Think of a lease agreement as the official rulebook for your new home. It’s a legally binding contract between you (the tenant) and the landlord, spelling out every detail of your stay. This document is the bedrock of your entire rental experience, making sure everyone is on the same page about their rights and responsibilities.

What Is a Lease Agreement, Really?

It’s easy to see a lease as just a pile of intimidating paperwork, but it’s better to view it as the blueprint for a good landlord-tenant relationship. This is where verbal promises get put into writing, creating an enforceable agreement that protects everyone involved. It’s all about getting rid of guesswork.

The main goal is to set crystal-clear expectations from the get-go. When you sign, the landlord is promising to provide a safe and livable space. In return, you’re agreeing to pay your rent on time, respect the property, and follow the established rules. This simple exchange is what prevents future headaches over things like late fees or how long a guest can stay.

The Foundation of Your Tenancy

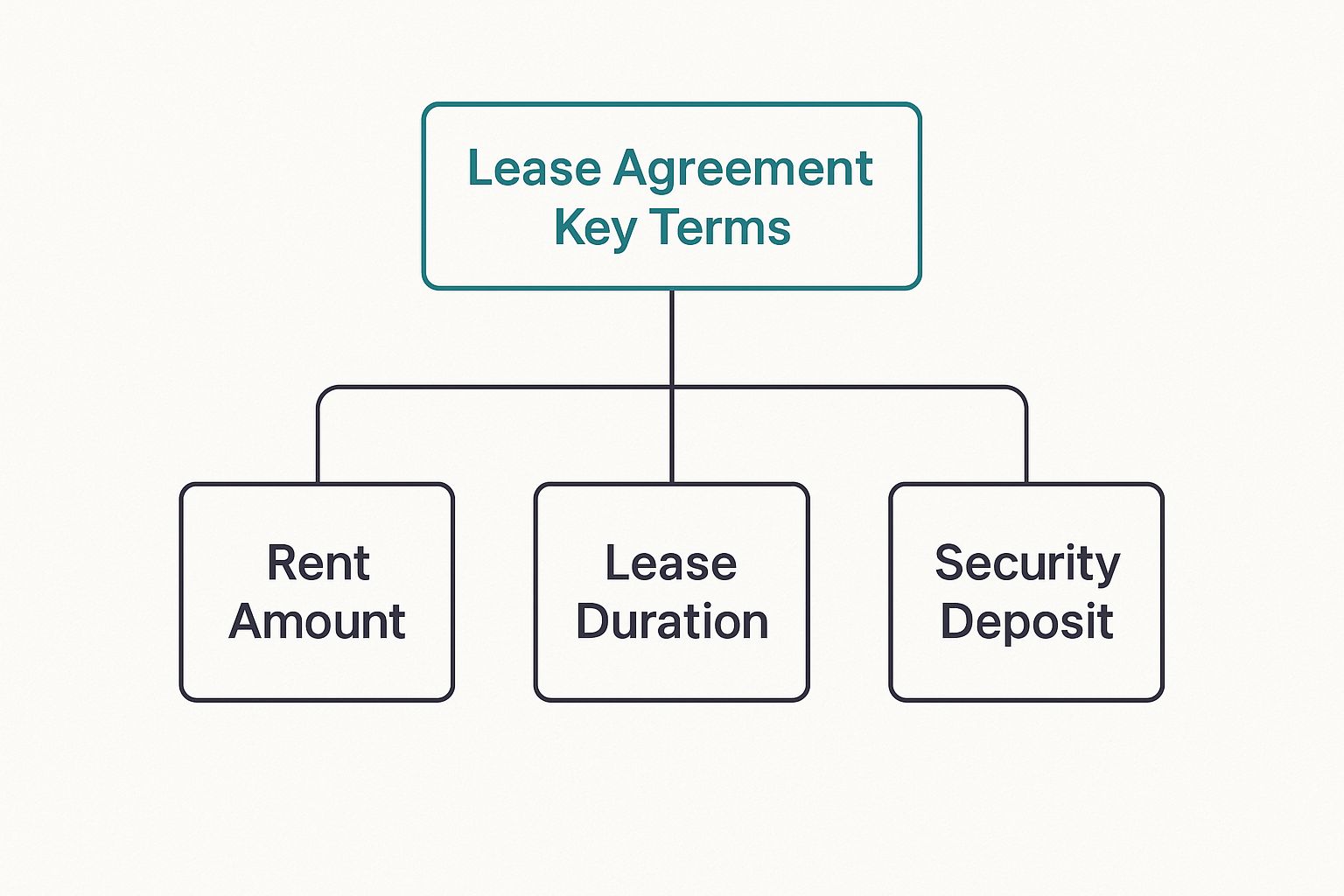

Before we get into the nitty-gritty clauses, let's look at the absolute must-haves—the skeleton of any standard lease. Getting these basics down makes the rest of the document much easier to understand. A solid lease is your ticket to a stress-free rental.

Here’s a quick rundown of the essential components that should be clearly laid out in any lease agreement you review.

Table: Essential Components of a Lease Agreement

| Component | What It Defines |

|---|---|

| Identification of Parties | The full legal names of the landlord (or management company) and every tenant living in the unit. |

| Property Details | The complete address of the rental, including the apartment or unit number, so there’s no confusion. |

| Lease Term | The exact start and end dates of your tenancy. It also specifies if it's a fixed-term (like one year) or a month-to-month agreement. |

| Rent Amount & Due Date | The precise monthly rent, the day it's due, and how you're expected to pay it (e.g., online portal, check). |

These fundamental pieces of information form the core of the contract.

A lease is so much more than a formality. It’s the single most important document governing your time as a renter. It offers security for you and peace of mind for the landlord, making it an essential tool for a smooth living situation.

Recognizing these key elements is a crucial first step when you're navigating the rental market to secure an apartment lease. With this foundation, you'll be much better equipped to dive into the more specific details we'll cover next.

Decoding the Most Important Lease Clauses

Once you've made sure the names, dates, and rent amount are all correct, it's time to dig into the heart of the lease: the clauses. These are the nuts and bolts of your agreement, the specific rules that will shape your experience living in the apartment. Don't think of them as legal traps—think of them as the operating manual for your new home and your relationship with the landlord.

Skipping this part is like building IKEA furniture without the instructions. Sure, you might end up with something that looks like a bookshelf, but it’s bound to be wobbly and fall apart later. Let’s walk through the big ones so you can sign on the dotted line without any lingering worries.

Lease Term and Renewal

One of the very first things you’ll see is the Term of Lease. This simply defines how long you're renting the place. It’s a huge detail that directly impacts your budget and your future plans.

You'll usually run into one of two types:

- Fixed-Term Lease: This is the standard, most often for 12 months. Your rent is locked in, and the rules can’t change for that entire year. It’s perfect if you know you’re staying put for a while because it gives both you and the landlord a sense of stability.

- Month-to-Month Lease: Just like it sounds, this lease renews every month. It offers a ton of flexibility if your plans are up in the air, since either you or the landlord can end the agreement with proper notice (typically 30 days). The trade-off? That flexibility goes both ways, meaning the landlord can also raise the rent or change the rules with the same short notice.

Knowing which one you're signing is critical. A fixed term offers security, while a month-to-month term offers freedom. Pick the one that truly aligns with your life.

Security Deposit and Other Fees

Almost every landlord requires a security deposit. This isn't just an arbitrary fee; it’s the landlord’s financial safety net in case of damages that go beyond normal wear and tear or if you skip out on rent. It’s basically a refundable insurance payment for them.

Florida law is pretty specific about how landlords must handle this money. For example, they have to give you a written notice if they plan to keep any of your deposit within 30 days of you moving out. Your lease should clearly spell out:

- The exact dollar amount of the deposit.

- What they can deduct money for (e.g., patching a huge hole in the wall, not replacing a carpet that's just old).

- The process for getting it back when you leave.

Keep a sharp eye out for any non-refundable fees, too, like pet fees or mandatory cleaning fees. You don’t want any nasty surprises when it's time to move out. For more on this, check out these smart tips for navigating apartment lease agreements to help protect your money.

Maintenance and Repair Responsibilities

So, who’s on the hook when the AC dies in the middle of a Boca Raton summer? The Maintenance and Repairs clause has the answer. This part of the lease explains who is responsible for fixing what.

Typically, the landlord handles the big stuff—anything that makes the apartment unlivable, like major plumbing, electrical, or structural problems. Your job as the tenant is to keep the place clean and, most importantly, to report problems right away. The lease should detail exactly how you should submit a maintenance request and how quickly you can expect a response.

A clear maintenance clause is your best friend. It stops small issues from becoming massive headaches, protecting both the property and your own comfort.

For instance, if you ignore a small drip under the sink and it later causes major water damage, you could be held responsible for not reporting it. It’s always best to communicate problems in writing to have a record.

Right of Entry and Quiet Enjoyment

Your apartment is your private sanctuary, and the lease protects it as such. A clause called the Covenant of Quiet Enjoyment is the landlord’s formal promise that you’ll be able to live in your home peacefully, without them showing up unannounced or letting other tenants cause a ruckus. It’s your fundamental right to privacy.

Of course, this is balanced with the landlord's Right of Entry. They do need to get into your unit sometimes for legitimate reasons like emergencies, repairs, or showing the apartment to a future renter. But—and this is a big but—the lease must state that they will provide "reasonable notice." In most places, that means 12 to 24 hours ahead of time, unless there’s a true emergency like a fire or a burst pipe.

This graphic really breaks down the core financial and time-based commitments that form the foundation of any lease. Getting a solid handle on these three pillars—rent, lease term, and the security deposit—is the first and most important step. Reading these clauses carefully ensures you know exactly when your landlord can (and can't) step foot in your home, protecting your privacy while still allowing for the necessary upkeep of the property.

Understanding Your Rights and Responsibilities

A lease agreement isn't just a pile of paperwork; it's the foundation of a partnership between you and your landlord. Think of it as a playbook for your new home. Both sides have a role to play, and knowing the rules from the start is the secret to a smooth, stress-free rental experience.

At its core, the deal is simple: you pay rent, and your landlord provides a safe and livable home. This fundamental promise from the landlord is legally known as the implied warranty of habitability.

The Landlord's Core Obligations

This "warranty" isn't something you'll find stamped on an appliance. It's a built-in legal guarantee that your rental meets basic living standards. It doesn't mean the place has to be a palace, but it absolutely must be habitable.

While the fine print can vary by state, a landlord is almost always on the hook for:

- Structural Soundness: Making sure the roof doesn't leak and the walls and floors are secure.

- Essential Utilities: You need reliable access to basics like heat, hot water, and electricity.

- Safety Measures: This includes working smoke detectors and keeping the property free from major hazards, like a serious pest infestation.

- Common Areas: Hallways, laundry rooms, and other shared spaces must be kept clean and safe.

If your landlord drops the ball on these critical items, you have legal recourse. But that brings us to your part of the deal, which starts with good communication.

The Tenant's Key Responsibilities

Being a good tenant means more than just cutting a rent check each month. Your lease will spell out your duties in maintaining the property and being a good neighbor.

Typically, your main responsibilities are:

- Timely Rent Payment: This is your most important job. Paying the full amount on the date it's due is non-negotiable.

- Property Upkeep: You're expected to keep your unit reasonably clean and avoid causing damage beyond normal wear and tear.

- Promptly Reporting Issues: See a leaky pipe? Notice the heater is on the fritz? Tell your landlord right away. Waiting can turn a small problem into a huge one, and you could even be held partially responsible.

A healthy landlord-tenant relationship is built on clear communication. Reporting a needed repair in writing creates a record and ensures that both parties are aware of the issue and the timeline for resolution.

Fulfilling these duties isn't just about following the rules in a lease agreement; it's about protecting your home and fostering mutual respect. When both sides understand what's expected, you prevent small issues from spiraling into major conflicts. Knowing this balance empowers you to live confidently, fully aware of your obligations and the rights you're entitled to.

Navigating Short-Term and Flexible Leases

The days of the standard one-year lease being your only choice are long gone. A much more adaptable option has become incredibly popular: the short-term or flexible lease. You'll see these everywhere from vacation rentals and corporate housing to temporary spots for people in between homes.

Unlike a traditional long-term contract, a short-term lease is all about convenience and a shorter time frame, typically lasting anywhere from a few weeks up to six months. That flexibility is the main draw, but it’s important to know that it comes with its own unique set of rules and expectations.

How Flexible Leases Differ

The structure of a flexible lease agreement is built around its temporary nature. These arrangements are often more of an "all-in-one" package, bundling costs that you'd normally pay for separately in a standard rental.

Here are a few key differences you’ll almost always encounter:

- Included Utilities: Most short-term rentals come fully furnished, with utilities like electricity, water, and internet rolled right into the monthly rent. It just makes life easier for someone who isn't planning on staying long.

- Higher Rental Rates: Convenience comes at a cost. Landlords have to deal with more frequent turnover and the risk of the unit sitting empty, so the monthly rent is almost always higher than a comparable long-term rental.

- Stricter Rules: Because the property needs to be ready for the next person quickly, you'll often find stricter policies on guests, pets, and making any changes to the apartment.

This model isn't just a niche—it's a massive response to the growing need for more adaptable living situations. The short-term leasing market was valued at around USD 124.6 billion and is expected to explode to over USD 477.9 billion by 2037, driven by the huge shift to remote work and evolving housing demands.

Is a Short-Term Lease Right for You?

Figuring out if a flexible lease is the right move for you really comes down to your specific situation. If you're a student here for a semester-long internship, a professional on a temporary work assignment, or even someone new to Boca Raton who wants to test-drive a few neighborhoods before putting down roots, the benefits are pretty obvious.

A short-term lease offers freedom from long-term commitment, making it an ideal solution for transitional periods. However, this convenience often comes at a higher price point and with less room for personalization.

The real decision is whether the higher cost is worth the incredible convenience and flexibility. For anyone curious about this modern approach to renting, our complete guide to short-term rentals in Boca Raton is the perfect place to explore local options.

A Look at Commercial Lease Agreements

While a residential lease dictates the terms for where you live, a commercial lease agreement sets the ground rules for where you work. These are the contracts that cover everything from a small downtown retail shop to a sprawling industrial warehouse or a sleek office suite. Although they share a legal backbone with apartment leases, the similarities pretty much end there. Commercial leases are a whole different beast—far more detailed, heavily negotiated, and tailored to a specific business.

A good way to think about it is that a residential lease is like a standard, off-the-lot car—it gets the job done and the features are mostly the same for everyone. A commercial lease, however, is more like a custom-built work truck. Every part of it is designed and negotiated to serve a specific business function, making it longer, more complex, and often shifting more day-to-day responsibilities onto the tenant.

Common Types of Commercial Leases

Unlike the one-size-fits-most approach of residential rentals, commercial leases come in several distinct types. The key difference usually boils down to one critical question: who pays for the building’s operating expenses? Things like property taxes, insurance, and maintenance costs (often called "the triple nets") have to be covered, and how that's handled can drastically change the deal for a business owner.

Here are the three main structures you'll run into:

- Gross Lease: This is the most straightforward setup, feeling a lot like an all-inclusive residential lease. You pay one flat rental fee, and the landlord takes care of all the building’s operational costs. It's simple and predictable.

- Net Lease: Here, the tenant pays a lower base rent but also covers some or all of the property's operating expenses. You'll hear terms like single (N), double (NN), or triple (NNN) net leases. Each "N" just adds another category of costs (taxes, insurance, or maintenance) to the tenant's tab.

- Percentage Lease: This is a staple in the retail world. The tenant pays a base rent plus a percentage of their gross sales once they hit a certain revenue target. It's a structure that gives the landlord a direct stake in the tenant's success.

The type of commercial lease agreement a business signs directly impacts its bottom line and operational budget. A Gross Lease offers predictable costs, while a Net Lease provides a lower base rent but with more variable expenses.

Trends in the Commercial Market

The world of commercial real estate is always in motion, heavily influenced by the economy and how people shop and work. For instance, the meteoric rise of e-commerce has triggered a massive demand for industrial and warehouse space, completely transforming that corner of the market.

Recent data shows that by mid-2025, industrial property vacancy rates hit a ten-year high. That slight oversupply has started to create a more tenant-friendly market, giving businesses a bit more leverage at the negotiating table. Interestingly, even with more space available, average market rents have still nearly doubled over the past decade. You can dive deeper into these industrial leasing trends on Site Selection Group.

Got Questions About Your Lease? We’ve Got Answers.

Even with a perfectly clear lease, real-life situations can throw you a curveball. It’s one thing to read the clauses, but it’s another to know what to do when something unexpected happens. Think of this section as your practical guide to the most common "what if" scenarios that renters face.

Getting a handle on these issues now can save you a world of headaches later. Let's dive into the questions we hear most often.

What Happens if I Need to Break My Lease Early?

Life happens. Sometimes, you have to move before your lease is up. But unlike canceling a Netflix subscription, breaking a lease usually has financial consequences. Most agreements have an "early termination" clause spelling out the penalties. You might lose your security deposit, or you could be on the hook for rent until the landlord finds a new tenant to take your place.

That said, there are some legally protected reasons to break a lease without penalty, like being called to active military duty. Before you do anything, your first step is to pull out your lease and read that clause carefully. Then, talk to your landlord—in writing. They might be willing to work with you, especially if you can help find a qualified person to take over your lease.

Can My Landlord Just Change the Lease Terms?

This is a huge one, and the answer really boils down to what kind of lease you signed.

- Fixed-Term Lease (e.g., one year): For the most part, the answer is no. The landlord can't just decide to raise your rent or change the rules mid-lease. The terms are set in stone for the entire period unless you both agree to a change in writing (this is called an addendum).

- Month-to-Month Agreement: Here, the answer is yes. A landlord can change the terms, including the rent, as long as they give you proper written notice. In Florida, that typically means 30 days' notice before your next rent payment is due.

This is the classic trade-off: a fixed-term lease gives you stability, while a month-to-month lease offers flexibility for everyone involved.

The core difference between a lease and a rental agreement is stability versus flexibility. A lease locks in terms for a long period, typically a year, offering security. A rental agreement, usually month-to-month, provides the freedom to change or end the arrangement with short notice.

How Can I Make Sure I Get My Full Security Deposit Back?

Getting your full security deposit back is totally doable—it just takes a little foresight and effort. The goal is simple: leave the apartment in the same condition you found it, allowing for a little normal wear and tear.

Here’s a simple game plan to get your money back:

- Be the Paparazzi: The day you move in, take photos and videos of everything. Do the exact same thing the day you move out. This is your proof.

- Give Notice the Right Way: Check your lease for how much notice you need to give and make sure you do it in writing.

- Clean Like You Mean It: Don't just sweep up. We're talking a deep clean—scrub the oven, wipe down baseboards, make the bathroom sparkle.

- Pay Your Dues: Make sure your rent is paid in full and you've settled any final utility bills.

- Tell Them Where to Send the Check: Give your landlord your new forwarding address in writing so they know exactly where to mail your deposit.

In Florida, a landlord has between 15 and 60 days to either return your deposit or send you a list of why they're keeping some of it. Following these steps builds a strong case for getting every penny back.

At Cynthia Gardens, we believe a great resident experience starts with a lease that’s clear, fair, and easy to understand. If you’re searching for a comfortable, well-managed apartment in Boca Raton with a straightforward approach to leasing, we invite you to see what we have to offer.