The biggest difference between an apartment and a condo really boils down to one simple concept: renting versus owning. When you're in an apartment, you're leasing a unit inside a building that's owned by one person or company. A condo, however, is a home you own yourself within a larger complex, sharing common areas with other owners.

Decoding the Core Differences

Choosing between an apartment and a condo is about so much more than just the layout. This decision shapes your finances, your day-to-day responsibilities, and even your lifestyle.

Apartments are all about flexibility. The costs are predictable, and you aren't tied down, which is perfect if you value mobility and want to keep maintenance off your to-do list. Condos are a different ballgame—they're a chance to build equity and make a space truly your own. This path appeals to people looking for a long-term investment and a deeper sense of community.

Getting a handle on these foundational differences is the first step. Each option comes with its own set of perks and trade-offs, pitting financial commitment against personal freedom.

Core Distinctions at a Glance

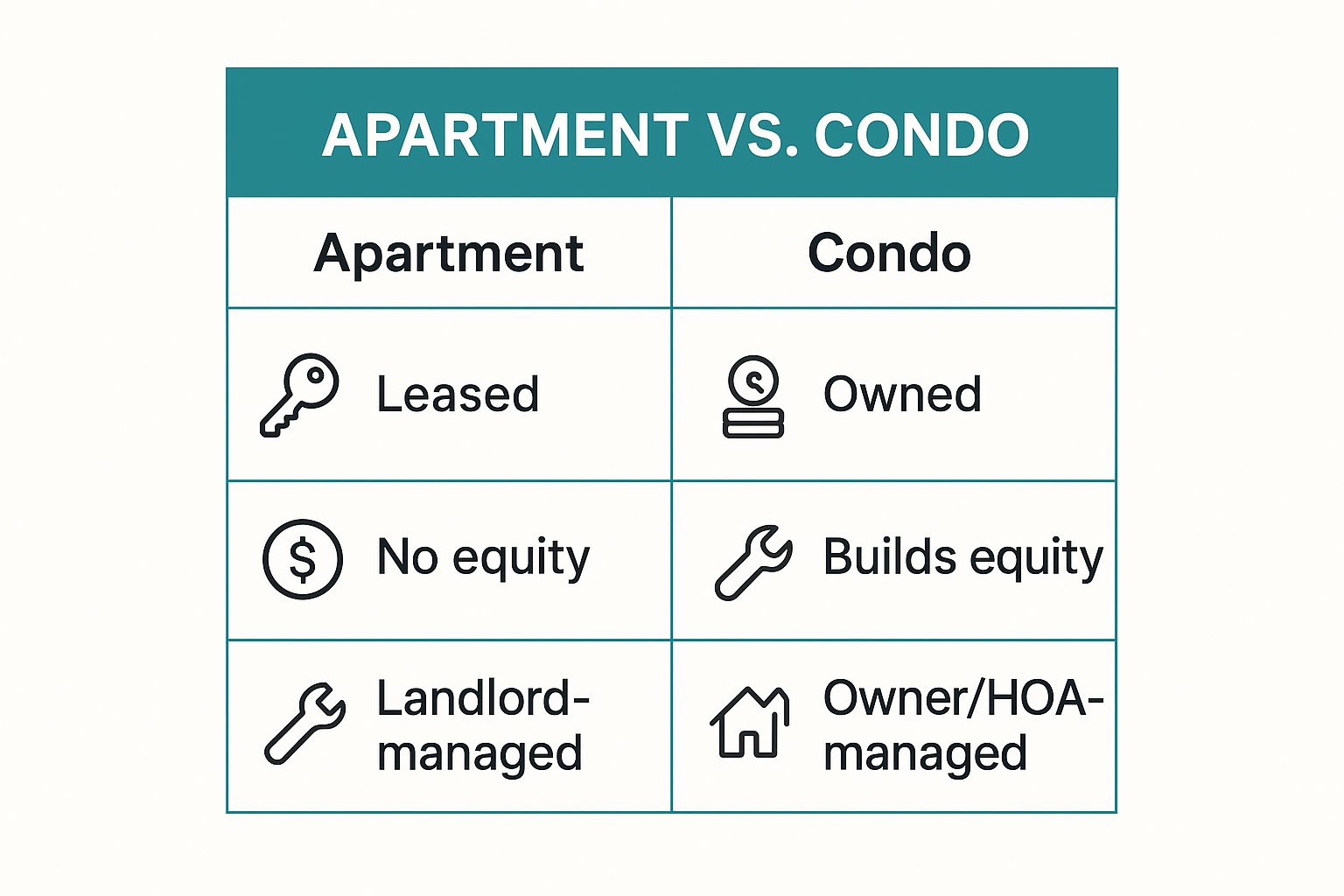

To make things clearer, let’s break down the primary differences between renting an apartment and owning a condo. This table gets right to the point on ownership, money, and maintenance.

The infographic really drives home the key takeaway: condo ownership is a path to building equity—a major financial asset—which just isn't part of the deal when you rent an apartment.

| Factor | Apartment (Renter) | Condo (Owner) |

|---|---|---|

| Ownership | Leased from a property management company | Individually owned unit; shared ownership of common areas |

| Maintenance | Handled and paid for by the landlord | Owner is responsible for interior; HOA covers exterior |

| Community Rules | Set by the landlord in the lease agreement | Governed by a Homeowners Association (HOA) |

| Upfront Costs | Security deposit and first month's rent | Down payment, closing costs, and moving expenses |

As you can see, the responsibilities and costs associated with each are worlds apart. One offers simplicity and predictability, while the other provides an asset and more control.

Understanding Your Ownership and Equity

The biggest difference between an apartment and a condo really boils down to one thing: ownership. This single factor has a massive impact on your financial future. When you rent an apartment, the deal is simple. You sign a lease, pay rent, and get a place to live. It's a straightforward transaction, but those monthly payments don't build any personal wealth.

This is a model built for flexibility, not financial growth. You're paying for housing as a service, freeing you from the burdens of property taxes, market swings, and surprise repair bills.

The Condo Path to Building Wealth

Choosing to own a condo is a completely different ballgame. You're not just renting space; you're buying a piece of real estate. The legal term for this is 'walls-in' ownership, meaning you own everything inside your unit.

You also get a shared stake in all the common areas—the lobby, the pool, the gym—all managed by a Homeowners Association (HOA). This is the key distinction in the U.S. housing market: a single company typically owns an entire apartment building and rents out the units, whereas condos are individually owned homes within a larger complex.

Owning a condo means every mortgage payment you make contributes to building personal equity. You are paying down a loan on a tangible asset that has the potential to appreciate in value over time.

This approach turns your monthly housing cost from a pure expense into a long-term investment. As your equity grows, you're building a valuable financial asset you can borrow against or cash out when you sell. In the end, deciding whether to rent or buy is a trade-off between short-term convenience and long-term financial gain. You might be interested in our guide on the pros and cons of renting vs buying to help you figure out which path makes the most sense for you.

Comparing the Financial Commitments

When you get down to it, the choice between an apartment and a condo often boils down to money. The financial path you take looks completely different for each, from what you pay on day one to the expenses that pop up years down the road. Let’s break it down so you can find the right fit for your wallet and your long-term goals.

Renting an apartment is the path of least resistance financially, at least at the beginning. You're typically looking at the first month's rent and a security deposit. That's it. This makes it far more accessible if you haven't built up a large nest egg. The monthly payments are predictable, which is great for budgeting, but there's a catch: none of that money builds your personal wealth. It goes straight to your landlord.

Deconstructing Condo Ownership Costs

Buying a condo is a much heavier lift from a financial perspective, especially upfront. The initial cash required is substantial and covers a few key things:

- Down Payment: This is the big one. Expect to pay anywhere from 3% to 20% of the condo's total purchase price.

- Closing Costs: These are the various fees for services needed to finalize the sale—think appraisals, title insurance, and loan processing. They usually add another 2% to 5% of the loan amount to your bill.

Once you’re in, your monthly housing payment is more than just a mortgage. It’s a bundle of costs that includes your loan's principal and interest, property taxes, and homeowners insurance. And then there's the one expense unique to condos: the Homeowners Association (HOA) fee.

The HOA fee is a game-changer in the condo vs. apartment debate. This isn't an optional expense; it's a monthly due that pays for all the shared amenities and upkeep—the pool, the lobby, landscaping, you name it. It can add a hefty sum to your monthly total.

That fee is mandatory and can increase over time to pay for major projects or rising costs. While it feels like another bill, it also acts as a buffer. You won't get hit with a sudden, massive bill for a new roof, which is a reality for single-family homeowners.

It's no secret that homeownership costs have skyrocketed, jumping by a reported 64% since 2021. This has made condos an increasingly appealing option. Their lower monthly costs and more predictable maintenance fees are a major draw. For more on this shift, check out these trends in homeownership costs. It’s easy to see why condos are becoming a go-to for buyers wanting a piece of the real estate market without the full financial weight of a detached home.

A Look at Maintenance and Amenities

The day-to-day experience of where you live often comes down to two things: what happens when something breaks, and what perks are included. This is a huge dividing line in the apartment vs condo debate.

Apartment living is designed around convenience. When the AC gives out in the middle of summer or a pipe starts leaking, you just make a call to the property manager. The problem gets fixed, and you don't see a bill for it.

This hands-off approach is a massive plus for anyone with a packed schedule or zero interest in coordinating home repairs. The catch? You're on the management's schedule, and you have no say in who they hire to do the work.

Who's Responsible for What?

With a condo, you're the owner, and that means you're the one in charge. If an appliance dies or a drain gets clogged inside your unit, it's up to you to find a professional and pay for the repairs—just like owning a traditional house. This takes more effort, but it also gives you total control over the quality of the fix.

So, what do those mandatory HOA fees cover? They handle all the big-ticket items for the building's exterior and the upkeep of shared spaces. This is where condos often shine, as those fees fund everything from landscaping to premium amenities.

The real difference comes down to this: Apartment renters pay for a service that handles all repairs, while condo owners take on interior maintenance themselves in exchange for a direct stake in the community’s shared assets.

The quality and range of amenities can vary dramatically from one property to another. It's always a good idea to see what's out there by comparing top apartment complex amenities and features to understand what modern communities offer.

Ultimately, your decision rests on what you prioritize. Is it the turn-key, hassle-free service of an apartment, or the personal responsibility and access to high-end facilities that come with condo ownership?

How Community Rules Shape Your Daily Life

When you're weighing the apartment vs. condo decision, it's easy to get caught up in costs and amenities. But don't overlook the rules. The guidelines of your community will directly impact everything from how you decorate to whether your furry friend is welcome.

In an apartment, life is governed by your lease. It's a straightforward, top-down agreement between you and the property management company. This contract lays out exactly what’s allowed—and what isn't. Think restrictions on painting, hanging heavy objects, or making any real modifications. The rules are the same for everyone, which offers consistency but can feel a bit restrictive.

The World of HOA Rules

Condo living operates on a completely different playing field, run by a Homeowners Association (HOA). As an owner, you have the freedom to renovate and customize the inside of your unit to your heart's content. However, once you step outside your front door, you're living by a set of community-wide Covenants, Conditions & Restrictions (CC&Rs).

These aren't arbitrary rules. They’re put in place by your fellow homeowners to maintain property values and ensure everyone has a pleasant living experience. They often cover things like:

- Exterior Appearance: Rules might dictate everything from the color of your front door to the type of decorations you can put on your balcony.

- Quiet Hours: Most HOAs have strictly enforced rules about noise levels, especially at night.

- Shared Spaces: There will be a clear set of guidelines for using the pool, gym, clubhouse, and other common areas.

When you buy a condo, you’re not just buying a home; you’re joining a self-governing community. This creates a strong sense of ownership and camaraderie, but it also means you'll need to be comfortable with compromise and collective decision-making.

You get a say in how your community is run—often by voting or even joining the HOA board—but you also carry the responsibility of following the rules everyone has agreed upon. Getting a feel for how community features enhance your living experience can help you decide if this trade-off is right for you. At the end of the day, your choice comes down to this: do you prefer the clear-cut rules of a lease or the shared governance of an HOA?

How to Choose the Right Option For You

So, how do you decide between an apartment and a condo? Honestly, it all boils down to where you are in life, both personally and financially. The right choice needs to sync up with your career, long-term plans, and the kind of lifestyle you actually want to live.

If your career might have you relocating in a year or two, or you simply aren't ready for the headaches of homeownership, an apartment lease gives you incredible flexibility. It’s a low-commitment way to live where you want without being tied down.

On the other hand, buying a condo is a smart play if you're looking to put down roots and start building some real wealth. You get the stability of owning your place and the freedom to make it truly yours.

Ultimately, it's a trade-off. Go with an apartment for short-term freedom and less financial pressure. Pick a condo if you're ready to invest in a tangible asset and have more say over your living space.

It’s a massive market—globally, these properties were valued at $1,321.54 billion in 2023. Condos tend to pull in buyers who want ownership and a sense of community, while apartments remain the go-to for anyone prioritizing flexibility and lower upfront costs. You can get a deeper look at what's driving these trends in this detailed housing market analysis.

Once you've made the call, the real work of moving begins. To make sure your move is as smooth as possible, check out these essential tips on moving house packing—they’ll help you stay organized and keep the stress levels down.

Frequently Asked Questions

Can You Rent a Condo Directly From an Owner?

Absolutely. Renting a condo is a popular option, and it works a bit differently than renting an apartment. Instead of dealing with a large management company, your landlord is the individual who owns the unit. This can sometimes lead to a more personal, direct relationship.

Just remember, even though you're renting from an individual, you’re still required to play by the rules of the condo's Homeowners Association (HOA).

Are Condos a Smart Financial Investment?

They certainly can be. Owning a condo means you're building equity with every mortgage payment, and you stand to gain if the property's value goes up. It's a classic path to real estate ownership.

However, its success as an investment hinges on a few key things: the local market, the financial stability of the HOA, and the overall condition of the building. Don't forget that those monthly HOA fees will cut into your net return, so factor them into your calculations.

Condos offer the chance to build wealth through ownership, but apartments give you predictable costs and shield you from the risks of a fluctuating housing market. It all comes down to your financial goals and how much commitment you're ready for.

Which One Usually Has Better Amenities?

Historically, condos held the edge here, often using high-end amenities as a major selling point for potential buyers. But that gap is shrinking fast.

Newer luxury apartment communities are now competing head-to-head, offering everything from rooftop pools and high-tech fitness centers to dedicated co-working spaces. They're designed to attract top-tier tenants who want a premium lifestyle without the hassle of ownership.

Ready to see what modern apartment living in a prime Boca Raton location is all about? Find your next home at Cynthia Gardens. Explore our available one-bedroom apartments today!