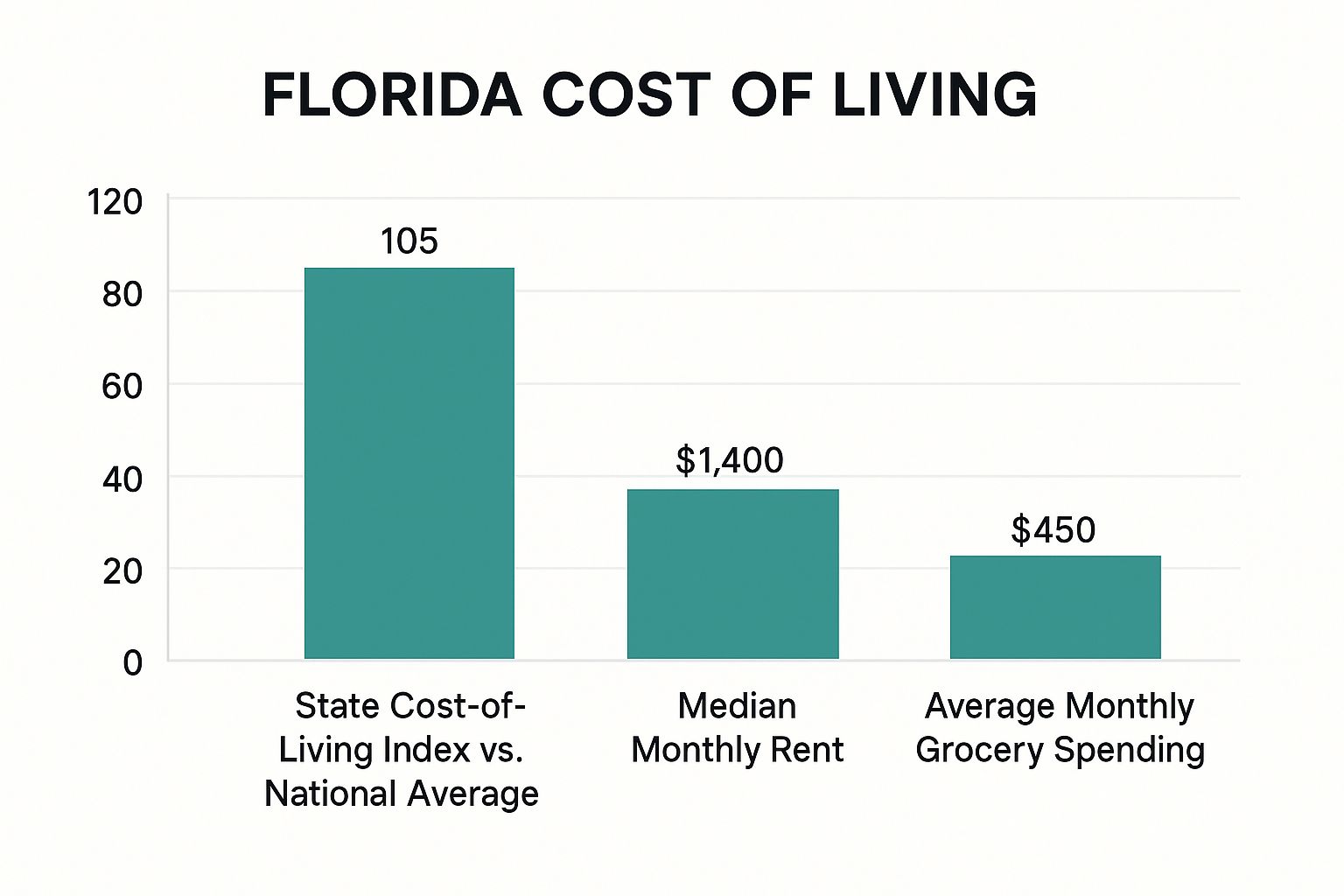

On the whole, the cost of living in Florida lands about 2% higher than the national average. It's a bit more expensive than many states, but don't let that number fool you—it’s still far more affordable than living in coastal hotspots like California or New York.

The main culprits driving up the cost? Housing and transportation. These two categories often pack a bigger punch to your wallet than everyday expenses.

What Does It Really Cost to Live in Florida?

Figuring out your budget for a move to the Sunshine State can feel like a bit of a balancing act. On one hand, you have fantastic perks like no state income tax, which leaves more money in your pocket. On the other, you're facing high insurance premiums and rent prices that seem to be constantly on the rise.

Ultimately, your personal budget will boil down to where you decide to plant your roots. The cost of living varies wildly from a quiet town in the Panhandle to the non-stop energy of a city like Miami.

To get a clearer picture, let's look at the numbers. Florida’s cost of living index is 102. Think of the national average as a baseline of 100; this means living in Florida is just 2% more expensive overall. This ranks it as the 33rd most expensive state—a far cry from Hawaii (182.3) or California (141.6). You can dig deeper into the data and see how Florida's expenses compare to other states.

A Snapshot of Monthly Expenses

So, how do those index numbers translate into real dollars and cents? Let's break down what a typical monthly budget might look like for both a single person and a family of four.

Estimated Monthly Living Expenses in Florida

Here’s a summary table that gives a realistic starting point for your financial planning, whether you're moving solo or with your family in tow.

| Expense Category | Average Monthly Cost (Single Person) | Average Monthly Cost (Family of Four) |

|---|---|---|

| Housing (Rent/Mortgage) | $1,750 | $2,500 |

| Utilities (Electric, Water, Internet) | $250 | $400 |

| Groceries | $375 | $1,100 |

| Transportation (Car, Gas, Insurance) | $550 | $1,050 |

| Healthcare | $450 | $1,400 |

| Total Estimated Monthly Cost | $3,375 | $6,450 |

Of course, these numbers are just estimates. Your actual spending will shift based on your lifestyle, location, and financial habits, but this gives you a solid baseline to work from.

As you can see, while Florida's overall cost is only slightly elevated, the housing market is what really tips the scales. Now, let’s take a closer look at each of these spending categories.

Navigating Florida’s Competitive Housing Market

For anyone thinking about moving to the Sunshine State, let's get straight to the point: housing is going to be your biggest expense. The cost of living in Florida is almost entirely driven by its wild and often unforgiving real estate market. The first step to finding a place you can actually afford is to get a handle on what you're up against.

Florida's population has been exploding for years, with a constant stream of new residents showing up every day. This flood of people creates a huge demand for a limited number of homes, especially in the popular coastal cities and metro areas. It’s a classic supply-and-demand problem, and it keeps pushing prices up for both renters and buyers.

This isn't a new development. The rental market, especially, has been on a relentless upward climb for the last decade. Back in 2010, the average rent for a one-bedroom apartment in Florida was about $900. Today, you're looking at closer to $1,291—that’s a jump of nearly 43%. And with experts predicting that number could hit $1,350 by the end of the year, the squeeze on renters is only getting tighter.

The Great Divide: Rent Prices Across Florida Cities

When it comes to housing costs, location is everything. Your monthly rent can swing by hundreds, even thousands, of dollars depending on the city you pick. Think of it like buying concert tickets: a front-row seat in Miami is going to cost a whole lot more than a spot in the back row in a smaller town like Tallahassee.

The big-name cities with hot job markets and tons of things to do are where you'll find the steepest prices.

- Miami: This is often the most expensive spot in the state. A one-bedroom apartment here can easily run you over $2,500 a month. You're paying a premium for those world-class beaches, the nightlife, and its status as an international business hub.

- Tampa: Over on the Gulf Coast, Tampa has more of a balanced urban-suburban vibe. Rent is a bit more reasonable than in Miami, usually somewhere between $1,600 and $1,900 for a one-bedroom, but its growing popularity means competition is fierce.

- Orlando: As a global tourism powerhouse with a budding tech scene, Orlando’s rental market is incredibly competitive. You should expect to pay between $1,500 and $1,800 for a one-bedroom, especially if you want to be near downtown or major employers.

Navigating a hot rental market like Florida's means you have to be prepared and ready to move fast. Having your documents in order, understanding what you're signing in a lease, and knowing your rights can make all the difference in snagging a great place without breaking the bank.

If you're working with a tighter budget, looking at cities like Jacksonville or Tallahassee could save you a lot of cash. One-bedroom rents there often stay below the $1,400 mark. Finding the right apartment is more than just scrolling through listings; our guide on navigating the rental market can help you secure an apartment lease near you is packed with practical tips.

The Homeownership Challenge

Thinking about buying instead? The picture is just as competitive. Florida’s median home price is almost always higher than the national average, which puts homeownership out of reach for a lot of first-time buyers. Right now, the median home price in Florida is sitting around $410,000, while the national median is closer to $395,000.

So, what's behind these high prices? It's a mix of a few key factors:

- Population Growth: More people moving in means more buyers fighting over the same houses.

- Limited Inventory: In the most desirable coastal and city areas, there just aren't enough homes for sale to keep up with demand.

- Land and Construction Costs: The price of land and building materials has shot up, making new construction more expensive, which naturally pulls up the prices of existing homes too.

This all cooks up a strong seller's market in many parts of the state. But it's crucial to remember that these are just statewide averages. In ritzy communities like Parkland or Naples, median home prices can easily soar past $1 million. On the flip side, you can find homes well below the state median if you look more inland or in rural areas.

In the end, whether you decide to rent or buy, your housing costs will be the foundation of your entire Florida budget. The key is to do your homework on specific neighborhoods, get a feel for the local market trends, and be ready to pounce when you find the right place.

Your Guide to Everyday Expenses

Once you've sorted out the big check you write for rent or a mortgage, it's the day-to-day costs that really define your budget and the true cost of living in Florida. These are the expenses that pop up week after week—things like utilities, groceries, and healthcare. Getting a handle on these is the secret to building a budget that actually works.

Think of your housing payment as the cover charge. Now, let’s get into what it really costs to keep your life running smoothly in the Sunshine State.

Keeping the Lights and AC On

Let's be honest: in Florida, your utility bill is mostly a story about your air conditioner. The state's legendary heat and humidity mean your A/C will be putting in some serious work for most of the year. For almost everyone, that’s the single biggest piece of the electricity bill.

On average, a single person can plan on spending around $250 per month for all the essentials—electricity, water, internet, and trash pickup. For a family of four in a bigger house, that number can easily hit $400 or more, especially during those brutal summer months from June to September.

Here’s a rough idea of how that usually breaks down:

- Electricity: This is the big one, often landing between $120 to $200+ depending on how much you crank the A/C and the size of your home.

- Water & Sewer: This cost is usually more predictable, typically hovering between $60 and $90 a month.

- Internet & Cable: Prices are all over the place depending on the provider, but a decent connection will generally set you back $70 to $120.

Your Weekly Grocery Bill

Groceries are another huge slice of the monthly budget pie. While Florida's food prices are pretty close to the national average, what you actually spend comes down to your personal shopping style and even your zip code. Someone living in an upscale neighborhood like Parkland is going to have a different grocery bill than a family in a more down-to-earth town.

A single person should probably budget around $375 per month for food, which works out to just under $95 a week. For a family of four, you're looking at a much bigger number—closer to $1,100 per month, or about $275 weekly. These estimates assume you're mostly cooking at home with a few meals out.

Being a savvy shopper really pays off here. True Floridians know the drill: hunt down the BOGO (Buy One, Get One) deals at Publix, make regular trips to discount spots like Aldi, and hit up local farmers' markets for fresh produce. These are the classic ways to keep your food costs from getting out of hand.

Navigating Healthcare Expenses

Here's a bit of good news: healthcare is one area where Floridians sometimes get a slight financial break. Overall, healthcare costs in the state trend a little lower than the national average. That includes everything from health insurance premiums and co-pays for doctor visits to prescription drugs.

Still, "lower" doesn't mean "cheap." These costs are still a major budget item. An average individual might see around $450 per month go toward health insurance and out-of-pocket medical bills. For a family of four, that figure can easily jump past $1,400 per month, all depending on the quality of the insurance plan.

And don't forget about the other "must-have" insurance down here. In many parts of Florida, hurricane and flood insurance aren't optional for homeowners. While it's not a medical expense, it’s a critical cost for protecting your biggest investment and is part of the complete financial picture of living safely in the state.

The Real Cost of Getting Around Florida

Transportation is one of those expenses that can really sneak up on you when you're figuring out the cost of living in Florida. You might be picturing savings on your heating bill, but getting from point A to point B often ends up costing more than the national average. It's a surprising reality for many newcomers to the Sunshine State.

So, why is that? A lot of it comes down to how the state is built. Florida's cities and suburbs are famously sprawling and designed almost entirely around the automobile. This isn't like a dense, walkable city up north where a car is a nice-to-have. Here, it’s pretty much essential for everything from your daily commute to a simple grocery run. That heavy reliance on driving means you're spending more on gas, maintenance, and insurance right out of the gate.

The Double Impact of Gas and Insurance

Two things really drive up Florida's transportation costs: the price at the pump and car insurance premiums. While gas prices bounce around, they often sit right at or even above the national average. When you pair that with the long commute times common in places like Orlando or Tampa, your monthly fuel budget can get out of hand fast.

But the real budget-buster? That’s car insurance. Florida consistently lands on the list of the most expensive states for auto coverage. A few things are at play here, including a high rate of accidents, widespread insurance fraud, and the constant threat of severe weather like hurricanes, which drives up repair costs and premiums for everybody.

Expect to pay significantly more for car insurance than you might in other states. It’s not uncommon for annual premiums to be 20-40% higher than the national average, making it a critical line item to research when building your Florida budget.

Breaking Down Your Monthly Transportation Budget

Okay, so what does this all mean in real dollars? A single person should probably budget around $550 per month for transportation. A family with a couple of cars could easily see that number climb over $1,050. That estimate covers your car payment, gas, insurance, and routine upkeep.

Here’s a closer look at what a typical driver is up against:

- Car Insurance: Florida's no-fault system and high claim rates mean you're going to pay a premium. Your rates can swing wildly depending on your driving record and where you live—it’s a lot different in a high-traffic city like Miami versus a quiet town.

- Fuel Costs: Since long commutes are the norm, expect gas to be a hefty part of your budget. And don't forget the tolls! Using roads like the Florida Turnpike will get you there faster, but it adds another recurring expense.

- Maintenance and Repairs: The intense heat and humidity are tough on cars. This can lead to more frequent service for things like batteries, tires, and especially your A/C system.

Can You Rely on Public Transit?

While having a car is almost a given in most of the state, you do have some public transit options in the larger metro areas. Cities like Miami and Orlando have bus systems, trolleys, and some rail services that can help take the edge off the high cost of car ownership, at least for a daily commute.

Just know that these systems aren't nearly as comprehensive as what you’d find in other major U.S. cities. For most people, especially anyone living in the suburbs, public transit just isn't a practical replacement for a personal car. It's better to think of it as a helpful supplement, not your primary way of getting around. Ultimately, your lifestyle and exact location will decide if you can realistically go car-free to save some cash.

How Much Income You Need to Live Comfortably

So, we've broken down the individual costs of things like rent, utilities, and getting around. But the real question is, what's the grand total? Knowing the average rent in Tampa helps, but the number you really need is the annual salary that lets you thrive, not just survive, in the Sunshine State.

First, let's get on the same page about what "comfortable" actually means. It's not just about scraping by to pay the bills. Living comfortably means you can cover all your necessities, have money left over for fun stuff like hobbies or a vacation, and still sock away a decent amount for savings and investments. It’s about feeling financially secure, not living paycheck to paycheck.

The Magic Number for Florida Living

Alright, so what’s the magic number? A recent analysis gives us a pretty clear benchmark for the cost of living in Florida. According to the report, a single adult needs to pull in an annual income of about $97,386 to live a comfortable life here.

For a family of four, that number skyrockets to roughly $217,651 a year. These figures aren't just pulled out of thin air; they're calculated to cover all your essentials, some fun money, and a healthy savings goal. You can learn more about the findings in this Florida housing report to see exactly how they crunched the numbers.

If those income levels seem a bit steep, you're not wrong. They really shine a light on the growing gap between what people earn and what it actually costs to maintain a stable, enjoyable lifestyle in many parts of Florida.

Applying the 50/30/20 Budget Rule

A great way to see how this plays out in the real world is with the classic 50/30/20 rule. It’s a simple but powerful framework for managing your after-tax income.

- 50% for Needs: This is the biggest chunk of your budget. It covers the absolute must-haves: housing, utilities, groceries, transportation, and healthcare.

- 30% for Wants: This is your lifestyle fund. Think dining out, grabbing concert tickets, weekend trips, and hobbies that keep you sane.

- 20% for Savings and Debt Repayment: This is where you build your future. It's for your emergency fund, retirement accounts, investments, and paying down high-interest debt.

Let's apply this to that "comfortable" income of $97,386 for a single person. After taxes, their take-home pay might be somewhere around $73,000.

- Needs (50%): That's $36,500 per year, or about $3,042 each month.

- Wants (30%): This gives them $21,900 per year, or $1,825 per month for fun.

- Savings (20%): They can put away $14,600 a year, which is a solid $1,217 per month.

This kind of budget sets you up for a strong financial future, but hitting these numbers takes discipline. If you're looking at your own budget and it feels a lot tighter, exploring affordable financial services can give you some expert guidance on making your money work smarter for you.

The Reality Check Against Median Income

Now, for the reality check. How do these "comfortable" income figures stack up against what the average person in Florida actually makes? This is where you can really see the financial squeeze many people are feeling. The median household income in Florida is currently around $71,700.

This stark contrast is central to understanding the affordability challenge in Florida. The income needed to live comfortably is significantly higher than what more than half of the state's households are earning.

The table below really drives this point home. It clearly shows the gap between the income needed for a comfortable life and the financial reality for many Floridians.

Income Needed for Comfortable Living vs Median Income

| Household Size | Annual Income for Comfortable Living | Median Household Income |

|---|---|---|

| Single Adult | $97,386 | (Varies, often lower than household median) |

| Family of Four | $217,651 | $71,700 |

This data is pretty eye-opening. For a family of four to live comfortably, they'd need to earn about three times the state's median household income. It's a tough reality that forces many families to make hard choices, often sacrificing savings or "wants" just to keep up with the rising cost of essentials. This is exactly why smart budgeting and financial planning are no longer optional—they're essential for making life in the Sunshine State work.

Making Florida More Affordable

Knowing that Florida's cost of living can be high is one thing, but figuring out how to actually manage it is a whole different ballgame. The good news? With a few smart strategies, you can really cut down your monthly bills and make life in the Sunshine State a lot more comfortable. This isn't about pinching every last penny; it's about making targeted changes to the biggest parts of your budget.

Your game plan for a cheaper Florida lifestyle really starts with where you decide to live. Sure, major hubs like Miami have rents that will make your jaw drop, but just looking at neighborhoods outside the city center or in more suburban spots can save you hundreds every single month. Cities like Jacksonville and Tallahassee, for example, are often a much more budget-friendly starting point for both renters and home buyers.

Strategic Savings on Major Expenses

Once you’ve got your housing sorted, the next biggest chances to save come from transportation and your day-to-day spending. A few tweaks here can free up a surprising amount of cash.

- Tackle Transportation Costs: A car is pretty much a necessity here, so the trick is to make it as efficient as possible. Think about a fuel-efficient model if you have a long commute, and definitely shop around for car insurance. Florida’s insurance market is super competitive, so quotes can be all over the map.

- Master the Grocery Game: Floridians are pros at saving on groceries. You have to embrace the weekly BOGO (Buy One, Get One) deals at stores like Publix. Then, fill in the gaps with trips to discount chains like Aldi for your basic pantry staples.

- Lean into Free Entertainment: Honestly, some of the best things about Florida don't cost a dime. Instead of expensive nights out, take full advantage of the state’s amazing beaches, huge network of state parks, and all the local community events like farmers' markets and outdoor concerts.

The real secret to making Florida affordable is to focus your energy where it makes the biggest difference. A smart choice on your apartment's location or a better grocery strategy will save you way more than skipping your morning coffee ever will.

Finding Your Affordable Niche

If you're looking for specific community ideas, places like Boca Raton offer a unique blend of lifestyle and value. While it has a reputation for being pricey, the city has hidden gems for renters who know where to look.

You can check out this complete guide to affordable housing options in Boca Raton to see how you can make even a more upscale zip code work for your budget. It all comes down to being intentional with your choices—from the neighborhood you pick to how you spend your weekends—to build a great financial life here in the Sunshine State.

Answering Your Florida Cost of Living Questions

Alright, you've done the research and crunched some numbers on Florida's living costs. But there are probably a few lingering questions bouncing around in your head. Getting those sorted is often the final piece of the puzzle before you can confidently decide if the Sunshine State is the right move for you.

Let's tackle some of the most common questions people ask.

Is Florida Really Cheaper Than California or New York?

Absolutely. While Florida isn't the cheapest state in the country, it's a world apart from the eye-watering expenses of places like California and New York. Your dollar simply stretches much, much further here.

The biggest relief you'll feel is in housing. It’s not uncommon to see median home prices in California climb past $750,000. In Florida, that number is closer to $410,000. That huge gap makes everything from renting an apartment to buying a first home feel far more attainable.

Where Are the Most Affordable Spots in Florida?

Florida is a huge state, and costs can swing wildly from one city to the next. While you'll hear all about the high price tags in Miami or Naples, there are plenty of places where you can live comfortably on a modest budget. Generally, you'll find the best deals inland and up north.

If you're hunting for value, start your search in these areas:

- The Panhandle: Look at cities like Pensacola or the state capital, Tallahassee. You'll find lower housing costs and a totally different, more Southern vibe.

- North Central Florida: Check out the areas around Gainesville (a college town) and Ocala (horse country). Life is a bit slower here, and the real estate is significantly cheaper than in South Florida.

- The Space Coast: Places like Melbourne or Palm Bay are growing but still offer a great quality of life without the Orlando or Miami price tags.

Looking beyond the major tourist hubs is the key to unlocking a more affordable Florida lifestyle.

One of the biggest financial wins of moving to Florida is the tax situation. Having no state income tax feels like an instant pay raise, putting more money directly into your pocket.

Wait, Is There Really No State Income Tax?

That’s right! Florida is one of the handful of states that does not levy a state income tax. This is a massive draw for everyone, from recent grads starting their careers to retirees looking to protect their nest eggs.

It means more of your hard-earned money stays with you. This tax break often helps balance out other costs that can be higher in Florida, like property taxes or the notoriously expensive homeowners' insurance. For most people, the savings from not paying state income tax make a real, tangible difference in their monthly budget.

Ready to find your own affordable piece of the Sunshine State? At Cynthia Gardens, we specialize in serene, comfortable, and budget-friendly one-bedroom apartments right in Boca Raton—perfect for students and young professionals. See how you can get the best of Florida living without stretching your finances.

Take a look at our available units at Cynthia Gardens Apartments.