it like this: your rent is what you pay to live there, while the deposit is a separate safety net for the property owner. Unless you have a specific written agreement with your landlord stating otherwise, you're expected to pay that last month's rent just like any other month. Trying to skip it and tell them to "just keep the deposit" could land you in hot water for violating your lease.

What if I Think My Landlord Is Wrongfully Keeping My Deposit?

If you get a notice from your landlord that they're keeping some or all of your deposit and you believe it's unfair, you need to move fast. Florida law is very specific here.

Your first official step is to send a formal written objection by certified mail. This isn't just a suggestion; it's a legal necessity to protect your rights. You have a strict deadline: the letter must be sent within 15 days of receiving their notice.

This letter is your formal challenge. If you still can't work things out, your next step might be taking the issue to small claims court. This is where all that documentation you kept—move-in photos, emails, and copies of every letter—becomes absolutely critical to proving your case.

For more answers to common rental questions, check out these frequently asked questions about apartments in Boca Raton.

At Cynthia Gardens, we believe transparency is key to a great rental experience. If you’re searching for a welcoming, professionally managed apartment community in Boca Raton, we invite you to visit us at https://cynthiagardens.com and see our available one-bedroom apartments.