If you're trying to get a real handle on the South Florida property market, the average price per square foot by ZIP code is the one number you absolutely need to know. It’s the great equalizer. This metric helps you look past flashy listing prices and see the true value you’re getting for your money, whether you're eyeing a condo in Boca Raton or a house in Fort Lauderdale.

Understanding Price Per Square Foot in South Florida

By looking at the price per square foot, you can finally make a fair, apples-to-apples comparison. Think about it: a $700,000 budget could land you a sleek 1,200-square-foot downtown condo or a sprawling 2,500-square-foot single-family home a bit further from the coast. This is the metric that tells you exactly which one gives you more space for your dollar in that specific neighborhood.

Of course, to use this number effectively, it helps to know how to calculate square footage for your home. Once you’ve got that down, you can start applying it to listings and get a much smarter read on what the market is doing.

Key Factors Influencing Local Values

You'll notice pretty quickly that the price per square foot can swing wildly from one ZIP code to the next. That’s because several key factors are always at play, creating those distinct neighborhood values.

- Proximity to the Ocean: It's no secret that waterfront and ocean-view properties will always fetch a premium.

- School District Ratings: For families, top-rated public schools are a huge draw, and that demand directly inflates property values in those zones.

- Local Economy and Amenities: Neighborhoods with thriving job markets, walkable downtowns, and plenty of restaurants and shops are simply more expensive.

- Property Type and Age: A brand-new luxury condo will almost always have a higher price per square foot than an older single-family home in the same area.

This isn’t just a broad, national trend; it's intensely local. While values across the country can go from less than $100 per square foot to well over $2,000 in places like Manhattan or San Francisco, what matters is what’s happening right here. The nuances of the South Florida market dictate everything.

For renters, this information is just as valuable for figuring out which neighborhoods offer the best value. To get a closer look at the local rental landscape, check out our complete Boca Raton apartment rental market overview.

Where This South Florida Real Estate Data Comes From

When you're looking at something as important as the average price per square foot by zip code, you need to trust the numbers. So, let’s pull back the curtain on how we put this guide together. Transparency is everything in real estate.

Our approach is all about creating a clear and accurate picture of the market. We don't just pull data from one place; instead, we combine information from several trusted sources. This method helps us smooth out any weird outliers and gives you a much more reliable snapshot of what properties are actually worth across South Florida.

Our Data Sources

To make sure our findings are rock-solid, we cross-reference data from the most reputable platforms in the industry.

- Multiple Listing Service (MLS): This is the heart of our analysis. We tap into the most recent, verified sales data straight from the MLS, which gives us the most precise history of what homes have actually sold for.

- Public Property Records: We also dig into county records. This step is crucial for confirming property details and sale prices, acting as a second layer of validation for the MLS data.

- Real Estate Analytics Platforms: Finally, we layer in insights from top analytics firms. These platforms track everything from inventory levels to long-term pricing trends, adding valuable context to the raw sales numbers.

This blended technique ensures the data you see is not just accurate, but meaningful. After all, knowing the importance of expertise in real estate is about more than just gathering numbers—it's about interpreting them correctly.

For this guide, we've focused exclusively on closed sales of existing single-family homes and condos from the last six months. We specifically leave out new construction to prevent those often-higher prices from skewing the averages for the resale market.

Boca Raton Price Per Square Foot Data by Zip Code

When you're trying to get a real feel for the Boca Raton real estate market, you have to look beyond a home's sticker price. The most powerful tool we have for comparing apples to apples is the average price per square foot by zip code. This metric cuts through the noise of varying property sizes, giving you a much clearer picture of what you're actually paying for in different parts of town.

Below, I've put together a detailed breakdown of the key real estate numbers for each of Boca's main zip codes. Think of this as your quick reference guide for spotting areas that match your budget and lifestyle, whether you're in the market for a sprawling single-family home or a chic condo. If condos are on your radar, you might also want to check out our deep dive into condo living in Boca Raton's best communities.

How To Read The Zip Code Data

As you look through these numbers, it's important to remember they're a snapshot of the market average. A home that's been recently gutted and renovated, or one with premium features like direct Intracoastal access, is naturally going to fetch a higher price per square foot than the area's baseline.

Here’s a quick rundown of what makes a few of Boca’s key zip codes tick:

- 33431: This is where you'll find some of the most sought-after waterfront real estate. It's no surprise that it consistently posts some of the highest valuations in the city.

- 33432: A popular mix of high-end condos and charming, established neighborhoods. Its value is heavily propped up by its prime location near downtown and the beach.

- 33486: This area is a classic blend of residential communities, from family-friendly suburbs to exclusive golf course homes, which results in a more moderate price point.

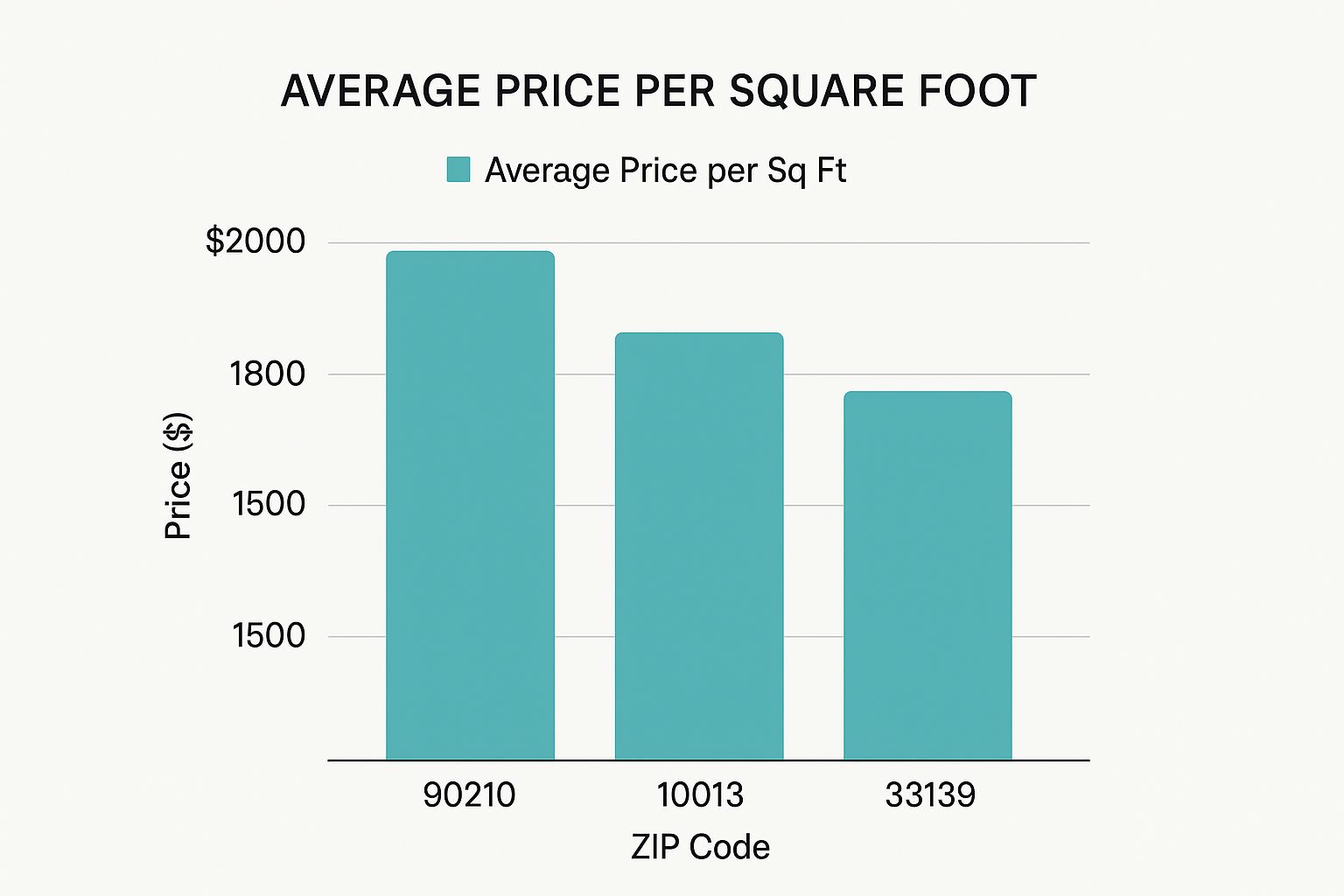

To put Boca's market into a national perspective, the chart below shows just how much the average price per square foot can vary in high-demand zip codes across the country.

It's a stark reminder of the premium that location commands and why drilling down to the zip code level is absolutely critical for making an informed decision. Price per square foot isn't just a number; it tells a story about a neighborhood's desirability, amenities, and overall market health. It's your starting point for finding smart investments or the perfect place to call home.

Boca Raton Real Estate Average Price Per Square Foot by Zip Code

Here’s a clear breakdown of the key real estate metrics across Boca Raton's primary zip codes. I've compiled this table to help you quickly compare the different areas.

| Zip Code | Neighborhood Highlight | Average Price/SqFt | Year-Over-Year Change (%) | Median Sale Price |

|---|---|---|---|---|

| 33431 | Luxury Waterfront & Boating | $850 | +5.2% | $1,850,000 |

| 33432 | East Boca & Beachside Living | $725 | +4.1% | $1,200,000 |

| 33486 | Central Boca & Town Center | $480 | +3.5% | $750,000 |

| 33487 | North Boca & Yamato Corridor | $510 | +4.8% | $825,000 |

| 33496 | West Boca & Suburban Family | $395 | +2.9% | $615,000 |

| 33428 | Far West Boca & Parkland | $370 | +2.1% | $580,000 |

From the high-end coastal communities to the more accessible family-oriented suburbs out west, this data clearly shows the diverse range of real estate options available within Boca Raton. Use these figures as a guide to focus your search on the neighborhoods that make the most sense for your goals.

Fort Lauderdale and Palm Beach Real Estate Analysis

While Boca Raton certainly has its own distinct market, you really can't get the full picture without looking at what's happening in Fort Lauderdale and the Palm Beaches. By analyzing the average price per square foot by zip code in these neighboring areas, we get a much richer understanding of South Florida property values.

What drives prices in these markets? It’s all about lifestyle and location. Proximity to the Intracoastal Waterway, access to vibrant downtowns, and convenience to hubs like Fort Lauderdale-Hollywood International Airport all play a massive role. The unique character of each community—from the yachting culture of Fort Lauderdale to the resort-style living in Jupiter—directly shapes demand and what people are willing to pay.

Comparing Broward and Palm Beach Counties

When you dig into the numbers, the differences between Broward County's urban density and Palm Beach County's more sprawling luxury communities become crystal clear. Both have their high-value pockets, but the reasons for those values can be worlds apart.

- Fort Lauderdale (Broward): Look at zip codes like 33301, which covers downtown and the iconic Las Olas Boulevard. Here, prices are driven by the demand for a walkable, urban lifestyle in high-rise condos. Then you have 33308, which offers a different appeal with its mix of waterfront homes and established neighborhoods for those wanting a coastal vibe that's still close to the action.

- Palm Beach County: Head north, and the definition of luxury shifts. In places like West Palm Beach and Jupiter, it's less about the urban core and more about proximity to world-class golf, sprawling equestrian estates, and untouched beaches. This is what attracts a truly global clientele.

Think about it this way: a sleek high-rise condo in downtown Fort Lauderdale's 33301 zip might fetch $750 per square foot thanks to its city views and walkability. A single-family home of the exact same size in a top-rated Jupiter school district could be closer to $550 per square foot, showing the premium buyers place on different lifestyle amenities.

Global Context for Local Prices

These local price shifts are really a small-scale version of what happens worldwide. Across the globe, residential property values vary wildly based on local economies and infrastructure. You have cities like Tel Aviv and Luxembourg posting some of the highest prices on the planet, while parts of Eastern Europe are experiencing rapid growth fueled by new development.

These global statistics underscore just how much real estate values can swing from one zip code to the next, right here in our backyard. If you’re curious about how international trends shape property markets, the latest Property Index from Deloitte is a great resource.

How to Use Price Per Square Foot Data to Your Advantage

So, what do you do with all this data? Understanding the average price per square foot by zip code isn't just for market analysts; it’s one of the most practical tools you can have when navigating the real estate world. Whether you're looking to buy, sell, rent, or invest, this single metric cuts through the noise and gives you a clear benchmark for value.

For homebuyers, especially, this data is your secret weapon for finding a good deal. It lets you look past the shiny listing photos and the asking price to compare different homes on an apples-to-apples basis. If you know the neighborhood average is $450 per square foot, you can immediately tell if that house you’re eyeing is a bargain or priced way above the local norm.

Strategies for Buyers, Sellers, and Investors

How you use this information really depends on your role in the market. Each player has a different goal, but the price per square foot data is valuable for everyone.

-

For Buyers: This is how you formulate a smart offer. Let's say you're looking at a 2,000-square-foot home in a Boca zip code where the average is $500/sqft. Right away, you know a fair market value is likely around $1,000,000, which gives you a solid starting point for negotiations.

-

For Sellers: It helps you price your home correctly from the get-go. Setting the right price is crucial. Knowing the local average prevents you from overpricing (and having your listing sit for months) or underpricing (and leaving serious money behind).

-

For Investors: This is how you spot opportunity. You can identify zip codes where the price per square foot is on the rise. An area with increasing values, combined with other strong market fundamentals, could be the perfect place for your next rental property or flip.

-

For Renters: It helps you judge if a rental rate is fair. While rent and sale prices aren't the same, they're closely linked. If property values are high in an area, you can expect rents to be, too. This gives you context for whether that monthly rent payment is reasonable.

Of course, local trends don't exist in a vacuum. Broader economic factors play a huge role, so it’s always wise to consider things like the impact of interest rates on real estate markets. This bigger picture gives your local analysis much-needed context.

You can see the power of this metric on a global scale, too. The massive price differences from one city to another show why drilling down to the zip code level is so essential for getting an accurate picture of the market. Urban hubs with booming economies often have zip codes with prices that are many times higher than the national average. For a broader perspective, you can check out the global property investment rankings on Numbeo.com.

Common Questions About Boca Raton Real Estate Data

When you're diving into the Boca Raton real estate market, data can feel overwhelming. But understanding a few key metrics is what separates a smart decision from a shot in the dark. Let's break down some of the most common questions people have when looking at the average price per square foot by zip code.

Isn't Median Home Price Good Enough? Why Focus on Price Per Square Foot?

This is a great question. While median price gives you a general feel for a neighborhood, price per square foot is where you get the real, actionable intelligence. It creates a level playing field for comparing properties.

Think about it this way: a $1 million sale price could represent a sleek 1,500 sqft downtown condo or a sprawling 3,500 sqft family home out west. The total price is the same, but the value you're getting for the space is completely different. Price per square foot cuts through that noise, giving you a true "apples-to-apples" way to see what you're paying for in a given area.

What Can Throw Off the Average Price Per Square Foot in a Zip Code?

Averages can be tricky, and a few things can definitely skew the numbers in any given month. A handful of sales of ultra-luxury waterfront estates or newly built penthouses can drag the average way up. On the flip side, a sudden wave of smaller, older condo sales can pull it down.

Here are the big variables to watch out for:

- Property Condition: A beautifully renovated home will always fetch a higher price per square foot than a fixer-upper next door.

- Unique Features: Things like swimming pools, premium finishes, or unusually large lots aren't captured in the raw square footage number but add significant value.

- The Mix of Sales: If one month sees mostly condo sales and the next is dominated by single-family homes, the average will naturally shift, even if underlying values haven't changed much.

That’s why you should always treat price per square foot as your starting point, not your final answer. It gives you a baseline, but the specific details of a property are what really seal the deal on its true value.

How Much Does a Home's Condition Really Impact its Price Per Square Foot?

Massively. This is one of the most significant factors that causes price swings within the same zip code. A home with a brand-new kitchen, stylishly updated bathrooms, and modern flooring will command a much higher price per square foot than a home of the exact same size that's stuck in the 1980s.

When you're looking at a specific house or condo, you have to mentally adjust its potential value based on its condition compared to the area's average. This is absolutely critical whether you're a buyer trying to make a competitive offer or a seller figuring out the right listing price.

At Cynthia Gardens, our goal is to offer clear, straightforward value right in the heart of Boca Raton. If you're searching for a comfortable and well-priced apartment in a fantastic location, we invite you to explore our available one-bedroom floor plans today.