When you're mapping out your apartment budget, the rent is just the starting point. The real monthly cost of living comes into focus when you add in utilities.

Across the United States, the average monthly utility bill for an apartment is now around $444. What's surprising is that this figure has jumped by 20% in only four years. This all-in number typically bundles together the essentials: electricity, gas, water, internet, and trash pickup.

Understanding Your Total Utility Expenses

Signing a lease secures your space, but it's the recurring utility bills that truly shape your monthly budget. Think of your rent as the fixed price of admission; utilities are the variable costs that depend on how you live. Getting a handle on these expenses before you move in is the best way to avoid sticker shock down the road.

This recent surge in utility costs isn't random. It’s a direct result of shifts in energy prices, the need for infrastructure updates, and our ever-growing reliance on high-speed internet. If you want to dive deeper into the numbers, ResidentShield.com offers a great breakdown of how these costs have evolved for renters.

What's Included in a Typical Utility Bill?

So, what exactly are you paying for each month? While the specifics can change from one apartment community to the next, the core services are almost always the same. These are the non-negotiables that keep your home running, comfortable, and connected.

Here’s a look at what you can expect to find on your monthly statements:

- Electricity: This is the big one. It powers everything from your lights and air conditioning to your laptop and TV. It will likely be your largest utility expense.

- Natural Gas: If your apartment has it, gas typically fuels the furnace, water heater, and sometimes the stove. You’ll see this bill spike during the colder months.

- Water and Sewer: This covers all the water you use for showering, washing dishes, and laundry, plus the cost of treating the wastewater.

- Trash and Recycling: This small but necessary fee pays for garbage collection. Sometimes, landlords roll this cost directly into the rent, but not always.

- Internet and Cable: In today's world, this is a must-have. It's your connection for everything from remote work and online classes to streaming your favorite shows.

To give you a clearer picture, here is a quick summary of what goes into that monthly utility figure.

Quick Breakdown of Average Monthly Apartment Utilities

This table provides a snapshot of the common utilities for a one-bedroom apartment, their typical cost ranges across the U.S., and the main things that can make those costs go up or down.

| Utility Service | Estimated Monthly Cost Range (U.S. Average) | Key Influencing Factors |

|---|---|---|

| Electricity | $70 – $150+ | Apartment size, season (A/C use), appliance efficiency, personal habits |

| Natural Gas | $30 – $100+ | Climate, season (heating use), insulation quality, water heater type |

| Water & Sewer | $30 – $60 | Number of occupants, personal usage (laundry, showers), landlord billing method |

| Trash & Recycling | $15 – $30 | Local city rates, whether the cost is bundled with rent or billed separately |

| Internet & Cable | $60 – $120+ | Provider, internet speed, channel package, promotional deals |

Keep in mind these are just averages. Your actual costs will hinge on where you live, the size of your apartment, and your own personal habits.

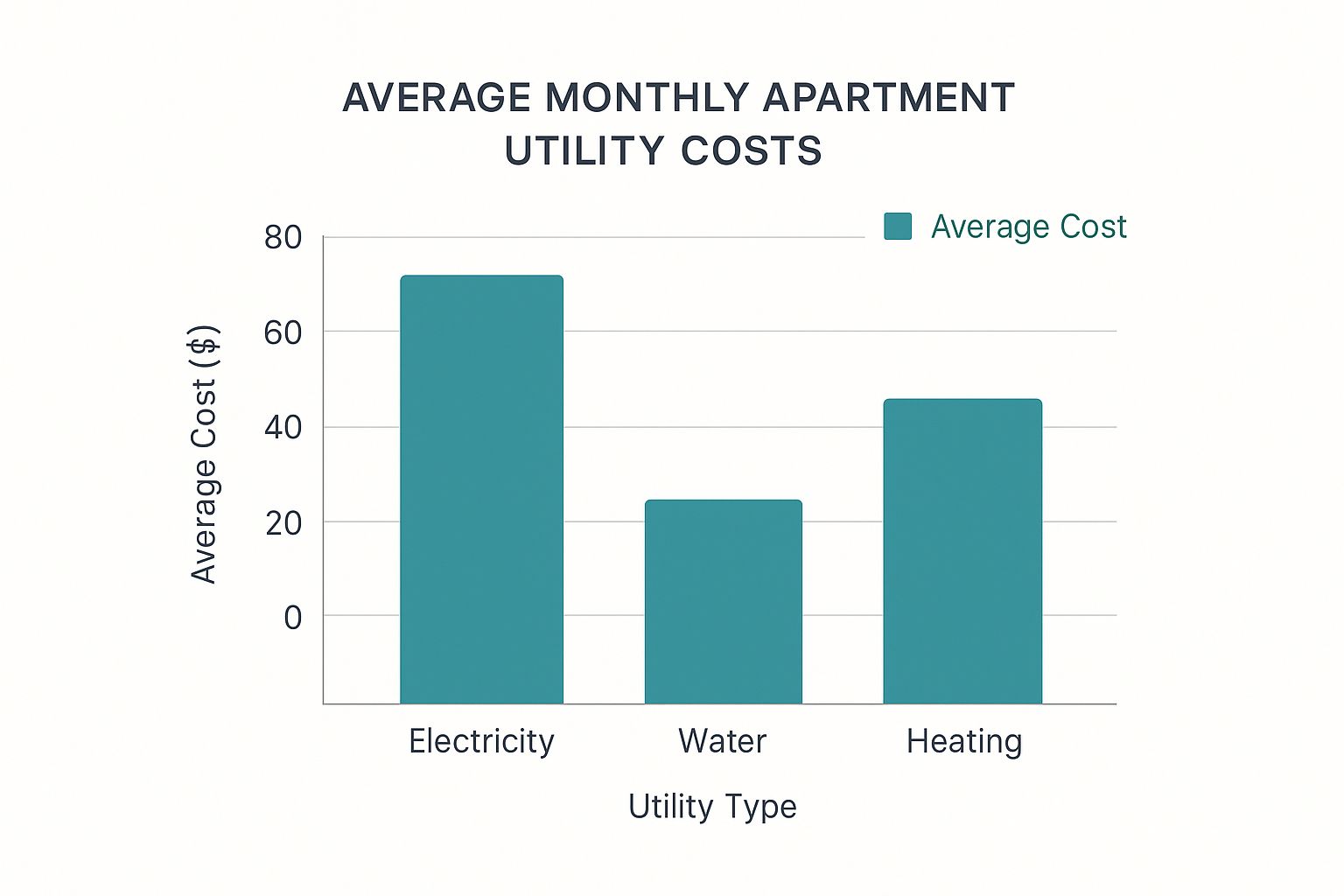

This chart really drives home how the "big three"—electricity, water, and heating—stack up against each other on a monthly basis.

As you can see, electricity and heating are the heavy hitters. They have the most potential to fluctuate, which also means they're the best places to look if you want to find some savings.

Making Sense of Your Monthly Utility Bills

Getting that first stack of utility bills can feel a little overwhelming. It's like trying to read a new language filled with terms like kWh, therms, and delivery charges. But once you know what you're looking at, you'll have a much better handle on where your money is going each month.

Think of your total utility cost as a pie. Each slice—electricity, water, gas, and so on—is a different service that keeps your apartment comfortable and running. They're all billed separately and measured in their own unique ways.

Let's pull back the curtain on each one so you can read those statements like a pro.

What's in Your Electricity Bill?

For most renters, electricity is the biggest and most unpredictable utility expense. The core of your bill is based on your usage, which is measured in kilowatt-hours (kWh). It’s just a fancy term for how much electricity you've used over the month.

When you look closely at the bill, you’ll see it’s more than just one number. It’s usually split into a few key parts:

- Supply Charges: This is the cost of the actual electricity you consumed.

- Delivery Charges: Think of this as the shipping and handling fee for getting that power from the grid to your outlet.

- Taxes and Fees: These are standard local and state charges tacked onto your bill.

So, what’s using all that power? Your air conditioning and heating system is almost always the main culprit. In fact, your HVAC system can be responsible for nearly 40% of your home's total energy use. That's why your bill will skyrocket during a hot Boca Raton summer compared to a mild winter day.

Understanding Natural Gas Costs

If your apartment has natural gas appliances—like a furnace, water heater, or stove—you'll get a separate bill for that. Gas is typically measured in therms, which is simply a unit of heat energy.

Your gas bill is extremely sensitive to the weather. A sudden cold front means your furnace will be working around the clock, causing your usage (and your bill) to jump. The age and efficiency of your appliances also make a big difference. An older, less efficient water heater has to burn more gas to do its job.

Pro Tip: Your electricity and gas bills are directly linked to your daily habits and the weather. Just adjusting your thermostat by a few degrees can make a real difference in your monthly costs.

What Your Water and Sewer Bill Really Covers

At first glance, your water bill seems simple. You pay for the water you use for showering, washing dishes, and doing laundry, which is measured in gallons. But there's often a hidden component people miss.

You're actually paying for two things:

- The clean water coming into your apartment.

- The wastewater that goes down the drain (this is the sewer charge).

The sewer fee covers the massive cost of treating that water so it can be safely returned to the environment. That's why you'll often see two distinct charges on a single bill—it's for water coming in and water going out.

Budgeting for Internet, Cable, and Streaming

Let's face it: in any modern apartment, internet isn't just a utility—it’s a lifeline. It’s how we work, relax, and connect with the world, making it a non-negotiable part of your monthly budget. But unlike your water bill, this is one expense where you have a surprising amount of control.

On average, you can expect your internet bill to land somewhere between $30 to $65 per month, though it can certainly go higher. The price really boils down to your provider and the speed you select. Think of it like a highway: if you just need to check emails and browse a few websites, a two-lane road is fine. But if you have multiple people working from home, gaming, and streaming 4K movies, you're going to need a superhighway to avoid traffic jams.

Choosing Your Connection and Entertainment

Before you jump on the first promotional bundle you see, take a moment to think about what you actually use. Service providers are masters at packaging internet, cable TV, and phone lines into what looks like a great deal. While it’s convenient, it’s not always the smartest way to spend your money, especially now that streaming is king.

The whole "cord-cutting" movement isn't just a fad; it's a real shift in how we watch our favorite shows. Many renters have discovered that a solid internet plan plus one or two streaming subscriptions costs way less than a traditional cable package.

The key is to balance your desire for entertainment with your budget. Paying for 200 cable channels you never watch is a common financial drain that's easy to plug.

Smart Ways to Structure Your Digital Bills

To keep from overspending, you need a game plan. First, figure out the right internet speed for your lifestyle. Then, you can decide which entertainment options to layer on top.

-

Internet-Only Plans: If you get your entertainment fix from services like Netflix, Hulu, or YouTube TV, an internet-only plan is almost always the way to go. Put your money toward a fast, reliable connection that won't leave you buffering.

-

Streaming Subscription Audit: Take a minute to add up what you're spending on all your subscriptions. Do you have services you haven't used in months? Try rotating them—subscribe to one for a few months to binge a show, then cancel it and pick up another.

-

Negotiate and Shop Around: Don't be shy about looking for new-customer deals or calling your current provider to ask if they can do better. Your loyalty won't always get you the best price, so making a habit of comparing offers once a year is a financially savvy move.

How Location and Apartment Size Affect Your Bills

Ever been shocked to hear a friend in another state pays half what you do for electricity? It happens all the time. When it comes to the utility costs for apartments, where you live and how much space you're working with are two of the biggest players in the game. You can't change these factors, but understanding how they work is the first step to building a realistic budget.

Think of it like a car's fuel efficiency. The local climate is the terrain you're driving on, and your apartment's size is the weight of the car. A hot, humid climate like ours in South Florida forces your A/C to work overtime, guzzling electricity just like a car burns more gas going uphill.

This geographic lottery goes beyond just the weather, too. Every state and city has its own energy regulations, local taxes, and power sources. A town that gets most of its power from a hydroelectric dam will likely have cheaper electricity than one that relies on natural gas, which can create huge price differences even between neighboring cities.

Geography: The Ultimate Cost Driver

Your location shapes a lot more than just your rent. The real cost of living is tied directly to regional utility systems and climate. A renter in a mild city like San Diego might barely touch their thermostat, while someone in Phoenix is bracing for a massive A/C-driven spike in their summer power bills.

This isn't just a U.S. thing, either. Around the world, utility costs are all over the map. The monthly bill for basic utilities can be as low as $31.49 in some places or skyrocket to $140.18 in others. In some cases, utilities eat up nearly 18% of the average local salary. You can discover more insights about these global utility costs and see just how much location matters.

This is why local context is so important. A national average provides a helpful baseline, but your actual utility costs will always be a reflection of your specific city and its unique circumstances.

This is especially critical for students and professionals zeroing in on a particular area. For instance, knowing the typical utility burden is a huge part of budgeting for anyone looking at apartments in Boca Raton near FAU, where summer cooling costs are a real financial factor.

How Square Footage Scales Your Expenses

The other big variable is the size of your apartment. It's a pretty straightforward relationship: the more square footage you have, the more air you have to heat or cool. This makes your HVAC system the undisputed heavyweight champion of energy consumption in your home.

Here’s a simple way to picture it: heating a small studio is like boiling a kettle of water. Heating a spacious two-bedroom apartment is like trying to bring a full bathtub to a boil with that same kettle. It’s going to take a whole lot more energy.

- Studio Apartment: With minimal space, studios are the easiest on the wallet. Electricity bills often land somewhere between $50–$80.

- One-Bedroom Apartment: As the most common rental size, expect a moderate jump. Electricity bills typically fall in the $60–$100 range.

- Two-Bedroom Apartment: That extra room and open space add up. Electricity for a two-bedroom can easily run from $100–$150 per month.

And it’s not just about climate control. A larger apartment usually means more light fixtures, more outlets for electronics, and maybe even more people living there—all of which contribute to higher consumption and a bigger bill at the end of the month.

Practical Ways to Lower Your Utility Costs

Alright, now that you know what goes into your utility bills, let's talk about how to shrink them. Taking control of your monthly utility costs for apartments isn’t about making huge sacrifices. It’s really about being a little smarter with how you use things day-to-day.

Think of it this way: you wouldn't leave a twenty-dollar bill on the sidewalk, but that's essentially what happens when you let energy and water go to waste. Small, consistent tweaks to your habits can add up to some serious savings over the life of your lease.

No-Cost Habit Changes

These are the easy wins—the simple adjustments you can start making today without spending a single penny. The real magic here is consistency.

Your thermostat is ground zero for energy consumption. Just nudging it a few degrees can make a surprising difference. A good rule of thumb is to set it around 78°F in the summer when you're home and 68°F in the winter.

Here are a few more no-brainers:

- Pull the Plug: Devices like your TV, coffee maker, and game console are energy vampires. They suck power in "standby mode" even when they're turned off. Unplug them or, even better, use a power strip you can flip off completely.

- Let the Sun In: Open up those blinds during the day. Natural light is free, and in the cooler months, it can help warm your apartment without you touching the heat.

- Wash on Cold: This one's huge. About 90% of the energy your washing machine uses is just to heat the water. Switching to the cold cycle gets most clothes just as clean and costs you a fraction of the price.

Low-Cost Upgrades

If you’re willing to spend just a little bit upfront, you can unlock even bigger savings down the road. Most of these small investments pay for themselves pretty quickly through lower bills.

A classic example is swapping out old incandescent bulbs for LEDs. An LED bulb might cost a few bucks more at the store, but it uses up to 75% less energy and lasts 25 times longer. You save money on your electric bill and on buying new bulbs.

Shifting your mindset from using utilities to managing them is the most powerful change you can make. Every degree you adjust on the thermostat and every leaky faucet you fix is a direct deposit into your savings account.

Consider these other easy and affordable upgrades:

- Get a Low-Flow Showerhead: This simple fix can slash your shower's water use by 40% or more, and you probably won't even notice a difference in water pressure.

- Invest in Blackout Curtains: In a place as sunny as Boca Raton, good curtains are your best friend. They act as a barrier, blocking the sun's heat from baking your apartment in the summer and giving your A/C a much-needed break.

- Seal Up Leaks: Pick up some cheap weatherstripping or window film to seal drafts around windows and doors. This stops your precious air conditioning (or heat) from escaping outside.

These small fixes can make a big difference. In fact, things like energy-efficient windows are often among the top must-have amenities for apartments in Boca Raton because they translate directly to lower living costs for residents. By taking a few of these steps, you're putting yourself firmly in control of your budget.

Common Questions About Apartment Utilities

Let's be honest, even after you get a handle on the basics, the world of apartment utilities can throw some curveballs. You're not alone if you still have a few "what-if" scenarios running through your mind.

This is where we tackle those lingering questions head-on. Think of it as your final checklist for making sure there are no surprises, from figuring out if an "all-inclusive" deal is a trap to knowing exactly what to do when money gets tight.

Is It a Good Deal If Utilities Are Included in My Rent?

An apartment with "utilities included" sounds amazing on the surface, right? One single payment, no juggling due dates. But before you jump on it, you need to look a little closer, because it’s not always the bargain it seems.

Landlords who bundle utilities don't just give them away for free. They calculate an average usage for the unit and bake that cost right into a higher rent. If you're someone who's rarely home or super diligent about turning off lights and unplugging electronics, you could easily end up subsidizing your neighbors' habits. On the flip side, if you love cranking the AC, it might be a fantastic deal.

The only way to know for sure is to do the math. Ask the landlord exactly what’s included, then compare that total rent to a similar apartment where you'd pay for utilities yourself. It’s the only way to see which option truly saves you money based on your lifestyle.

How Can I Estimate Utility Costs Before Signing a Lease?

This is probably the single most important question you can ask before committing. Walking into a lease without a ballpark figure for utility costs for apartments in that specific building is a recipe for budget stress.

The best-case scenario? Ask the property manager if they can share the previous tenant's average monthly bills from the last year. This gives you a real-world baseline for that exact unit.

If they can't provide that, don't worry. You have another powerful tool:

- Call the Local Utility Companies: Just give them the apartment's address. More often than not, they can tell you the high, low, and average monthly costs for that unit over the past 12 months. A five-minute phone call can give you an incredibly accurate picture of what to expect.

What Should I Do If I Cannot Pay My Utility Bill?

Life happens, and facing a bill you can't pay is incredibly stressful. But the worst thing you can do is ignore it. If you know you're going to have trouble, the most powerful step you can take is to be proactive.

Get in touch with your utility provider before the due date. You’d be surprised how willing they are to work with you—it’s much better for them than shutting off your service. Most have programs specifically for customers going through a tough patch.

They might offer solutions like:

- Payment Plans: These let you spread the overdue balance over several months, making it much more manageable.

- Budget Billing: This averages your energy costs over the year, so you pay a predictable, stable amount each month instead of facing shocking spikes in the summer or winter.

- Assistance Programs: They can often connect you with local or federal aid, like the Low Income Home Energy Assistance Program (LIHEAP), designed to help people in your exact situation.

Honest communication is your best friend here. Of course, the best strategy is to find a home that fits your budget from the get-go. To help with that, check out our guide to affordable apartments in Boca Raton, where we break down some great options for renters keeping a close eye on their finances.

At Cynthia Gardens, we believe in making your life easier, starting with a comfortable and transparent living experience. Our serene Boca Raton community offers beautiful, spacious apartments ready to become your perfect home base. Explore our available floor plans today!