Alright, let's get right to it. When you're trying to rent an apartment, there's one number that landlords focus on more than any other: your credit score.

So, what’s the magic number? While it can vary, most landlords are looking for a credit score of 650 or higher. Think of this score as your financial report card—it gives a landlord a quick look at how you've handled your debts and bills in the past.

Understanding the Ideal Credit Score for Apartment Rental

For a landlord, your credit score is a key piece of the puzzle. It helps them predict whether you're likely to pay your rent on time, month after month. A high score tells them you have a solid track record of financial responsibility, making you a much safer bet as a tenant. In a hot rental market like Boca Raton, a strong score can make your application stand out from the crowd.

Now, don't panic if your score is below 650. It doesn't automatically disqualify you. It just means the landlord will probably dig a little deeper into your application. They'll pay closer attention to your income, job stability, and past rental history to get the full story.

How Landlords Interpret Different Score Ranges

To get a better sense of how you look on paper, it helps to understand what these numbers actually mean to a property manager. Each credit score range paints a different picture of your reliability as a renter.

A great credit score does more than just get your foot in the door. It can be a powerful negotiating tool, sometimes even helping you secure a lower security deposit.

Here’s a quick breakdown of how landlords typically view different credit scores. This will give you a good idea of where you stand before you even start filling out applications.

Credit Score Ranges and What They Signal to Landlords

This table summarizes how landlords might perceive your application based on your credit score, from "ideal tenant" to "higher risk."

| Credit Score Range | Risk Level | Typical Landlord Perception |

|---|---|---|

| 750 – 850 | Excellent | The ideal applicant. Landlords see you as extremely reliable and a very low risk for late payments. |

| 700 – 749 | Very Good | A strong candidate who is very likely to be approved quickly with few, if any, concerns. |

| 650 – 699 | Good | You're generally seen as a safe bet. This score meets the standard for most rental properties. |

| 600 – 649 | Fair | This is a borderline score. You might be asked for a higher security deposit or a cosigner to offset the perceived risk. |

| Below 600 | Poor | Considered a high-risk applicant. Approval is tough unless you have other very strong factors, like high income or a perfect rental history. |

Ultimately, landlords are just trying to find tenants who will pay on time and take care of the property. Your credit score is their first and fastest way to gauge that.

Why Landlords Really Check Your Credit History

Ever wondered what's really going through a landlord's mind when they ask to pull your credit? It’s not about judging your shopping habits or where you went on vacation. It's about risk.

From their point of view, they're handing over the keys to an incredibly valuable asset, often worth hundreds of thousands of dollars. A credit check is simply their best tool for gauging whether you're a responsible person who will take care of the place and, most importantly, pay the rent on time. It's just a standard part of their business, meant to protect their investment.

More Than Just a Three-Digit Number

That main credit score everyone talks about? It's just the headline. Landlords and property managers dig deeper, looking at the full story your credit report tells. The details behind that number often matter more than the score itself.

They’re looking for patterns. Does your report show a history of meeting your financial obligations, or does it reveal a struggle? This track record is probably the single most important thing they care about.

A landlord isn't just renting out space; they're entering a financial partnership with a tenant. The credit report acts as a resume for this partnership, highlighting your experience and reliability in managing financial commitments.

At the end of the day, they're trying to answer one simple question: "Can I count on this person to honor the lease?" A strong history of paying your bills is the best evidence you can provide.

Key Details Landlords Scrutinize

When a landlord pores over your credit history, they're hunting for specific clues that build a complete picture of your financial health.

-

Payment History: This is the big one. They want to see a solid track record of on-time payments for things like car loans, credit cards, and student debt. A couple of slip-ups from years ago might not be a deal-breaker, but a consistent pattern of late payments is a huge red flag.

-

Debt Levels and Collections: Are your credit cards maxed out? High debt can signal that you're stretched thin financially. And if you have any accounts that have been sent to collections, that’s an even bigger warning sign—it means you've completely failed to pay a past debt.

-

Evictions or Rental-Related Judgments: For a renter, this is the worst-case scenario. A past eviction or a court judgment from a previous landlord is often an automatic disqualifier. It speaks directly to your reliability as a tenant.

Ultimately, your credit score for apartment rental applications is seen as a predictor of your future behavior. A clean report tells a landlord you’re a low-risk applicant who is likely to treat their property and the lease agreement with respect.

How Your Location Changes the Credit Score Game

When it comes to the credit score you need for an apartment, there's no magic number. A score that gets your application fast-tracked in one town might not even make the first cut in another. Where you want to live plays a massive role in setting the bar for what landlords are looking for.

Think of it like this: it all boils down to simple supply and demand. In a city with plenty of available apartments and fewer renters, property managers tend to be more flexible. But in a hot market like Boca Raton, where everyone wants to be, landlords can afford to be picky. With a long line of applicants, they naturally raise their standards and look for higher credit scores.

Market Competitiveness And Credit Expectations

It’s a straightforward reality: the more competitive the rental market, the higher the credit score you'll likely need. In major cities with high demand, a single apartment listing can get dozens of applications. This allows landlords to be highly selective, often choosing tenants with stellar financial track records.

An analysis of over 5 million lease applications revealed that the average renter's credit score in the U.S. was 638 back in 2020. But that's just an average. In fiercely competitive areas like San Francisco and Boston, the average score for approved renters climbed above 700. It's fascinating to see how these national rental trends shift from city to city.

To get a clearer picture of how different rental markets stack up, take a look at the average scores in some major U.S. cities.

| City | Market Type | Average Renter Credit Score |

|---|---|---|

| San Francisco, CA | High-Demand | 724 |

| Boston, MA | High-Demand | 718 |

| New York, NY | High-Demand | 712 |

| Seattle, WA | High-Demand | 711 |

| Chicago, IL | Average-Demand | 682 |

| Austin, TX | Average-Demand | 651 |

| Dallas, TX | Average-Demand | 638 |

| Houston, TX | Average-Demand | 623 |

This table really highlights the gap. A score that’s perfectly fine in an average market might not be competitive enough in a high-demand city, pushing you to aim higher.

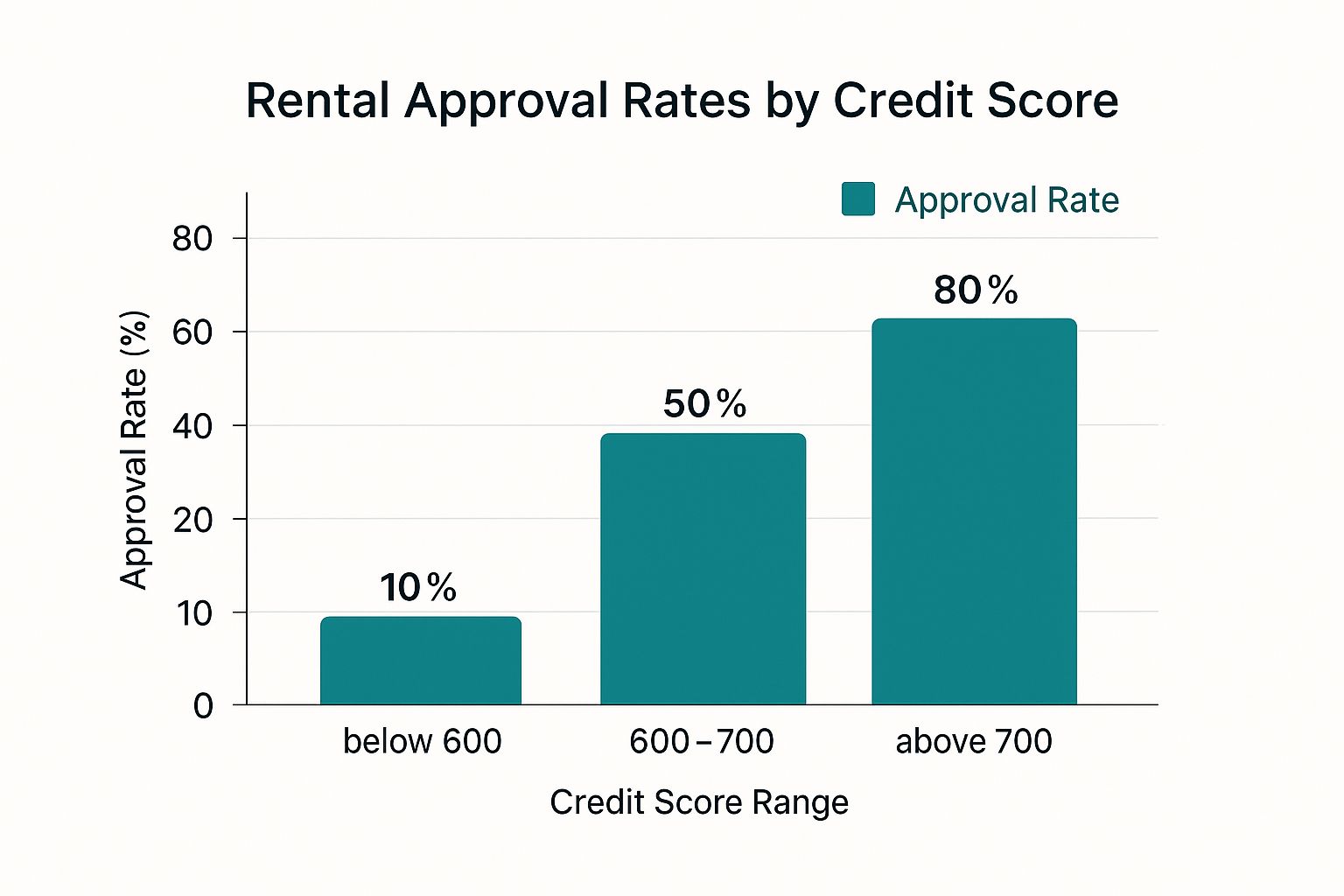

Visualizing Your Approval Odds

This next chart breaks down exactly how your credit score bracket impacts your chances of getting approved. It's a great visual guide to where you stand.

As you can see, once you cross that 700-point threshold, your approval odds get a serious boost. It’s clear proof of the advantage a strong score gives you, no matter where you're looking.

A strong credit score is like having a fast pass at an amusement park. While others are waiting in the long line of applicants, your application often gets moved to the front, especially in a sought-after location.

The local economy is another big piece of the puzzle. In cities with a higher cost of living and more high-paying jobs, the average credit score just tends to be higher overall. Landlords simply adjust their requirements to match the financial health of the people living there. This is why doing your homework on your target city's rental scene is so critical.

And don't forget to take care of yourself during the apartment hunt—it can be stressful! Staying active is a great way to manage that stress, and it's one of the reasons more people are heading back to the gym.

How to Rent an Apartment with a Low Credit Score

Discovering your credit score is lower than you’d like can feel like a huge obstacle in your apartment hunt, but it’s definitely not a dead end. Instead of seeing it as a hard no, think of it as a sign that you just need to make a stronger case for yourself as a tenant. The goal is to show a landlord that you're a reliable person who will pay their rent on time, even if your score tells a different story.

At the end of the day, landlords are just trying to minimize their risk. If you can get ahead of their concerns and address them directly, you can shift their attention away from past financial mistakes and toward your current stability. It’s all about building trust and proving you’re a great choice for their property.

Strengthen Your Application with Proactive Steps

If you know your credit is a weak point, you can tip the scales back in your favor by offering other assurances that lower the landlord’s financial risk. A few smart moves can make a world of difference and demonstrate that you're a serious and responsible applicant.

One of the most convincing tactics is to offer a larger security deposit. This gives the property manager an extra safety net and shows you're financially committed. Another great option is to secure a cosigner or guarantor—this is usually a parent or close relative with excellent credit who agrees to cover the rent if, for some reason, you can't.

Think of these strategies as building a bridge of trust. Each step you take—whether it's offering more money upfront or bringing in a guarantor—helps close the gap between a landlord's risk and their confidence in you as a tenant.

Create a Comprehensive Renter Resume

Your credit score is only one chapter of your financial story. A "renter resume" is your chance to tell the rest of it and highlight all the other reasons you’d be a fantastic tenant. You can submit this document right alongside your formal application to provide extra context and showcase your best qualities.

A good renter resume paints a complete picture of your dependability. To build a strong case, be sure to include these key elements:

- Proof of Stable Income: Collect recent pay stubs or an employment offer letter. The goal is to show you comfortably earn at least three times the monthly rent, which is a common industry standard.

- Positive Landlord References: Nothing speaks louder than a glowing recommendation from a previous landlord. These letters act as powerful testimonials, confirming you have a history of paying on time and taking care of the property.

- Solid Employment History: A consistent work history is a powerful indicator of stability. It reassures a landlord that you have a reliable source of income to cover your monthly obligations.

By putting this information together, you get to control the narrative. You’re making it clear that while your credit score for apartment rental might not be perfect, your character and reliability as a tenant are top-notch. When you're ready to put these tips into practice, you can start by finding your ideal apartment in Boca Raton and preparing your application with a new sense of confidence.

Long-Term Strategies to Boost Your Credit for Rentals

Getting into your next apartment is the immediate goal, but building a solid financial foundation is a marathon, not a sprint. Raising your credit score doesn't happen with the flip of a switch, but a few powerful, long-term habits can make a world of difference. These strategies will do more than just make you a fantastic rental applicant—they'll set you up for better financial health for years to come.

Think of it like tending to a garden. It takes consistent effort and the right approach, but the reward is huge. Small, steady actions will eventually give you a healthy, thriving credit history that opens up all kinds of doors.

Turn Your Rent into a Credit-Building Tool

One of the smartest moves you can make is to use a rent reporting service. For the longest time, your single biggest monthly expense—your rent—did absolutely nothing for your credit. These services finally change that. They report your on-time rent payments to the major credit bureaus, turning your reliable payment history into a positive mark on your credit report.

This can be a real game-changer. A study from TransUnion found that renters who reported their payments saw their credit scores jump by an average of nearly 60 points. Even better, for renters who didn't have enough credit history to even have a score, 9% were able to establish one, with an average score of 631. You can read more about how rent reporting impacts credit scores in recent industry analyses.

Adopt Sustainable Credit Habits

Beyond just reporting your rent, the real foundation of a great credit score comes from simple, sustainable financial habits. These aren't quick fixes; they're the bedrock practices that pay off in the long run.

Building a strong credit score is less about making one big move and more about making dozens of small, smart choices consistently over time.

Focus on these key areas, and you'll see steady improvement:

- Lower Your Credit Utilization: This is just a fancy term for the percentage of your available credit you're using. The golden rule is to keep this ratio below 30%. So, if you have a credit card with a $5,000 limit, your goal should be to keep the balance under $1,500.

- Make On-Time Payments, Always: Nothing impacts your score more than your payment history. The easiest way to nail this is to set up automatic payments for all your bills. That way, you never have to worry about missing a due date.

- Regularly Check Your Credit Reports: You're legally entitled to a free credit report from each of the three major bureaus every year. Pull them, read them, and check for any errors. If you find something that doesn't look right, dispute it immediately.

Mastering these habits will not only improve your credit score for apartment rental applications but will also set you up for a much stronger financial future. A great score is a huge asset, especially when you're enjoying all the reasons why renting in Boca Raton is worth it.

Got Questions? We’ve Got Answers on Credit Scores and Renting

Even when you've done your homework, a few specific questions always seem to pop up during the apartment hunt. Let's walk through some of the most common ones so you can move forward with total confidence.

Diving into the details of a credit score for apartment rental can feel a little confusing, but the answers are usually simpler than you think. Getting these points straight now means no surprises later.

Will the Landlord's Credit Check Ding My Score?

This is a big one, and the short answer is: probably not. Most of the time, landlords use what’s called a “soft inquiry” or a dedicated rental screening report. These don't touch your credit score at all.

However, some might run a “hard inquiry,” which can cause a tiny, temporary dip in your score. The best move is to simply ask the property manager what kind of check they run before you apply. The good news? Credit scoring models are smart enough to see you're apartment hunting. They usually bundle multiple rental inquiries in a short time frame into a single event, which keeps any potential impact to a minimum.

Can I Still Rent an Apartment if I Have No Credit History?

Absolutely. You just have to approach it a bit differently. When you have no credit history, a landlord doesn't see you as a risk—they just don't have the data they need to feel secure. Your job is to provide it in other ways.

"A lack of credit isn't the same as bad credit. You just have to provide alternative proof of your financial responsibility, like a steady income or a cosigner."

Here are a few proven ways to build a strong application without a credit history:

- Offer a larger security deposit. This is a direct way to lower the landlord's financial risk.

- Bring in a cosigner. A parent or trusted individual with a solid credit history can vouch for you financially.

- Show them the money. Provide recent bank statements showing healthy savings and pay stubs proving a reliable income.

- Gather glowing references. Strong letters of recommendation from past landlords or even employers can speak volumes about your character and reliability.

How Do I Check My Own Score Before I Start Applying?

This is a fantastic and proactive step to take. You’re legally entitled to get a free copy of your credit report from each of the three main bureaus—Equifax, Experian, and TransUnion—once every year through AnnualCreditReport.com. On top of that, many credit card companies and banks now offer free credit score monitoring as a standard perk.

Checking your score early is your secret weapon. It gives you the chance to spot and dispute any errors before a landlord ever lays eyes on your report, ensuring you're putting your best foot forward.

Ready to find a place that feels like home? At Cynthia Gardens, we offer a welcoming community in the heart of Boca Raton with a straightforward application process. Find your perfect apartment with us today!