Living in Boca Raton, whether you're a student at Florida Atlantic University or a renter enjoying the sunshine, means making your budget work for you. The high costs of rent and education demand smart financial management. But navigating the world of banking, investing, and budgeting can be overwhelming, especially when trying to avoid hidden fees and complicated terms. Finding truly affordable financial services can feel like a full-time job.

This guide cuts through the noise. We have compiled and analyzed a comprehensive list of 12 genuinely affordable platforms, from zero-fee bank accounts and low-cost investment brokerages to free tax filing tools and international money transfer apps. Each option was selected to help you manage your money effectively and keep more of it in your pocket. To effectively manage your daily spending and savings, explore the best free budgeting apps that can help you master your money without extra cost.

Our goal is to give you a clear, direct path to financial wellness. We will show you exactly which platforms solve specific problems, like avoiding checking account fees or starting an investment portfolio with just a few dollars. Each recommendation includes direct links and an honest look at its features, so you can choose the best tools for your needs and start building a stronger financial future in South Florida.

1. Fidelity Investments

Fidelity stands out as a top-tier platform for students and young professionals venturing into investing, offering a robust suite of affordable financial services without the high fees that often act as a barrier to entry. For an FAU student with a part-time job or a young renter in Boca Raton starting their career, Fidelity provides a powerful yet accessible entry point to building long-term wealth. The platform’s key advantage is its combination of zero-cost core offerings and extensive educational resources.

You can open a brokerage account or an IRA with no minimum deposit and begin trading U.S. stocks and ETFs immediately with $0 commissions. This structure is ideal for those investing small, consistent amounts. The real game-changer is Fidelity's selection of zero-expense-ratio index funds, like FZROX, which allows your entire investment to work for you without management fees chipping away at returns.

Key Features & User Experience

Fidelity's platform is user-friendly, with a clean interface on both its website and mobile app, making it easy to manage your portfolio on the go. Its 24/7 customer support is a significant benefit for new investors who may have questions outside of typical business hours.

- Best For: New investors, long-term retirement savers, and anyone seeking a comprehensive financial hub.

- Pricing: $0 account minimums; $0 commissions for online U.S. stock/ETF trades. Options contracts are $0.65 per contract.

- Unique Offering: Access to proprietary zero-expense-ratio mutual funds (e.g., FZROX, FNILX).

- Limitation: While many funds are free, transaction fees can apply to certain non-Fidelity mutual funds.

Website: https://www.fidelity.com

2. Vanguard

Vanguard is a cornerstone for disciplined, long-term investors, particularly those focused on minimizing costs. For a young professional in Boca Raton planning for retirement or an FAU student looking to start a low-maintenance portfolio, Vanguard’s client-owned structure translates directly into some of the most affordable financial services available. Its primary strength lies in its relentless focus on driving down expense ratios, ensuring more of your money stays invested and works for you over the long haul. This philosophy makes it a powerful tool for building wealth steadily.

The platform offers $0 commissions on online stock and ETF trades, along with thousands of no-transaction-fee mutual funds. While their fund selection is extensive, it’s crucial for new investors to understand the nuances of these products; taking time for understanding the differences between ETFs and mutual funds can help you make more informed decisions. Vanguard’s average expense ratio of 0.08% is significantly below the industry average, making it an ideal choice for fee-conscious investors committed to a buy-and-hold strategy.

Key Features & User Experience

Vanguard's platform is straightforward and built for serious investing rather than frequent trading. While not as flashy as some competitors, its functionality is clear and effective for managing a diversified portfolio. The focus is on providing detailed fund information and long-term performance data to support informed decisions.

- Best For: Long-term buy-and-hold investors, retirement savers, and anyone prioritizing low costs above all else.

- Pricing: $0 commissions for online stock/ETF trades. Some account service fees may apply but can be waived by enrolling in e-delivery or meeting asset minimums.

- Unique Offering: An investor-owned structure that drives its mission to lower fund expense ratios for clients.

- Limitation: Broker-assisted trades over the phone incur a $25 fee, and the platform may feel less modern to users accustomed to newer fintech apps.

Website: https://investor.vanguard.com

3. Charles Schwab

Charles Schwab masterfully bridges the gap between digital convenience and traditional banking, making it a stellar choice for those who value both affordable financial services and the option of in-person support. For a young professional in Boca Raton who is comfortable trading online but still wants access to a physical branch for complex questions, Schwab offers the perfect hybrid model. The firm’s commitment to accessibility is clear through its powerful combination of zero-commission trading and a vast network of local branches.

Similar to other leading brokerages, you can trade U.S. listed stocks and ETFs with $0 commissions and no account minimums, removing major barriers for new investors. Schwab distinguishes itself with its excellent customer service and extensive, high-quality research tools available to all clients. This makes it an ideal platform for someone who wants to grow from a novice to a more sophisticated investor without ever needing to switch platforms.

Key Features & User Experience

Schwab’s platforms, including the user-friendly website and the advanced StreetSmart Edge for active traders, are known for their robust functionality. The ability to walk into one of over 300 branches for face-to-face help provides a level of reassurance that purely digital platforms cannot match.

- Best For: Investors who want a full-service brokerage experience with both digital tools and in-person branch access.

- Pricing: $0 account minimums; $0 commissions for online U.S. stock/ETF trades. Options contracts are $0.65 per contract.

- Unique Offering: A large physical branch network combined with competitive low-cost and no-cost investment products.

- Limitation: While online trades are free, broker-assisted trades incur a fee, and yields on uninvested cash sweep accounts can be lower than competitors.

Website: https://www.schwab.com

4. Ally Bank (Spending/Checking)

Ally Bank redefines daily banking for the digital age, making it an excellent choice for FAU students and young professionals in Boca Raton who want to avoid traditional bank fees. As an online-only bank, it eliminates overhead costs and passes the savings to customers through affordable financial services, notably its fee-free Interest Checking account. For a renter managing tight budgets, Ally’s transparent, no-nonsense approach to banking provides a reliable and low-cost foundation for managing day-to-day finances.

You can open an account with no minimum deposit and immediately benefit from no monthly maintenance fees and no overdraft item fees, which can be a lifesaver when funds are unexpectedly low. While Ally's account doesn't offer a traditional line of credit, understanding responsible borrowing is crucial. To explore related concepts, you can learn more about managing credit lines to avoid long-term debt. The account also pays a competitive interest rate on your balance, something rarely seen in free checking accounts from brick-and-mortar banks.

Key Features & User Experience

Ally’s digital platform is exceptionally user-friendly, with a highly-rated mobile app that handles everything from mobile check deposits to Zelle payments seamlessly. Customer support is available 24/7 via phone or chat, ensuring you can get help whenever needed.

- Best For: Individuals seeking a primary fee-free checking account with a strong digital experience.

- Pricing: $0 account minimums; $0 monthly maintenance fees; $0 overdraft item fees. Outgoing wire fees apply.

- Unique Offering: ATM fee reimbursement up to $10 per statement cycle for fees charged at any Allpoint ATM in the U.S.

- Limitation: As an online-only bank, there are no physical branches for in-person services like cash deposits.

Website: https://www.ally.com/bank/interestchecking

5. Chime

Chime has redefined daily banking for the digital age, making it an excellent choice for FAU students and young professionals in Boca Raton who are tired of traditional bank fees. It offers some of the most affordable financial services by eliminating common charges that can quickly drain a student's or new renter's budget. Chime’s mobile-first approach is perfect for managing money on the go, whether you’re on campus or navigating your first apartment lease, providing a seamless, fee-free banking experience.

The platform’s appeal lies in its straightforward, no-nonsense fee structure. There are no monthly maintenance fees, no minimum balance requirements, and a massive network of over 50,000 fee-free ATMs. A key feature for those on a tight budget is SpotMe, an optional service that can cover small debit card overdrafts for eligible members without charging a fee. This provides a crucial safety net against unexpected expenses.

Key Features & User Experience

Chime’s app is known for its clean, intuitive interface and real-time transaction alerts, which help users stay on top of their spending. The early direct deposit feature, which can make paychecks available up to two days sooner, is a significant advantage for managing cash flow and paying rent on time.

- Best For: Individuals seeking a simple, mobile-centric banking experience with no monthly fees.

- Pricing: $0 monthly fees; no minimum balance fees; no overdraft fees with SpotMe.

- Unique Offering: Fee-free overdraft protection through SpotMe (eligibility required) and early direct deposit access.

- Limitation: While Chime provides banking services, it is a fintech company, not a bank. Services are provided through partner banks, which might be a consideration for some users.

Website: https://www.chime.com

6. Alliant Credit Union

Alliant Credit Union redefines what a bank can be, operating as a digital-first institution that provides exceptional, affordable financial services without the overhead of physical branches. For an FAU student or a young professional in Boca Raton who values digital convenience and fee avoidance, Alliant offers a compelling alternative to traditional banking. Its High-Rate Checking account is a standout product, designed for a modern, mobile-first user by eliminating common fees and rewarding members with high interest rates and ATM fee rebates.

This structure is perfect for budget-conscious individuals who rarely carry cash but need it on occasion. Alliant reimburses up to $20 per month in out-of-network ATM fees and provides access to over 80,000 fee-free ATMs nationwide, giving you more freedom than many brick-and-mortar banks. This combination of fee-free banking and broad ATM access makes managing your money simple and cost-effective.

Key Features & User Experience

Alliant’s digital platform is sleek and intuitive, making mobile deposits, transfers, and bill payments seamless. While it lacks physical branches, its 24/7 phone support and secure online messaging provide reliable customer service.

- Best For: Digitally-savvy individuals looking for a high-yield checking account with minimal fees and nationwide ATM access.

- Pricing: No monthly service fees on High-Rate Checking; no minimum balance requirements.

- Unique Offering: Up to $20 per month in out-of-network ATM fee rebates, a rare and valuable perk.

- Limitation: The competitive APY requires opting into e-statements and having at least one electronic deposit per month.

Website: https://www.alliantcreditunion.org

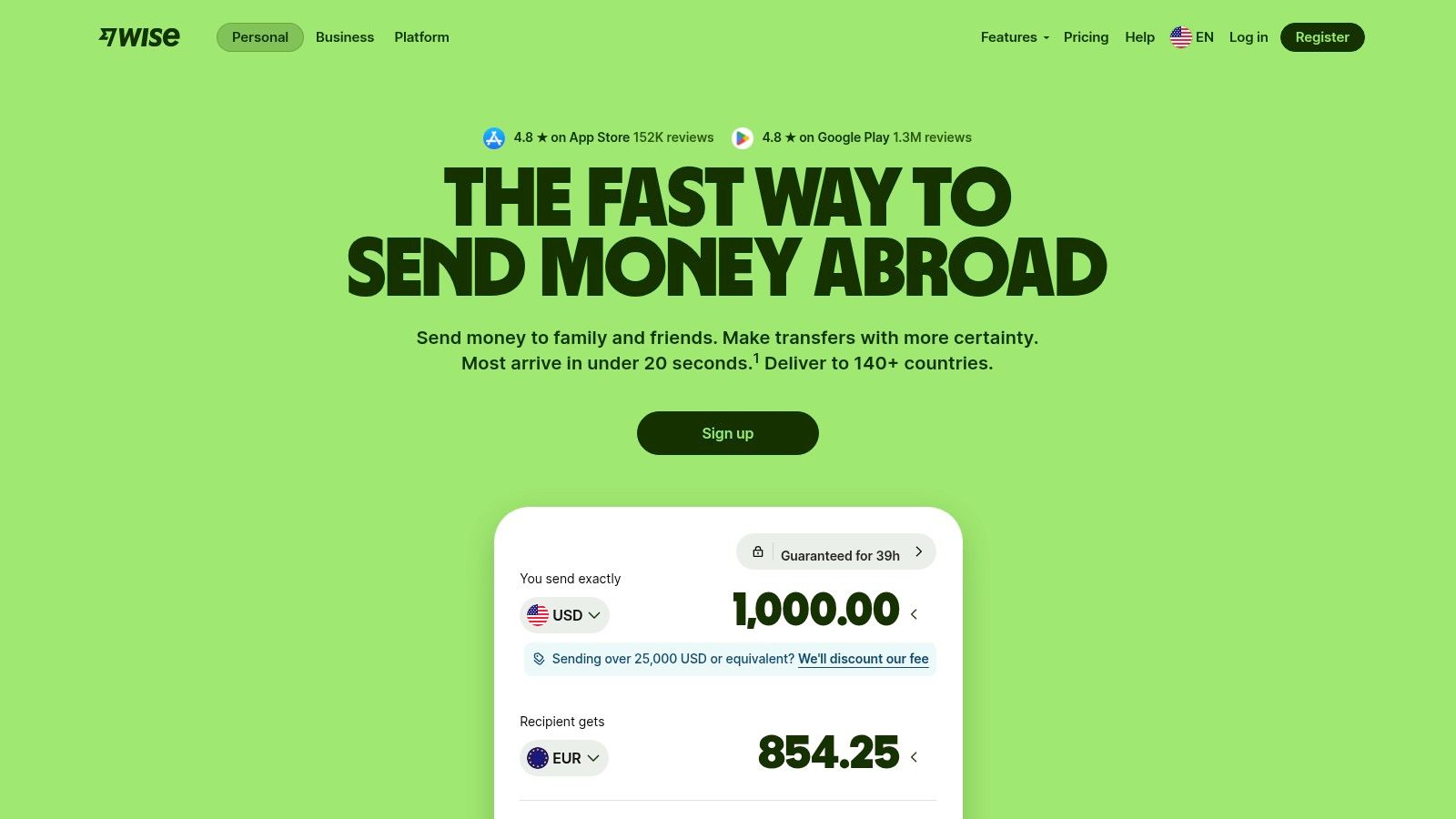

7. Wise (formerly TransferWise)

For FAU students with family abroad or young professionals in Boca Raton working with international clients, Wise offers a powerful and transparent solution for managing cross-border payments. It stands out by providing affordable financial services that directly challenge the high fees and poor exchange rates common with traditional banks. Wise's core principle is to use the mid-market exchange rate, the real rate you see on Google, ensuring you aren't losing money to hidden markups when sending or receiving funds internationally.

The platform’s multi-currency account is a game-changer, allowing users to hold balances in dozens of currencies and receive payments like a local in major economies, including the UK, Eurozone, and Australia. This is incredibly useful for freelancers or anyone needing to manage finances across different countries without opening multiple foreign bank accounts. The associated debit card makes spending these foreign balances seamless and cost-effective.

Key Features & User Experience

Wise’s interface is exceptionally clear, showing all fees upfront before you commit to a transfer, which builds a strong sense of trust. The mobile app is streamlined for quick transfers on the go, making it easy to send money home or pay an international invoice from anywhere in South Florida.

- Best For: International students, freelancers, and anyone sending or receiving money across borders.

- Pricing: Free to open an account. Small, transparent conversion fee; free to receive money via ACH; free to send money to other Wise users.

- Unique Offering: Uses the mid-market exchange rate for all conversions, plus a multi-currency account with local bank details.

- Limitation: While cheap, it’s not free; fees vary by currency corridor and payment method, and ATM withdrawals have monthly free limits.

Website: https://wise.com

8. Remitly

For FAU students or Boca Raton residents supporting family abroad, Remitly offers a streamlined and affordable financial service for international money transfers. It simplifies what can often be a costly and complicated process, providing a transparent and user-friendly platform. Whether you're sending a small gift to a relative or helping with regular expenses, Remitly’s clear pricing and multiple delivery options make it an essential tool for cross-border financial support.

The platform allows you to choose between a low-cost "Economy" transfer, which takes a few days, or a faster "Express" option for urgent needs. Fees and exchange rates are shown upfront, eliminating surprise charges. This transparency is particularly valuable for budget-conscious users who need to know the exact amount their recipient will get. Frequent promotional offers for new users can also significantly reduce the cost of your first few transfers.

Key Features & User Experience

Remitly’s website and mobile app are designed for simplicity, allowing you to set up a transfer in minutes. The guaranteed delivery promise provides peace of mind, refunding your fees if the money doesn't arrive on time. Its 24/7 customer support is also a major plus for handling issues across different time zones.

- Best For: Individuals sending money internationally, especially those needing flexible delivery options like cash pickup or mobile money.

- Pricing: Varies by country, amount, and delivery speed. Economy transfers often have lower fees, while Express transfers cost more.

- Unique Offering: A clear choice between low-cost Economy and fast Express transfers, plus a delivery guarantee or your fee back.

- Limitation: Exchange rate markups and fees can be less competitive for larger transfers compared to some other services.

Website: https://www.remitly.com

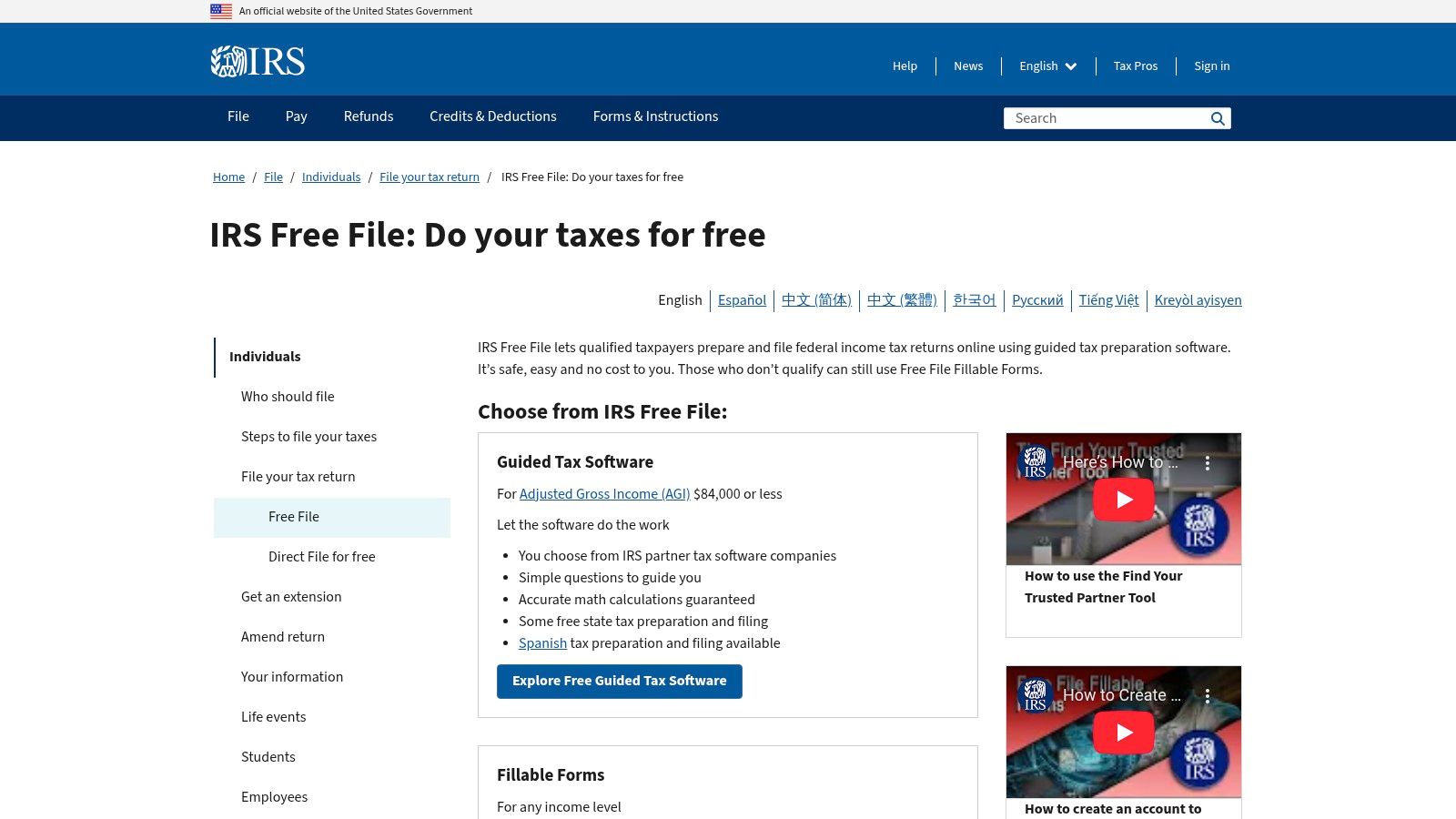

9. IRS Free File (plus IRS Direct File)

When tax season arrives, many FAU students and young professionals in Boca Raton face the unexpected cost of filing returns, but the IRS offers a genuinely free solution. The IRS Free File program provides a powerful and entirely affordable financial service by partnering with established tax software companies. It allows eligible taxpayers to prepare and file their federal and often state taxes at zero cost, ensuring you keep every dollar of your refund without paying for basic preparation.

This government-backed initiative is the most direct way to avoid paying for tax software. Taxpayers with an Adjusted Gross Income (AGI) up to a certain threshold can use guided software from trusted brands. For 2024, the new IRS Direct File pilot program also offers a simple, mobile-friendly tool for those with straightforward tax situations in select states, with plans for future expansion.

Key Features & User Experience

The IRS Free File landing page directs you to choose a partner provider based on your eligibility, offering a familiar guided interview format. The newer Direct File tool is praised for its clean, step-by-step interface. For those needing hands-on help, the IRS also supports free in-person assistance through local VITA/TCE programs.

- Best For: Students, part-time workers, and anyone with a straightforward tax situation wanting to file for free.

- Pricing: $0 for federal and often state filing if you meet the AGI or other eligibility requirements.

- Unique Offering: The only officially sanctioned, completely free e-filing system directly from the U.S. government.

- Limitation: The partner software has AGI limits, and the new Direct File tool is not yet available in all 50 states.

Website: https://www.irs.gov/freefile

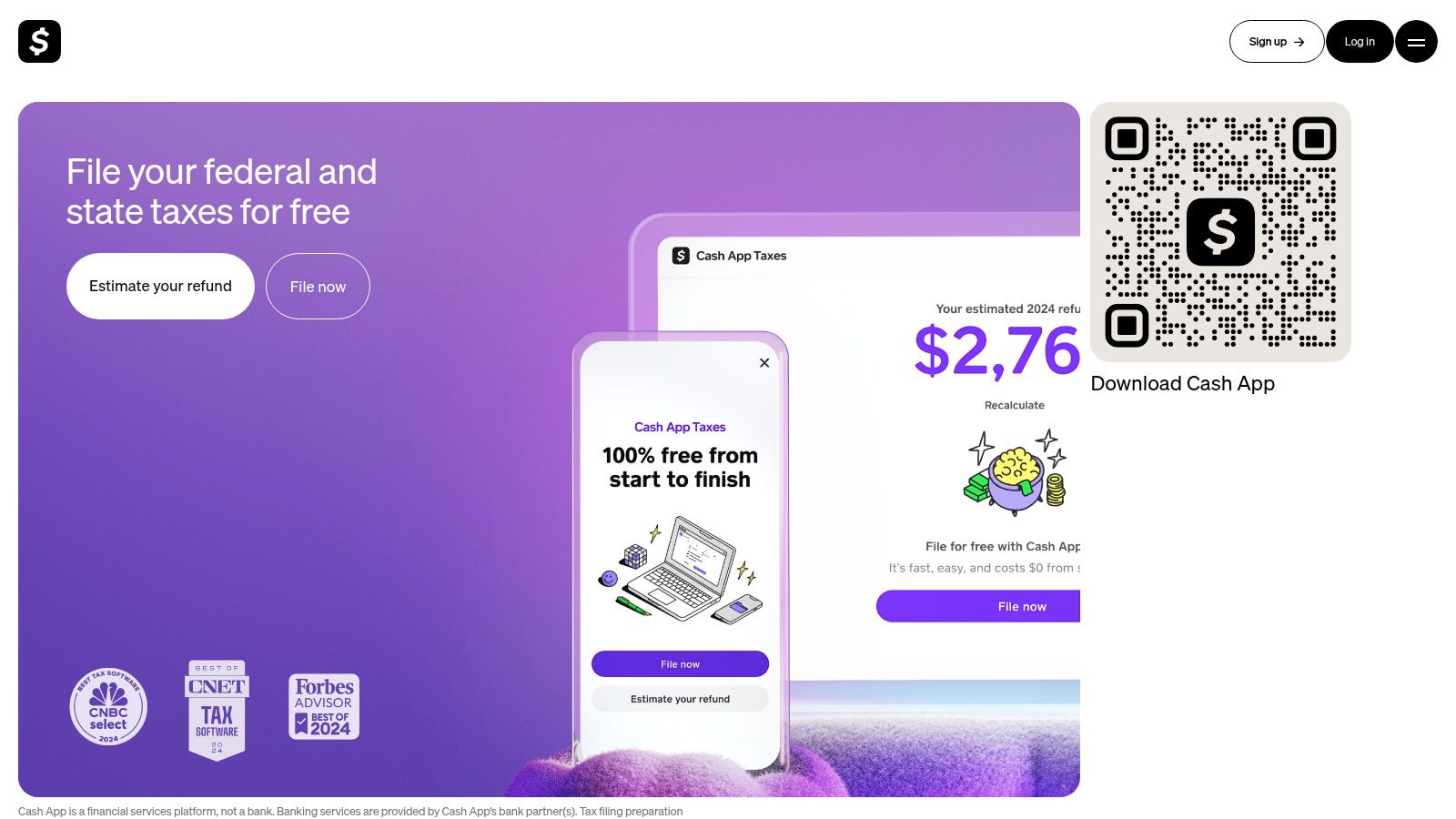

10. Cash App Taxes

Cash App Taxes provides a genuinely free solution for tax season, making it one of the most affordable financial services available for straightforward tax situations. For an FAU student with a simple W-2 from a part-time job or a Boca Raton renter with basic investment income, this platform removes the cost barrier associated with tax preparation software. The service is integrated directly into the popular Cash App, offering a seamless, mobile-first experience that appeals to a younger, digitally native audience.

Unlike competitors that advertise "free" filing but then upsell for state returns or specific deductions, Cash App Taxes is 100% free for all supported forms. This includes federal and one state filing, with no hidden fees or surprise charges. If your tax refund is deposited directly into your Cash App account, you can potentially receive it up to five days earlier than with traditional banks, a significant perk for anyone needing quick access to their funds.

Key Features & User Experience

The platform’s strength lies in its simplicity and integration. The user interface is clean and guide-driven, making the filing process feel less intimidating, especially on a mobile device. Since it requires a Cash App account, the sign-on process is quick and secure for existing users.

- Best For: Students, gig workers, and individuals with simple tax returns who prefer a mobile experience.

- Pricing: Completely free for federal and state e-filing for all supported forms. No upsells.

- Unique Offering: Truly free tax filing integrated within a leading mobile payment app ecosystem.

- Limitation: It does not support all tax situations, such as multiple state filings or more complex investment scenarios.

Website: https://cash.app/taxes

11. NerdWallet

NerdWallet serves as a comprehensive financial marketplace, making it an indispensable research tool for anyone seeking affordable financial services. Instead of being a direct provider, it operates as a powerful comparison engine, helping Boca Raton renters and FAU students find the best credit cards, bank accounts, and loans by putting rates and fees side-by-side. It simplifies the often-overwhelming process of shopping for financial products, translating complex terms into plain English.

The platform excels at helping you find products with low or no fees, from high-yield savings accounts to credit cards with no annual fee. Before committing to a bank or applying for a loan, a quick search on NerdWallet can reveal better options you may have missed. Their editorial independence and clear methodology also build trust, ensuring the recommendations are well-researched. The platform's educational resources are also valuable for learning how to avoid predatory offers, a crucial skill for financial security.

Key Features & User Experience

NerdWallet’s user interface is clean and intuitive, with powerful filters that let you narrow down options based on your specific needs, like finding a bank account with no monthly maintenance fees. The site’s annual "Best-Of" awards provide a great starting point for research.

- Best For: Comparison shopping for financial products, learning about personal finance, and finding the lowest fees.

- Pricing: Free to use. NerdWallet earns money through affiliate partnerships when a user signs up for a product through its links.

- Unique Offering: Unbiased, in-depth reviews and side-by-side comparisons of hundreds of financial products.

- Limitation: It's a referral site, not a direct provider, so you must verify all terms on the actual financial institution's website before applying.

Website: https://www.nerdwallet.com

12. Policygenius

Navigating the world of insurance can be daunting, but Policygenius simplifies the process by functioning as a comprehensive online marketplace. It provides a vital service for Boca Raton renters needing affordable renters insurance or young professionals securing their first life insurance policy. The platform excels by consolidating quotes from top carriers, presenting them in an easy-to-compare format, and offering one of the most user-friendly affordable financial services for safeguarding your assets and future. This transparent approach demystifies insurance, making it accessible even for those with no prior experience.

The core benefit is getting personalized, side-by-side quotes for life, home, auto, and disability insurance without the hassle of contacting multiple agents. The platform’s licensed, non-commissioned agents are available to answer questions and help with paperwork, ensuring you make an informed decision without any sales pressure. This model is perfect for an FAU student on a budget who needs to find the cheapest, most effective renters or auto policy quickly.

Key Features & User Experience

Policygenius offers a clean, intuitive interface that guides users through the quoting process step-by-step. The real value comes from the combination of technology and human expertise, making a complex purchase feel straightforward and secure. The platform's commitment to consumer education is also evident throughout the site.

- Best For: First-time insurance buyers, renters, and anyone looking to comparison-shop for major insurance policies.

- Pricing: Free to use; agents are salaried and do not work on commission, so their assistance adds no extra cost to your premium.

- Unique Offering: A one-stop-shop that aggregates quotes and provides unbiased, licensed agent support for multiple insurance types.

- Limitation: The marketplace is comprehensive but may not include every single insurer or local discount, so a final check might be beneficial.

Website: https://www.policygenius.com

Affordable Financial Services: Key Feature Comparison

| Provider | Core Features / Highlights | User Experience / Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Fidelity Investments | $0 commissions on U.S. stocks/ETFs, zero-expense funds | ★★★★☆ 24/7 support & research | 💰 Low-cost investing, no account minimums | Investors seeking research tools | 🏆 Broad product lineup, strong education |

| Vanguard | $0 commissions on ETFs/stocks, ultra-low fees | ★★★★☆ Long-term fee reductions | 💰 Industry-leading low expense ratios | Fee-conscious long-term investors | 🏆 Investor-owned, large index fund range |

| Charles Schwab | $0 commissions, 300+ branches, strong tools | ★★★★☆ Robust platforms & service | 💰 Competitive pricing | Investors wanting in-person help | 🏆 Extensive branch network |

| Ally Bank | Fee-free checking, no minimum, mobile deposits | ★★★★☆ Transparent fees | 💰 No maintenance/overdraft fees | Digital banking users | ✨ ATM fee reimbursements |

| Chime | No fees, 50K+ fee-free ATMs, SpotMe overdraft | ★★★★☆ Mobile-first, intuitive app | 💰 Extremely low fee structure | Mobile, fee-averse users | ✨ SpotMe overdraft, early direct deposit |

| Alliant Credit Union | No fees, 80K+ ATMs, $20 ATM rebates | ★★★★☆ Highly rated | 💰 ATM rebates + low fees | Nationwide digital credit union | ✨ High-rate checking & large ATM network |

| Wise | Transparent low-cost international transfers | ★★★★☆ Clear pricing | 💰 Lower transfer costs than banks | Cross-border payment users | ✨ Multi-currency accounts + volume discounts |

| Remitly | Economy & Express transfers, 24/7 support | ★★★★☆ Global network & promos | 💰 Corridor-based transparent fees | Small international senders | ✨ Guaranteed delivery or refund |

| IRS Free File | Free federal & some state tax filing | ★★★★☆ Official, government-backed | 🏆 100% free filing | Eligible taxpayers (AGI ≤ $84k) | ✨ IRS Direct File e-filing tool |

| Cash App Taxes | Free federal & most state filing, mobile-first | ★★★★☆ Integrated with Cash App | 🏆 Fully free tax prep | Cash App users | ✨ Single sign-on, mobile experience |

| NerdWallet | Financial product comparison & education | ★★★★☆ Clear guidance & filtering | 💰 Free research & product shopping | Consumers researching finance | ✨ Annual awards & deep market insights |

| Policygenius | Insurance quote comparison, licensed agent help | ★★★★☆ Strong consumer ratings | 💰 Saves time and money | Insurance shoppers | ✨ Expert assistance with no commission increase |

Final Thoughts

Navigating the world of personal finance can feel overwhelming, especially when you're managing the unique expenses of renting in Boca Raton or balancing your budget as an FAU student. The landscape of affordable financial services is vast and constantly evolving, but the core principle remains the same: you don't need to pay high fees to manage your money effectively. The tools and platforms we've explored prove that powerful financial management is accessible to everyone, regardless of your starting point.

From the robust, low-cost investment options at Fidelity and Vanguard to the user-friendly, high-yield checking accounts at Ally Bank and Alliant Credit Union, the right tools can fundamentally change your financial trajectory. Fintech innovators like Chime and Wise are challenging traditional banking models, offering fee-free services and transparent international transfers that directly benefit consumers. Similarly, tackling taxes no longer requires expensive software, thanks to comprehensive free services like IRS Free File and Cash App Taxes.

Your Action Plan: Moving from Knowledge to Implementation

The most crucial step is translating this information into action. Simply knowing about these resources isn't enough; the key is to strategically integrate them into your financial life. Don't feel pressured to adopt every tool at once. Instead, identify your most significant financial pain point right now and start there.

- If you’re struggling with high bank fees: Consider opening an account with Ally Bank or Alliant Credit Union. The process is entirely online and can be completed in under 15 minutes.

- If you want to start investing but feel intimidated: Explore the fractional share options and educational resources at Charles Schwab or Fidelity. You can begin with as little as $5.

- If you're overwhelmed by finding the right insurance: Use a comparison tool like Policygenius. It centralizes the research process, saving you hours of work and potentially hundreds of dollars.

- If you need to send money internationally: Compare the rates on Wise and Remitly before your next transfer. The savings on a single transaction can be substantial.

Choosing the Right Tools for Your Boca Raton Lifestyle

Your specific situation as a renter, student, or young professional in South Florida should guide your choices. An FAU student might prioritize a budgeting app and a fee-free checking account like Chime to manage fluctuating income. A young professional renting near Mizner Park might focus on automating investments with Vanguard and optimizing their savings with a high-yield account.

The ultimate goal is to build a personalized financial toolkit that works for you. Combine a primary bank for daily spending, a separate high-yield account for your emergency fund, a low-cost brokerage for long-term growth, and a free tax service. This multi-platform approach empowers you to select the best-in-class service for each specific need, creating a powerful, affordable financial services ecosystem tailored to your life. Take control, start small, and build a secure financial future, one smart choice at a time.

Finding an affordable place to live is the cornerstone of a healthy financial plan, allowing you to save and invest more effectively. If you're looking for an apartment community in Boca Raton that values your budget without compromising on quality, explore what Cynthia Gardens has to offer. Discover your next home and secure your financial foundation at Cynthia Gardens.