Trying to find an affordable apartment can feel like you're navigating a maze blindfolded. It's not just about finding a lower rent; it’s a whole system with its own rules, income brackets, and specific programs. Getting a handle on these basics is the real first step to finding a place you can call home without breaking the bank.

Decoding the Affordable Housing Market

Before you even start scrolling through apartment listings, it’s smart to understand what you're up against. The simple truth is that there are way more people looking for affordable places than there are apartments available. This creates a really competitive environment, but if you know the lingo and the different types of housing out there, you'll have a serious leg up.

This isn’t just a Boca Raton problem, either. It’s a global issue.

Across major developed countries, there's a shortage of about 6.5 million housing units, which is fueling a massive affordability crisis. It's a big reason why renting is becoming the norm for so many—over 80% of households in these areas are leaning toward renting because buying a home is just out of reach. You can dig deeper into these global rental market trends on Hines.com. This bigger picture helps explain why you need a solid game plan to find an affordable apartment.

Key Terms You Need to Know

To get anywhere in your search, you have to speak the language. Getting familiar with these terms will make property listings and application forms a lot less confusing.

- Area Median Income (AMI): This is the magic number. It's the midpoint household income for a specific county or city, and the government (specifically HUD) sets it every year. Your eligibility for nearly all affordable housing is based on how your income compares to the local AMI.

- Income-Restricted: You'll see this phrase a lot. It means an apartment is set aside for people earning less than a certain percentage of the AMI, like 50% or 80%. Communities like Cynthia Gardens have units that fall into this category.

- Section 8 (Housing Choice Voucher Program): This is a well-known federal program that helps low-income families, seniors, and people with disabilities afford rent. If you have a voucher, you find your own apartment, pay a portion of the rent, and the program pays the landlord the rest.

A common mistake is thinking all affordable housing is "the projects" or public housing. The reality is that many great communities, like Cynthia Gardens, are privately owned and managed. They just partner with government programs to offer some of their apartments at a reduced rent to qualified people.

Types of Affordable Housing Explained

To help you sort through the options, here's a quick breakdown of the main types of affordable housing you'll run into. Each one works a little differently.

| Housing Type | Who It's For | How Rent Is Calculated |

|---|---|---|

| Public Housing | Low-income families, the elderly, and individuals with disabilities. | Rent is typically set at 30% of the household's adjusted monthly income. |

| Income-Restricted Apartments | Households earning below a certain percentage of the Area Median Income (AMI). | Rent is a fixed, below-market rate based on the unit size and the AMI level (e.g., 60% AMI). |

| Section 8 Vouchers | Very low-income families. | The tenant pays 30% of their income toward rent, and the voucher covers the rest, up to a limit. |

Knowing the difference between these programs is crucial. It helps you focus your search on the right kind of communities and prepare the right paperwork for your applications. For example, income-restricted properties often use the Low-Income Housing Tax Credit (LIHTC) program. These are apartments in privately-owned buildings—like the ones you might find at Cynthia Gardens—that get tax breaks for keeping a certain number of units affordable.

This is a completely different setup from public housing, which is actually owned and run by a local government agency. Understanding these differences means you can target the opportunities that are the best fit for you, which is the key to actually landing a great, affordable place to live.

Confirming Your Eligibility for Housing Programs

Before you pour hours into searching for apartments, let's nail down the most critical detail: your eligibility. Honestly, this is the one thing that will determine which doors are actually open to you. Think of it as getting pre-approved for a mortgage—it saves you from the frustration of finding the perfect place only to discover it's out of reach.

The entire affordable housing system is built around a metric called the Area Median Income (AMI). This is a number set by HUD each year that represents the income midpoint for all households in a given area, like Palm Beach County. Where your household income falls in relation to the AMI is what determines which programs and apartment communities you can apply for.

Calculating Your Total Household Income

Okay, let's get your numbers in order. The first thing any property manager will look at is your gross annual income, which is your total household earnings before a single dollar is taken out for taxes or other deductions. It's a much bigger picture than just your take-home pay.

You'll need to round up the income for every single person who will be on the lease. Make sure you don't miss anything:

- Paychecks: Grab your latest pay stubs, W-2 forms, or recent tax returns.

- Side Hustles: If you're a freelancer or run your own business, you’ll need to show your profit and loss statements.

- Other Money Coming In: This is the one people often forget. Include child support, alimony, Social Security benefits, pension payments, and even any consistent financial help you get from family.

Add it all up for a full year. That final number is your total household income, and it's your key to the next step.

This process is so strict because of the intense affordability crisis we're facing. Housing experts often talk about a 'median multiple,' and a price-to-income ratio over 3.0 is considered unaffordable. In some major cities, housing has become 'impossibly unaffordable.' The Demographia International Housing Affordability report really puts into perspective how massive this issue is on a global scale.

Comparing Your Income to AMI Brackets

With your total income calculated, it's time to see how it stacks up against the current AMI for Boca Raton. Affordable housing programs don't just have one cutoff; they use different percentage brackets of the AMI to sort applicants.

Pro Tip: Don't rely on old information or guess what the AMI is. These numbers are updated annually. Your best bet is to do a quick search for "[Your County] HUD AMI limits" to find the most current figures directly from the source.

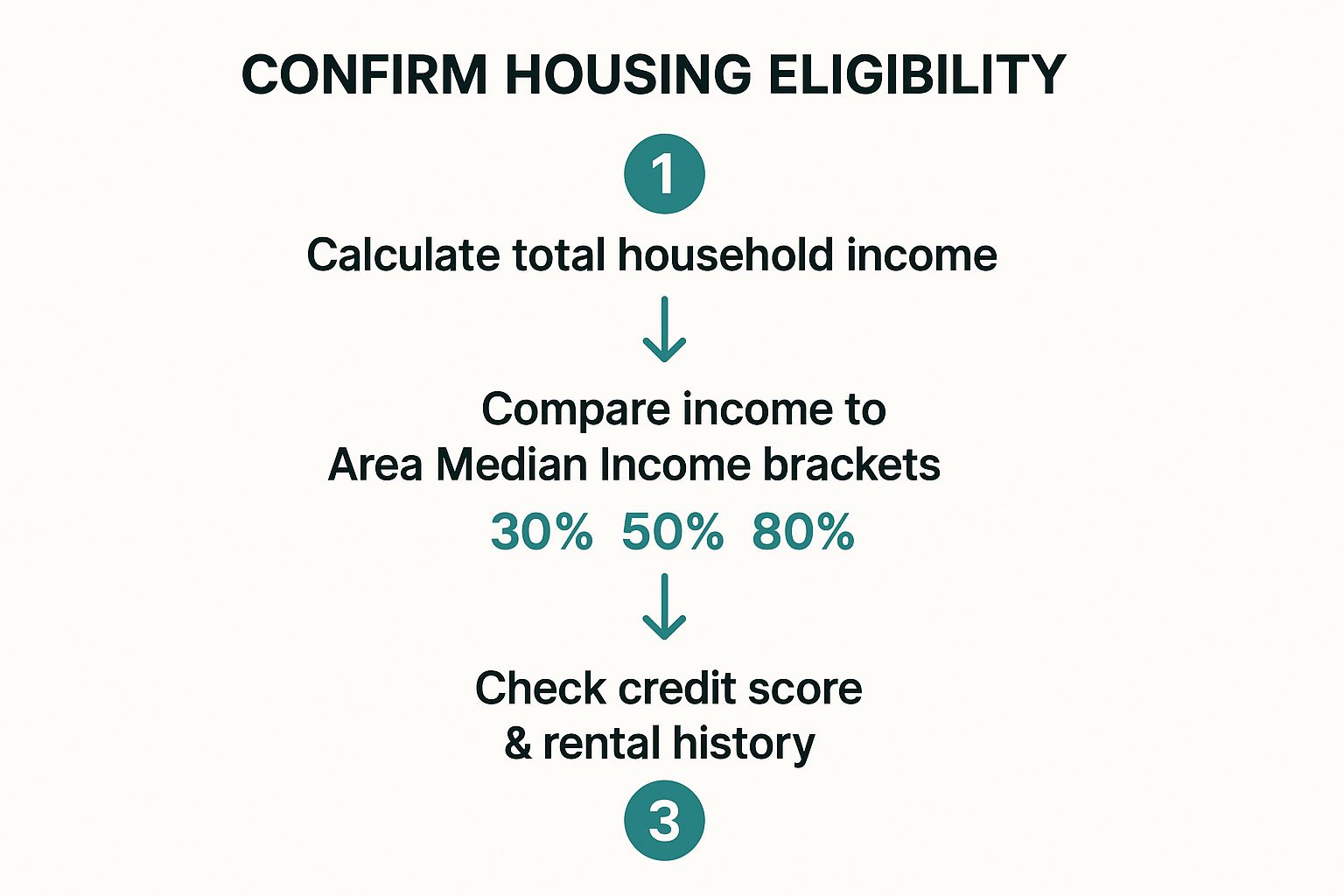

The infographic below breaks down the simple, three-step check to see where you stand.

As you can see, figuring out your income and checking it against the AMI limits are the first two hurdles. The final piece of the puzzle is your overall financial and rental history.

Other Factors Managers Consider

Income is definitely the biggest piece, but it's not the whole story. Property managers, including those at communities like Cynthia Gardens, are also looking for reliable residents who will be a good addition to the community. They'll almost always look at a few other things.

- Credit Score: While the credit requirements are often more flexible than at luxury, market-rate apartments, they still want to see a pattern of you paying your bills. Big red flags can be recent bankruptcies or a lot of unpaid debt sent to collections.

- Rental History: This one is huge. A glowing reference from your last landlord can make all the difference. They need to know you paid your rent on time and didn't cause any problems.

- Background Check: This is standard practice everywhere. It’s a simple safety measure for everyone living in the community.

Getting all this sorted out upfront is a game-changer. It allows you to stop wasting time and start focusing your apartment search with real confidence, knowing you’re looking at places that are actually a good fit for you.

Finding and Vetting Affordable Apartment Listings

Alright, you've confirmed your eligibility—now the real search begins. Looking for an affordable apartment isn't quite like scrolling through Zillow on a Sunday afternoon. It takes a more strategic approach, blending savvy online searching with a bit of old-fashioned local legwork.

The trick is knowing where to look. Many income-restricted communities, including Cynthia Gardens, don't always list their openings on the big, public rental sites. They often fill vacancies directly from a waitlist, so you have to know how to get on it.

Where to Look for Openings

Start your search with the official sources. Government and local housing authority websites are your most reliable bet because they exist specifically to connect people like you with the right housing programs. They cut right through the clutter of market-rate apartments you don't need to see.

Once you’ve exhausted those, you can broaden your search to other platforms. For a deep dive into the pros and cons of different rental sites and how to set their filters just right, take a look at our guide to the best apartment finding sites. But don't just stay online; sometimes, the most effective method is picking up the phone.

Here’s where I’d focus my energy:

- Local Housing Authority Websites: This should be your first stop. Your city or county housing authority usually keeps the most current lists of participating properties.

- HUD Resource Locator: The U.S. Department of Housing and Urban Development offers a great online tool for finding affordable housing options in your area.

- Direct to the Source: Make a list of communities you’re interested in and visit their websites directly. Better yet, give their leasing office a call. Many, like us at Cynthia Gardens, manage their own applicant lists and can give you the most accurate info.

A quick pro-tip from my experience: The affordable housing game is intensely local. National websites are a good starting point, but the local resources will almost always have the most up-to-date information on waitlist openings in your neighborhood.

Spotting Scams and Red Flags

With such high demand for affordable apartments, scammers are unfortunately a real problem. You need to know the warning signs before you share any personal data or, worse, send any money. A legitimate property manager will never pressure you or ask for payment in a sketchy way.

Be extremely cautious if someone asks for a "holding fee" through a wire transfer, gift cards, or a cash app before you've even toured the apartment and signed a lease. That’s a classic scam. Another huge red flag is a rent price that seems way too low, even for an affordable program. If it feels too good to be true, it almost certainly is.

Questions to Ask a Leasing Agent

When you find a community that looks promising, your next move is to vet the management. The questions you ask now can tell you everything you need to know about what it's really like to live there. This is your moment to get the details that aren't advertised online.

I always recommend creating a standard checklist of questions. When you ask the same things at every property, it makes comparing your options much, much easier.

Your Essential Vetting Checklist:

- Application Fees: "What’s the total application fee for each adult, and is any part of it refundable if my application isn't approved?"

- Waitlist Status: "Do you currently have a waitlist for your income-restricted apartments? If you do, what’s the estimated wait time?"

- Utility Costs: "Can you tell me which utilities are included in the rent? Do you offer a utility allowance?"

- Community Policies: "I'd love to know more about your policies for pets, parking, and overnight guests."

- Required Documents: "To make sure I'm prepared, what specific documents will I need to provide with my application?"

Asking these questions not only gets you crucial information but also shows the leasing agent that you're a serious, organized applicant. It’s a simple step that helps you avoid dead ends and focus your time on the communities that are genuinely a great fit.

Assembling a Winning Rental Application

When you're searching for an affordable apartment in a competitive market, being prepared isn't just an advantage—it's everything. A complete, organized application lets you move quickly when the right apartment becomes available, putting you way ahead of the competition.

Think of your application as your first impression. Property managers are sifting through dozens, looking for responsible, stable tenants. A sloppy, incomplete submission can get you moved to the bottom of the pile, or worse, tossed out completely. Getting your ducks in a row before you start applying is the single best thing you can do to land your next home.

Get Your Paperwork in Order

Don't wait until you've found the perfect place to start digging for documents. The best approach is to create a dedicated "rental application" folder—either a physical one or a digital one on your computer—and gather everything you need right now. When you find a unit you love, you can apply in minutes.

Before you begin, use this table to make sure you have everything on hand. This little bit of prep work prevents that last-minute scramble and ensures you submit a complete package.

Affordable Housing Application Checklist

| Document Category | Specific Items Needed | Pro Tip |

|---|---|---|

| Proof of Income | Your 2 most recent pay stubs, last year's W-2, or a recent tax return if you're self-employed. | Save these as clearly labeled PDF files (e.g., "Jane Doe – Pay Stub May 2024"). It looks professional and makes things easy for the property manager. |

| Identification | A clear, readable copy of a government-issued photo ID (driver's license, passport, etc.) for every adult applying. | Take a high-quality photo or scan against a plain, dark background. Make sure there's no glare and all text is legible. |

| Financial Health | Your 2 most recent bank statements. Some communities may ask for more. | Download official statements directly from your bank's website. Screenshots are often not accepted and can look unprofessional. |

| Rental History | A list of your addresses for the past 3-5 years, including your landlord's name and contact info. | Call your previous landlords ahead of time to give them a heads-up. It's a great way to confirm their contact information is still accurate. |

Having these documents ready to go is a game-changer. For a more detailed look at what's involved, you can review the common requirements for apartment rental applications to see exactly how to fill them out for success.

One of the most common—and avoidable—mistakes I see is applicants submitting blurry phone pictures of their documents. Take the extra minute to ensure every scan is crisp and every field is filled out. It signals that you’re detail-oriented and serious.

Telling Your Financial Story

Your financial profile is much bigger than just a credit score. While a strong score certainly helps, property managers are really looking at the whole picture. They want to see a pattern of paying bills on time and a debt-to-income ratio that shows you can comfortably afford the rent.

What if you have little or no credit? It’s not an automatic "no." You just need a different approach. There are proven strategies for renting without a credit history, such as offering a larger security deposit or providing glowing letters of recommendation from employers or past landlords.

A fantastic reference can make all the difference. Always contact your previous landlords before you list them on an application. This courteous heads-up ensures they’re prepared to give you a positive review and confirms you have their correct phone number. By putting together a thoughtful, complete package, you're not just applying for an apartment—you're making a strong case for why you're the best person for it.

Navigating Waitlists and The Move-In Process

Getting your name on a waitlist is a huge step forward, but it's really just the beginning of the journey. This is where your patience and persistence truly come into play. Once your application is in, the waiting game starts, and it can last for months—sometimes even longer—depending on how high the demand is.

The trick is to stay engaged without becoming a nuisance to the leasing office. I always advise people to send a polite, professional check-in email every 4-6 weeks. A quick note asking if they need any updated information keeps you on their radar and shows you're still serious about the apartment.

It's also absolutely critical to let them know immediately if anything changes with your application. A new job, a change in family size, or even a new phone number needs to be reported right away to keep your file current.

The long wait times aren't unique to Boca Raton; they're a symptom of a much larger housing crunch. The affordable housing crisis in the U.S. is a tough reality, with fewer and fewer rental options available for people with lower incomes. If you want to dig deeper into the national trends, this 2025 U.S. Affordable Housing Impact Report from Nuveen.com offers some eye-opening context.

When You Finally Get The Call

The moment your name hits the top of the list, things start to move fast. Expect a call from the property manager to confirm you’re still interested and to verify that you still meet all the eligibility requirements. This is when you'll handle the final paperwork and sign your lease.

Take a deep breath and read every single word of that lease agreement. Leases for income-restricted communities have very specific rules, especially around things like annual income recertification. Don't hesitate to ask for clarification on any part that seems confusing before you put pen to paper.

Once the lease is signed, you'll work out your move-in date and sort out the initial payments. This typically includes your first month's rent and a security deposit. We've put together a simple guide that breaks down exactly what a security deposit is and what it covers.

The Last Few Steps Before Unpacking

Before you even think about bringing in boxes, there are a couple of crucial things to do.

First, the move-in inspection. This is non-negotiable. Grab the checklist from the manager and walk through the entire apartment. Document the condition of everything—scratches on the floor, dings in the wall, a leaky faucet, you name it. Take pictures or a video of any existing damage, no matter how small it seems. This documentation is your best friend when it comes time to get your security deposit back.

Lastly, you’ll need to get your utilities up and running. The property manager can give you a list of the services you're responsible for (like electricity and internet) and who the local providers are. Make sure to have these accounts set up and activated in your name before your move-in day. Trust me, you don't want to spend your first night in a new home without power

Answering Your Affordable Housing Questions

Even after the boxes are unpacked and you're settling in, you might still have questions about life in an income-restricted community. Getting the hang of the day-to-day rules is just as important as the initial application, and we've heard just about every question there is.

Let's clear up some of the most common concerns we hear from residents about their new affordable housing apartments for rent. Knowing the answers ahead of time makes for a much smoother experience, letting you focus on what really matters—enjoying your new place.

How Often Do I Need to Recertify My Income?

This is a big one, and it's absolutely crucial. You'll need to recertify your household's income and size every single year. Think of it as an annual check-in to confirm you still qualify for the program.

Don't sweat the deadline, though. Our management team will give you a heads-up well in advance, providing all the forms and instructions you need. The key is simply to get it done accurately and on time to secure your lease for another year.

Can I Get a Roommate?

Yes, you can absolutely have a roommate in most cases. But there's a critical catch: their income gets added to yours.

The new combined household income still has to be under the maximum limit for your specific apartment. Before anyone moves in, they must go through the same screening process you did—background check, credit history, the works. Once they're approved by management, they'll be officially added to the lease.

Here's a good way to think about it: The apartment unit itself is qualified for the program, not just the person who first signed the lease. Everyone living there has to meet the guidelines to keep the apartment within the affordable housing system.

What if I Get a Raise and My Income Goes Up?

This is a fantastic problem to have, but it naturally comes with questions. If you get a promotion or a new job that pushes your income over the limit after you've already moved in, you typically won't be asked to leave right away.

What usually happens is that your rent will be adjusted to the standard market rate at your next lease renewal. Honesty is the best policy here. You're required to report any significant income changes to the property manager as soon as possible. They’ll walk you through your community’s specific rules so you know exactly what to expect.

Are Utilities Included in the Rent?

This is something that really changes from one property to the next, so you should never assume. Some affordable housing apartments for rent might offer a utility allowance that covers basics like water, sewer, and trash—a nice bonus for your budget.

However, you should almost always plan on covering electricity, internet, and cable on your own. Before you sign anything, get a crystal-clear breakdown from the leasing agent. Ask them to show you in writing exactly what's included and what you'll be responsible for. This is the best way to avoid any surprises when that first bill arrives.

At Cynthia Gardens, we want to make finding a comfortable, affordable apartment in Boca Raton as simple as possible. Our team is always here to help you navigate the process. To see our beautiful community and learn more about our one-bedroom apartments, visit us online at https://cynthiagardens.com.